[ad_1]

[ad_1]

Bitcoin (BTC-USD) is in crisis, rising from around $ 10,500 in early October, to a peak of $ 19,129 on November 24, a whopping 82% increase in less than two months. Many investors have wondered: is cryptocurrency back with a vengeance? And is this the next big rally?

I started watching Bitcoin quite early during the 2017 rally, thanks to a friend who was involved in space (he worked for a crypto payments company). He told me all about the advantages of cryptocurrency: decentralization on the blockchain, anonymity, ease of accessibility especially for the global population without a bank, the elimination of banks as intermediaries, the lack of cross-border barriers, the periodic halving of rewards and etc .

Indeed, this all looked great at first glance, but as I continued to research the subject, I realized that there were some important fundamental flaws with Bitcoin. These flaws have been widely discussed, but they are worth repeating here.

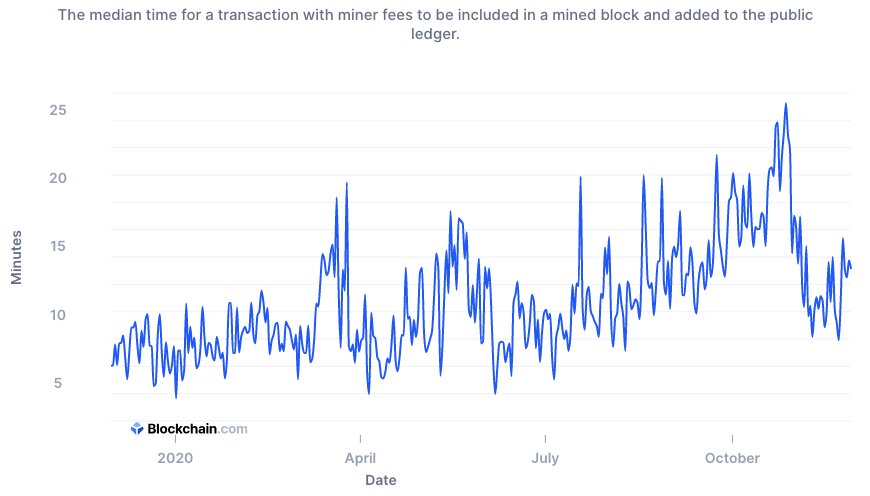

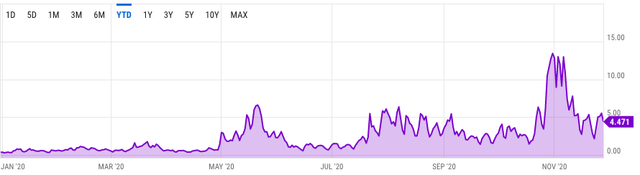

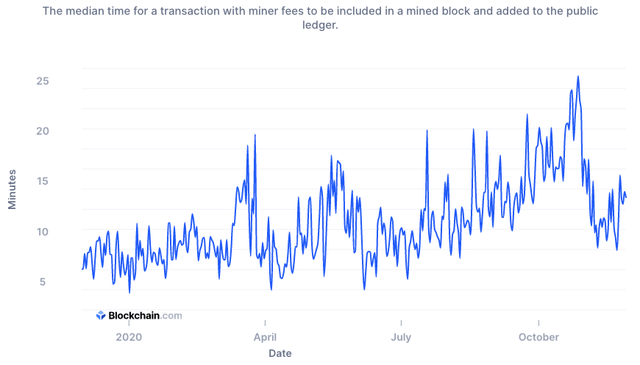

In essence, for a cryptocurrency to be useful, it should be i) an efficient means of transfer or ii) a good store of value. Bitcoin was none of those. In terms of an efficient transfer medium, Bitcoin’s transaction fees (around $ 4 USD per transaction currently) and average confirmation time of around 13 minutes make it a poor tool for transactions, especially lower value ones that dominate the our daily life, requiring almost zero commissions and instant confirmation. Meanwhile, its price volatility excludes it from being a good store of value – just look back at the one-day free fall of 27% on March 12.th this year, compared to a 6% drop in the S&P on the same day. Sure, that was the peak of the coronavirus market crisis and all asset classes were in free fall, but Bitcoin’s intra-day volatility has far eclipsed that of other asset classes.

Chart: Average Bitcoin transaction fee in USD

Source: YCharts

Chart: Average Bitcoin Transaction Time in Minutes

Source: Blockchain.com

So, I started investing in Altcoins, cryptocurrencies with a smaller market capitalization that incorporated technologies intended to overcome Bitcoin’s shortcomings. This served me well for a while, until the big crash of 2018. Fortunately, I managed to profit and quit while still decently in black, but have been sitting on the sidelines ever since.

Because? I learned an important lesson about cryptocurrencies from the 2017-2018 cycle and the subsequent rebound since: fundamentals don’t matter. There are a plethora of Altcoins with better technology than Bitcoin out there, but the antiquated behemoth of the cryptocurrency world has outperformed the small cap space by nearly 10 times since the market depression in January 2019. This trend also applies to the recent rally. since the beginning of October 2020, where Bitcoin has outperformed the small cap space by a factor of 6.6 times over the span of around two months. My conclusion from these price trends is as follows: if I cannot generate alpha based on research and analysis of the fundamental differences between cryptocurrencies, then I am not investing.

Chart: Bitwise 70 (representing the 70 largest small cap cryptocurrencies) has massively underperformed Bitcoin since January 2019

Source: bit by bit

But taking it one step further, what could be behind the massive Bitcoin rally? I believe it is the powerful mix of i) sustained brand popularity and ii) increasingly disproportionate ownership of the asset. In essence, a small number of “ whales ” are able to crowd out the market and move prices disproportionately, and these price swings therefore tend to attract many retail investors who think “ Bitcoin ” whenever the word “ cryptocurrency ” is mentioned to participate in the rally, broadening the recovery. The whales can then choose to profit at these higher levels.

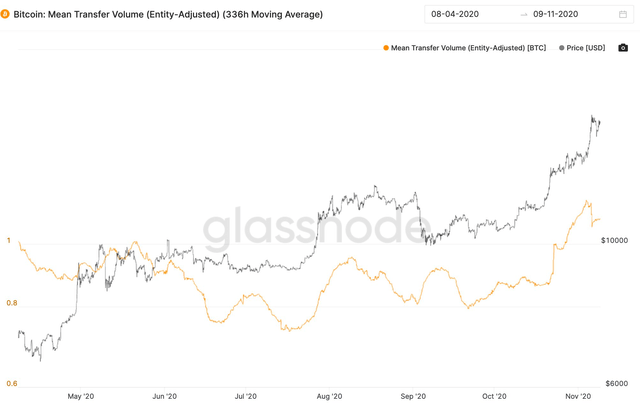

This type of activity is relevant to the ongoing rally because various parameters indicate that whales lead the rally. First, Bitcoin’s average transfer volume has increased since the beginning of October, which means that big exchanges are distorting the market.

Chart: Average Bitcoin Transfer Volume

Source: Cointelegraph

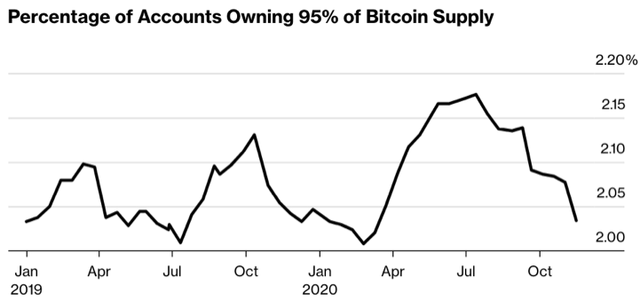

Second, the percentage of accounts holding 95% of Bitcoin in value has again dropped to lows of 2%, which means that ownership concentration among whales has increased.

Graph: concentration of ownership of Bitcoin

Source: Bloomberg

As a comparison to illustrate how highly concentrated the Bitcoin market is, here is a quote from the New York Times in 2018, detailing their concerns about concentration of stock ownership in the United States:

“A whopping 84 percent of all stock owned by Americans belongs to the richest 10 percent of households. And that includes everyone’s stake in retirement plans, 401(NYSE: K)individual and individual retirement accounts, as well as trust funds, mutual funds, and college savings programs such as the 529 plans. “

If these shareholding levels are troubling, surely the distribution of Bitcoin ownership should be far more concerning. However, the constant news flow around the Bitcoin rally only serves to attract investors who feel the FOMO. I think there should be another meaning for FOMO: Fear of Massive Overhype!

Take profits if invested or look elsewhere if you are not yet

In summary, Bitcoin is actually a low-quality cryptocurrency in terms of technology that fulfills the goals of a digital currency and its value comes mainly from the investor’s familiarity with the name. Whales dominate the market, causing large price swings in both directions, and such whale activity appears to be the engine of the recent rally. Obviously it’s hard to tell when the rally has gone too far, but think about it from the perspective of a Bitcoin whale. Given that prices have climbed back to 2017 highs and have risen 10x from desperation lows in 2019 and 145% year to date, would you start taking profits? I would like to. Retail investors should anticipate this move and act early.

For those who haven’t invested yet, my advice would be to avoid Bitcoin, especially at today’s prices. In fact, I believe the alpha generation in the wake of the fundamental pursuit of any cryptocurrency is a wild chase, and I’m not a fan of the asset class in general. That said, for those who want exposure to cryptocurrency as part of a larger portfolio, other large-cap alternatives such as Litecoin (LCC-USD), Ethereum (ETH-USD), or Ripple (XRP-USD) may be considered. ). These cryptocurrencies each have their own differentiators, are in the top 10 in terms of market capitalization, and yet have not rallied as much as Bitcoin since January 2019 lows.

Finally, remember that cryptocurrency is the wild west of investing, and while huge gains can be made quickly, don’t bite into more than you can chew and invest responsibly!

Disclosure: We have no positions in any of the stocks mentioned and have no plans to initiate any positions within the next 72 hours. I wrote this article myself and express my views. I don’t get any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.

[ad_2]Source link