[ad_1]

[ad_1]

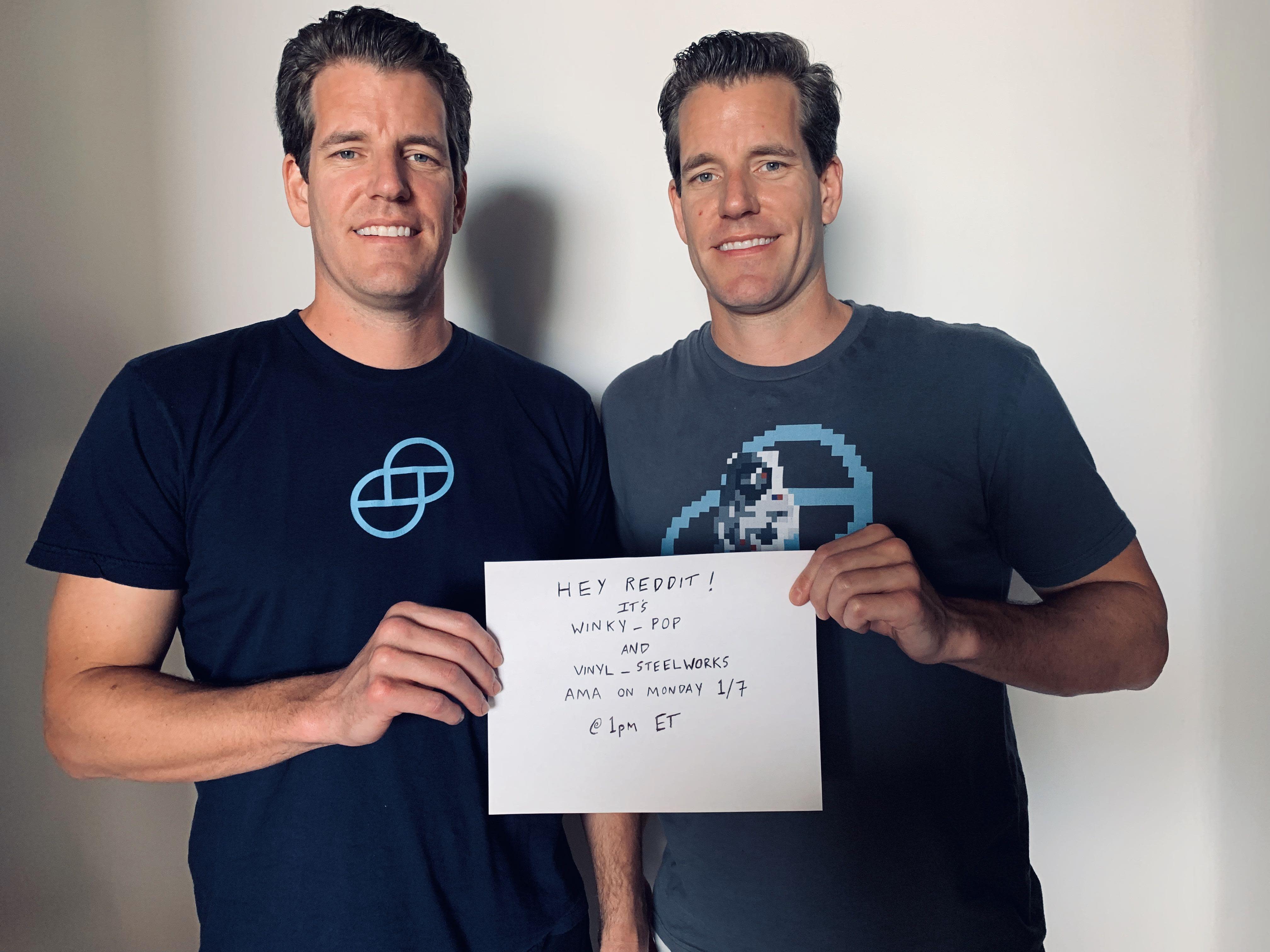

Cameron and Tyler Winklevoss did an Ask Me Anything session on Reddit after a full-page advertisement in the New York Times.

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "The twins answer some of the questions posed, including this, which also CCN recently reported. "data-reactid =" 19 "> The twins answered some of the questions posed, including this one, of which CCN also recently reported.

Some entries in the crypt have darkened with your recent advertising campaign in New York. The slogan read "Gemini: the exchange of REGULATED cryptocurrencies". Could you explain the reasoning behind it? Are the Gemini alone in this sense?

Cameron Winklevoss said:

We know that we will not be satisfied, but the healthiest and liveliest economies have thoughtful rules to promote positive results. You can not aim for a lawless economy that is thriving.

To be clear, there are exchanges and custodians that adhere to our principles and it is encouraging to see that we are not alone in this sense – but for us this is a central goal and something we have worked hard to be thought leaders.

Bitcoin is "The Most Likely Winner"

One user asked "Do you think Bitcoin will always be Crypto # 1?"

To this, Cameron Winklevoss said:

Bitcoin is certainly the OG crypto! It is difficult to defeat the network effects – so in terms of "hard money" (that is, value deposit), Bitcoin is most likely the long-term winner.

This led to unanswered questions about the "definition" of CW Bitcoin by a Bitcoin Cash supporter, who claimed that Bitcoin Cash is now Bitcoin according to him.

<p class = "canvas-text canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "Another user asked to the controversial question of whether or not Bitcoin is a "value deposit". "data-reactid =" 31 "> Another user asked about the problem of litigation whether or not Bitcoin is a" value deposit ".

Is not calling Bitcoin a "Store of Value" by creating many problems to solve bitcoin scalability problems and then use it as a value transfer?

For this reason, Tyler Winklevoss replied that decentralization is, in his opinion, the "heart of the matter" as regards the debate on the scalability of Bitcoin. This debate led to the difficult fork and the subsequent creation of Bitcoin Cash.

I believe that bitcoin is a store of value (given its current properties) and they agree that being a good store of value is in conflict with being a good medium of exchange. It's hard for the money to be good at both at the same time. However, I believe that decentralization (eg size of blocks and remaining resistance to censorship) is the crux of the matter without the debate on scalability, not whether or not bitcoin is a store of value.

"Engaged as always" twins on Bitcoin ETF

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "Cameron Winklevoss answered a question about the term" short-circuit " "plans to turn a Bitcoin ETF into reality some examples of Gemini shares is committing to foment this sought product. "data-reactid =" 38 "> Cameron Winklevoss replied to a question about" short-term "plans related to the implementation of a Bitcoin ETF, he gave some examples of actions Gemini is committed to fostering this sought-after product.

We understand the concerns of the Commission and we are working hard to resolve them (that is, more market surveillance). […] We are committed as always to turning an ETF into reality!

A user says he has concerns with "market surveillance". To this, Cameron replied:

I know, it looks worse than it is, lol. The term suffers from a branding problem, but it is not Big Brother. Marketplace Surveillance is commonplace in stock and derivative markets – so we're not reinventing the wheel here, simply by bringing good practices into the crypt.

Segwit on the cards for the twins

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "A user asked a rather difficult technical question about why Gemini has yet to implement Segregated Witness, Tyler Winklevoss replies this question saying: "data-reactid =" 45 "> A user asked a technical question a little bit about why Gemini has not yet implemented the Segregated Witness.Tyler Winklevoss answered this question by saying:

Our hot Bitcoin wallet was created before Segwit was just a shimmer in the eyes of Pieter Wuille. It would be very complicated to remodel Segwit there. We have therefore created a new hot wallet, starting from scratch, with support for Segwit, batches of transactions, Bech32 addresses and all kinds of other extras. We have used this new system for Zcash, Litecoin and Bitcoin Cash, which is why we are already using native Segwit and P2SH wrapped for Litecoin.

<p class = "canvas-text canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "CCN requested some questions which has not been answered. "data-reactid =" 48 "> CCN has asked some questions that have not been answered.

At the time of writing, Gemini was the number 52 in terms of market volume. Their strategy of carefully implementing additional cryptographic products has seen their retail market potential usurped by exchanges such as Coinbase and Binance. Coinbase was # 30. Binance was the 2nd, recently overtaken by the most recent LBank contender.

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "

The post Cameron Winklevoss: "We know we're not going to please everyone" appeared first on CCN.

"data-reactid =" 50 ">

The post Cameron Winklevoss: "We know we're not going to please everyone" appeared for the first time on CCN.