[ad_1]

[ad_1]

As the weekend approaches rapidly, the cryptocurrency market seems to be facing further downward momentum.

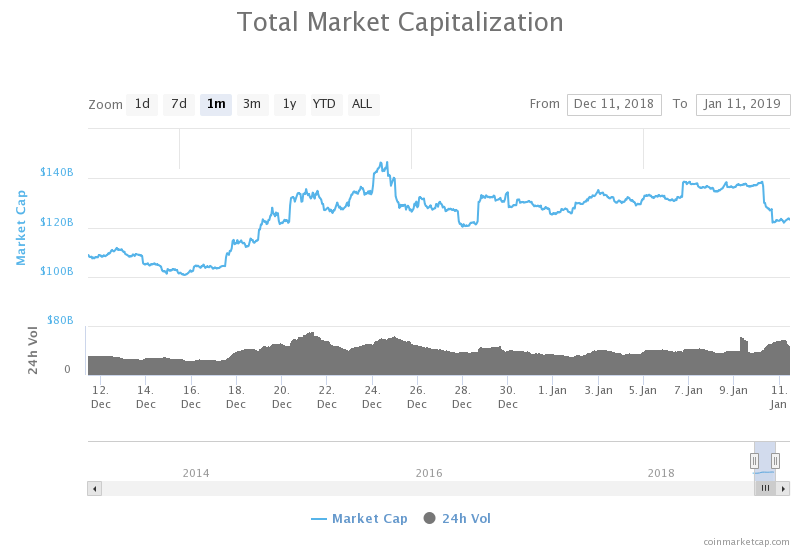

At the time of writing, total market capitalization fell about 15%, from around $ 140 billion on January 9 to nearly $ 120 billion today. Since December 16, when the cryptography market has reached the lowest levels of the year at about $ 100 billion, the cryptosphere has recovered over 20%.

If I had to guess, I would bet on total market capitalization by touching the $ 120 billion support level over the weekend, before hoping to rebound on Monday, as has happened so many times in the past.

The daily volume ranged from around $ 15 billion to nearly $ 30 billion.

An important reminder is that slower price fluctuations are more likely to occur with lower liquidity, as it is necessary to spend less fiat to have an impact on the total price.

The fundamentals continue to improve

As reported by Coin Rivet last week, there are two events taking place in the first quarter of 2019 that give me confidence in the development side of cryptocurrencies.

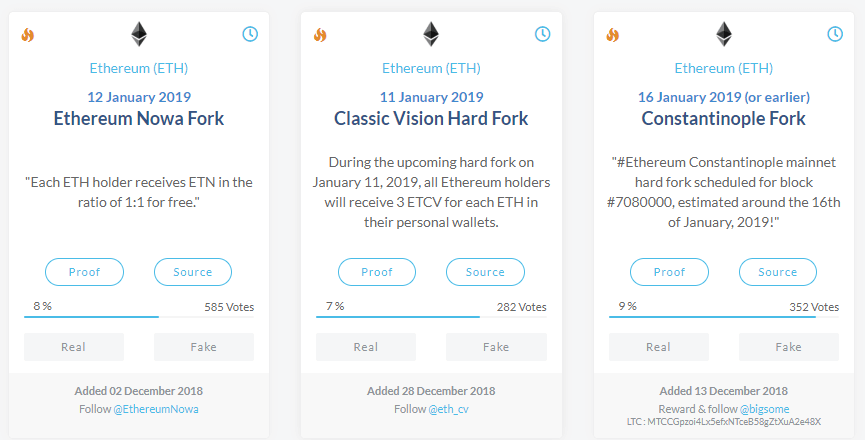

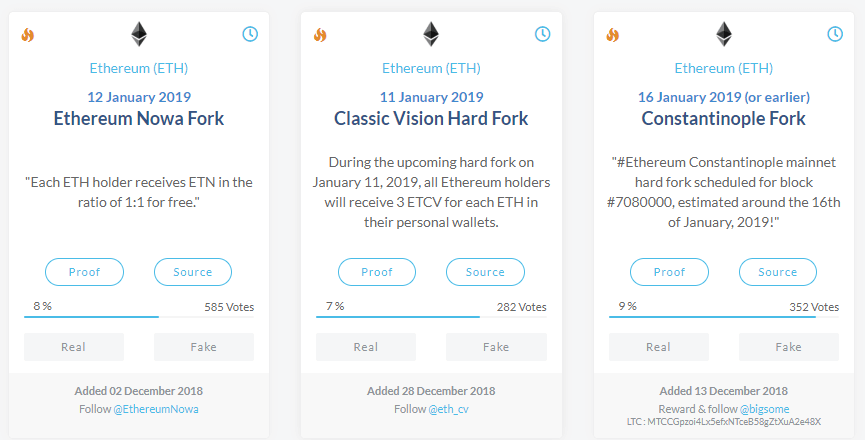

The first concerns Ethereum, currently the third largest cryptocurrency according to CoinMarketCap. Ethereum will perform an update (or a hard fork) to implement some necessary changes that will help the protocol move from PoW to PoS, as well as reduce the block premium from three ETHs to two ETHs, putting even more positive pressure on short- forward price.

With the spread of Constantinople, improvements are expected to take place at both the network and infrastructure levels.

The second is the NEO developer conference in Seattle, Washington, which aims to raise awareness among NEOs and address a range of technical topics.

I think this kind of events are particularly important to raise awareness on cryptocurrency, since there are many companies that send key employees to know the blockchain technology and NEO will have the opportunity to promote its latest developments with the entire community.

The first NEO DevCon, which was held in San Francisco last year, attracted over 600 participants and more than 40 speakers.

More regulation at the horizon

There are also two events that you should follow closely on the regulatory side of things, as I believe they could kick off another round of adoption by users.

First, as might be expected, we have the SEC decision on a Bitcoin ETF (or Exchange Traded Fund), which has been postponed to February 27, 2019. Although they are somewhat against cryptographic ETFs, in as users would not actually keep their private keys, I understand for price action would be a giant step for cryptocurrencies, especially Bitcoin.

Secondly, during the week, an important document was issued by the ESMA (European Securities and Markets Authority), which set out some key crypto-regulatory guidelines and created concerns for investors, businesses and cryptocurrency enthusiasts. One that I would like to emphasize is the following:

"Where crypto-assets do not qualify as financial instruments (…) ESMA believes that the absence of applicable financial rules leaves consumers exposed to substantial risks." ESMA believes that those responsible EU policymakers should consider possible solutions to address risks proportionately. ESMA believes that all crypto-activities and related activities should be subject to AML provisions… "

Although the document is still inconclusive in many aspects of regulation, it begins to address some of the problems with the tokenisation of digital resources, as these types of tokens should be subject to the same laws and regulations as traditional resources.

Increased regulation could certainly help businesses out, as there would be less fear of encountering problems with regulatory agencies. However, I am also of the opinion that the EU should not attempt to regulate what does not rightly fall under their jurisdiction, such as the theme of decentralized money.

If people choose to take care of Bitcoin, I barely see a way for an agency to always control users' access beyond a starting point.

With the increase in privacy protection on the Bitcoin protocol level, such as the addition of zero knowledge evidence, increased randomness on every level of communication or any other improvement in privacy, we give people globally in a way that regulation could never reach: leaving people fail, learn, repeat and improve.

After all, regulation is only useful when it can be applied and when people are agreed it should be applied.