[ad_1]

[ad_1]

- Financial institutions must report transfer information with a value greater than $ 250 for international transactions.

- Comments on the regulatory proposal will be accepted until 23 November this year.

A proposed amendment to the US Bank Secrecy Act indicates an increase in the strictness of regulations towards cryptocurrencies. A press release from the Financial Crimes Enforcement Network (FinCEN) and the Federal Reserve Board (FSB) announces that these entities will receive public comment on the proposal starting October 23.

The proposal aims to change the regulations on the rules known as registration and travel rule. If approved, financial institutions should report transfer information with a value greater than $ 250 for international transactions. Currently, the rule applies to transactions over $ 3,000 making this proposal a significant reduction in the transfer amount. Comments will be accepted until November 23 of the current year.

Regulatory agencies clarify that the change will only apply to transactions that begin or are conducted outside the United States. Furthermore, the agencies indicate that transactions with “virtual currencies and digital assets” such as Bitcoin, Ethereum and XRP, also apply to the rule:

The proposed rule also clarifies that these regulations apply to transactions above the applicable threshold involving convertible virtual currencies, as well as to transactions involving digital assets having legal tender, clarifying the meaning of “money” used in certain defined terms.

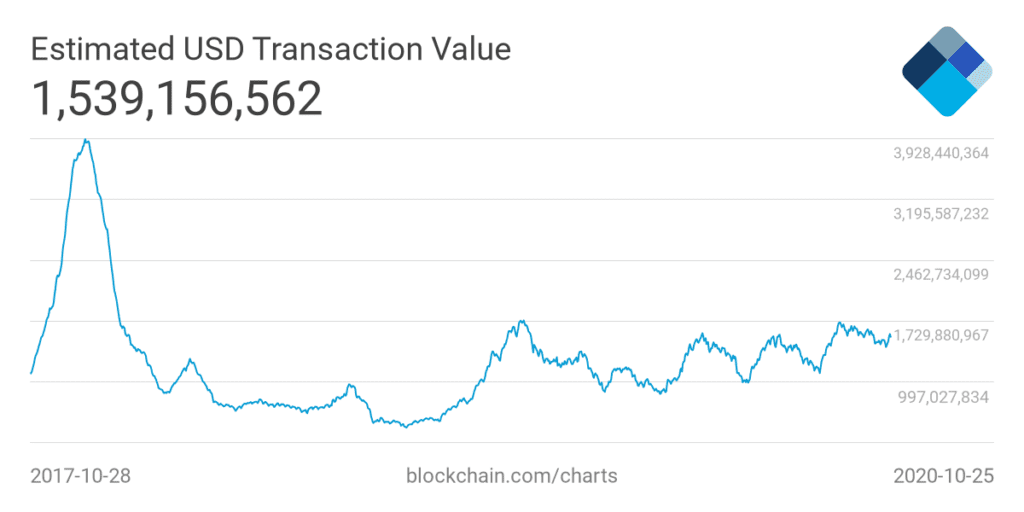

However, in the case of these activities, the standard applies to “domestic and cross-border transactions”. Agencies estimate that BTC transactions alone grew from $ 366 billion in 2019 to $ 312 billion “through 2020 and through August,” as shown in the image below. They also indicate that there has been an increase in Bitcoin’s market capitalization. In this sense, the agencies underline:

(…) malicious actors have used CVCs (cryptocurrencies) to facilitate the financing of international terrorism, the proliferation of arms, the evasion of sanctions and transnational money laundering, as well as to buy and sell controlled substances, stolen identification documents and fraudulent and access devices, counterfeit goods, malware and other hacking tools, firearms and toxic chemicals.

Source: https://www.blockchain.com/charts/estimated-transaction-volume-usd

IRS asks Americans if they have Bitcoin (BTC)

While the Bank Secrecy Act amendment will not affect domestic transactions, Americans will be required to provide information on their cryptocurrency assets. Under an amendment to the U.S. Internal Revenue Service mandatory form, U.S. citizens will be required to respond to the following:

(you) engaged in a transaction involving virtual currency, you will need to answer the question on page 1 of Form 1040 or 1040-SR.

Therefore, the citizen must say whether he has received, sold, exchanged or made any other transaction involving “any virtual currency”. If the citizen only had Bitcoin funds, for example, without moving them, then he can select the “No” option. Otherwise, the answer must be positive.

[ad_2]Source link