[ad_1]

[ad_1]

Very quietly and with very few people who notice, the total amount of computing power used to extract bitcoins has reached a new value every Monday.

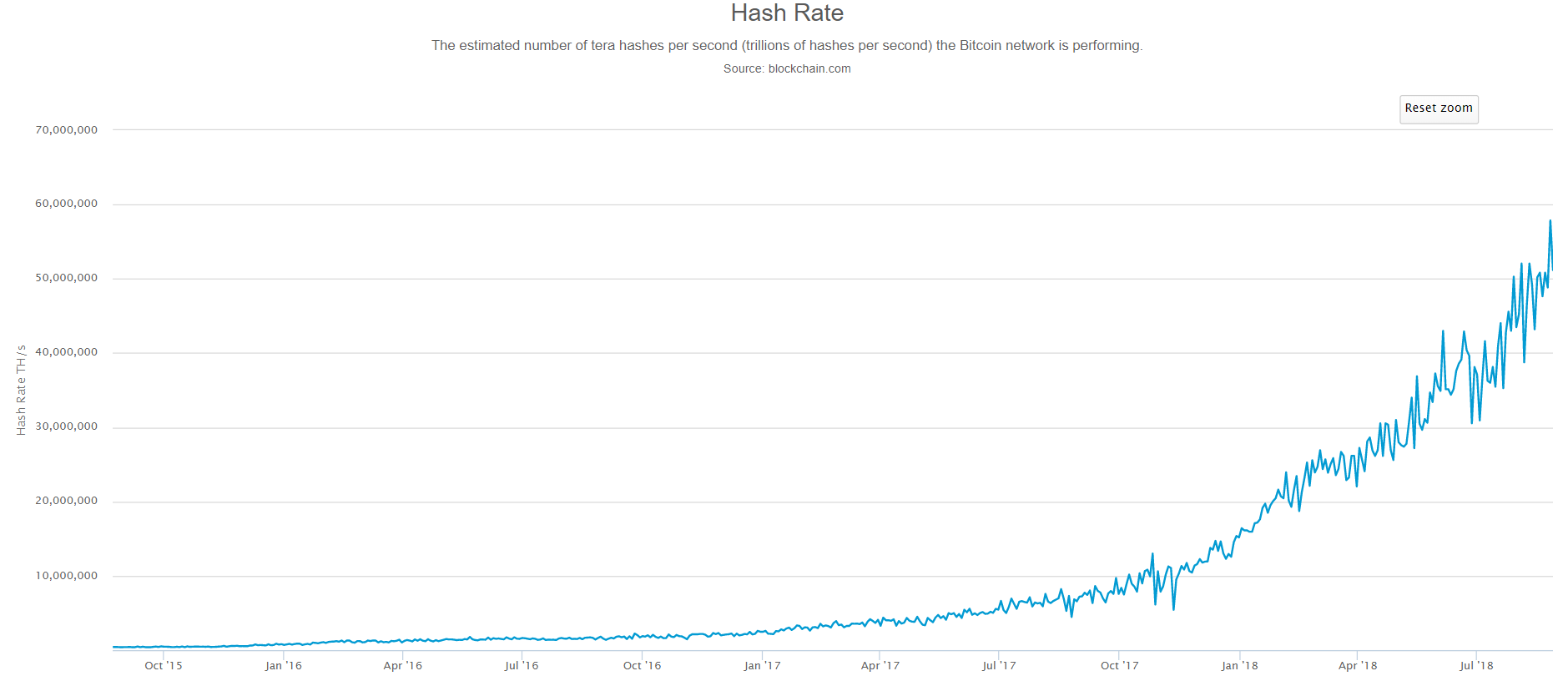

Here we can see the beautiful graphic of the hockey stick of the Bitcoin hashrate blockchain in the last three years. A figure that has exceeded 61 quintillion hashes per second this week.

What shows is a wave of new miners coming online. The more computers enter the network the more difficult it is to produce new coins and even more expensive.

This hash-powered arms race could be useful for hodlers because higher extraction costs tend to lead to a higher price per coin, but it certainly has other consequences as well.

Note: all data, figures and graphs are valid until August 30th. All trading involves risks. Only the risk capital that you can afford to lose.

Optimism was seen in US stock markets yesterday as Trump's North American commercial war segment is finally seeing the light at the end of the tunnel.

The tech The heavy Nasdaq has flown 1.26% in territory of all time showing a marubozu marvelous candle on Wednesday (purple circle).

Despite the stable pace in the United States, Asian and European stocks are seeing little compared this morning.

Here we can see the China50 falling during the day while the DAX and the CAC show a terrible opening.

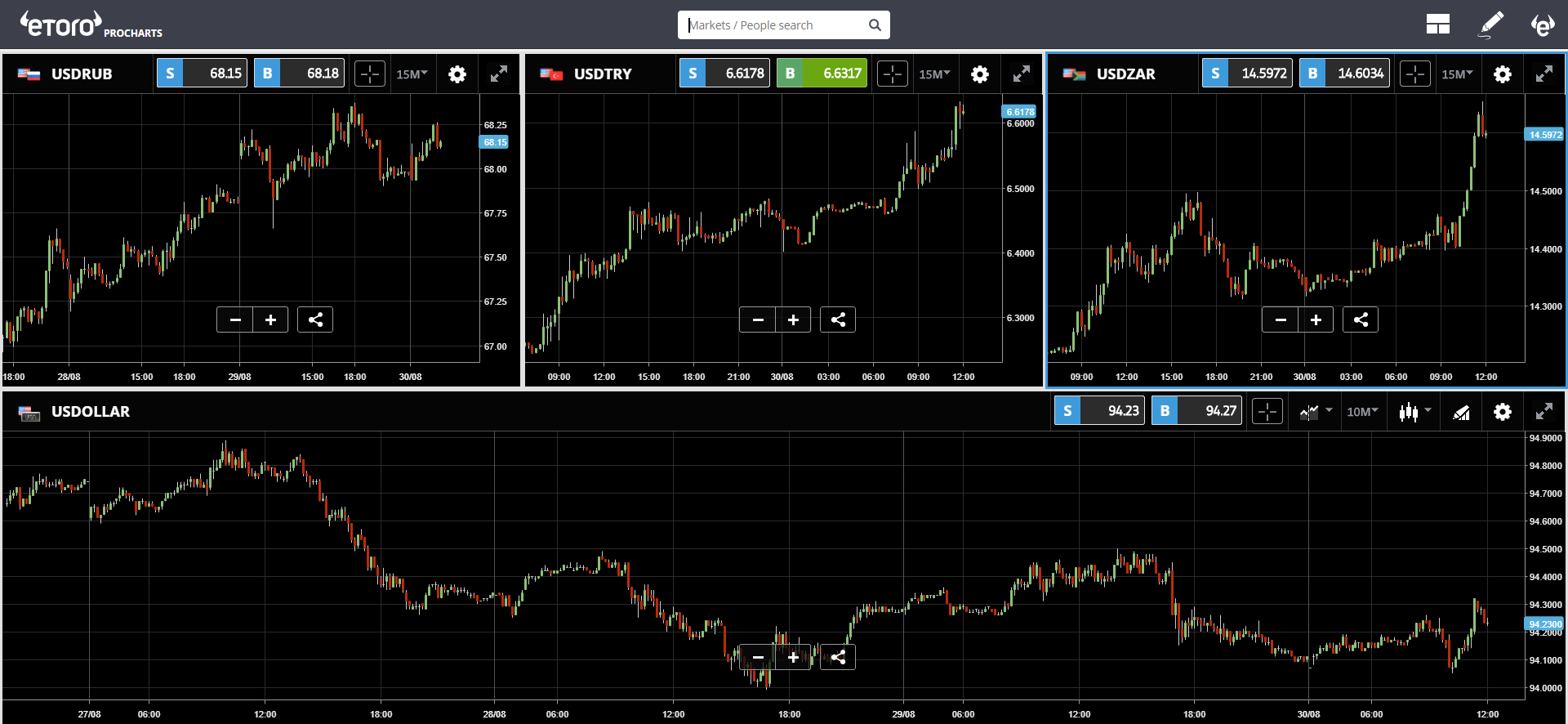

The US dollar is not going big, but it is stable at the lows (graph at bottom). However, emerging market currencies are taking another hit today.

Here we can see the dollar rise against the Ruble, the Lira and the Rand.

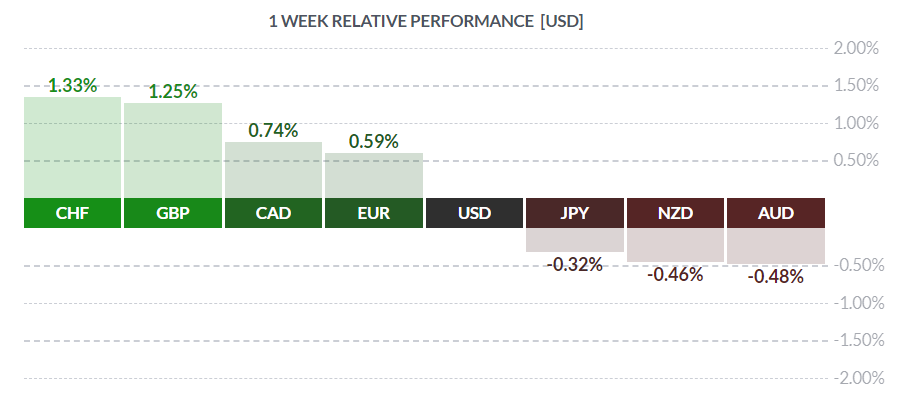

However, although emerging market currencies show a particular vulnerability, the dollar's performance is actually quite average compared to other major currencies this week.

Because the price of bitcoin remains stable, what is interesting to observe are volumes throughout the world.

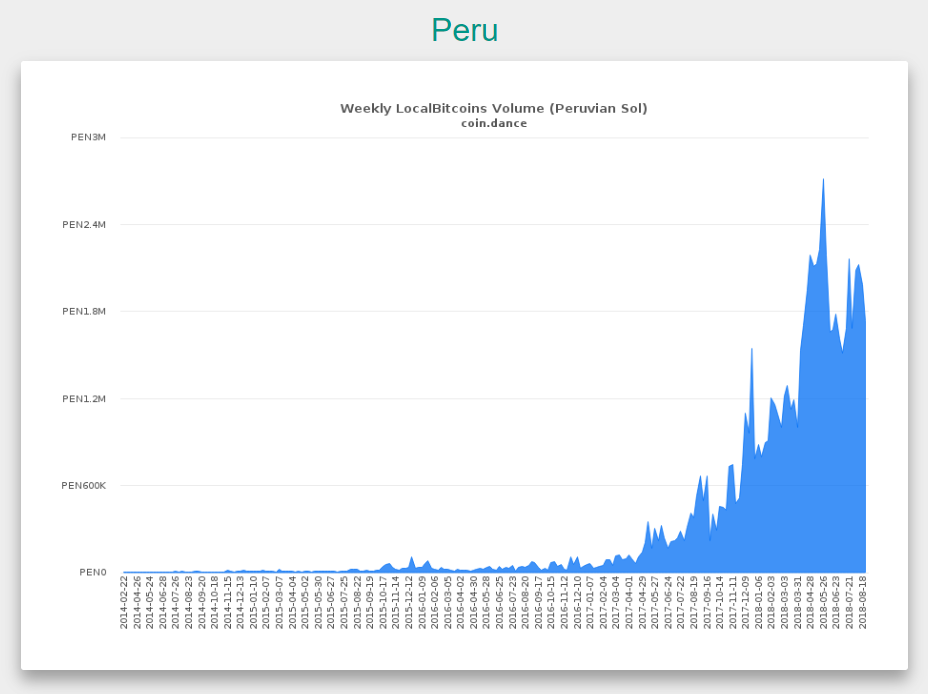

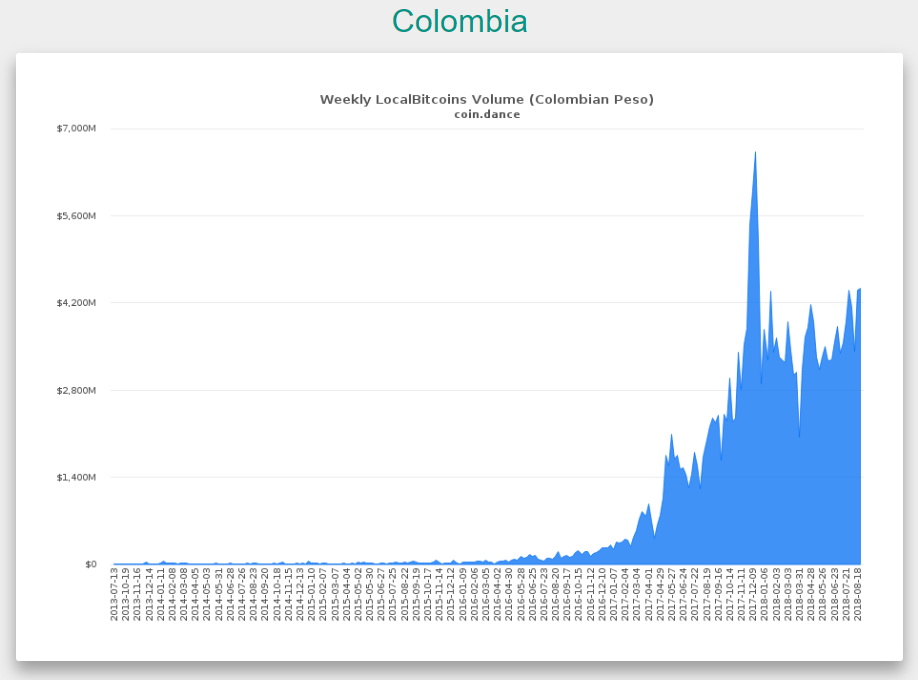

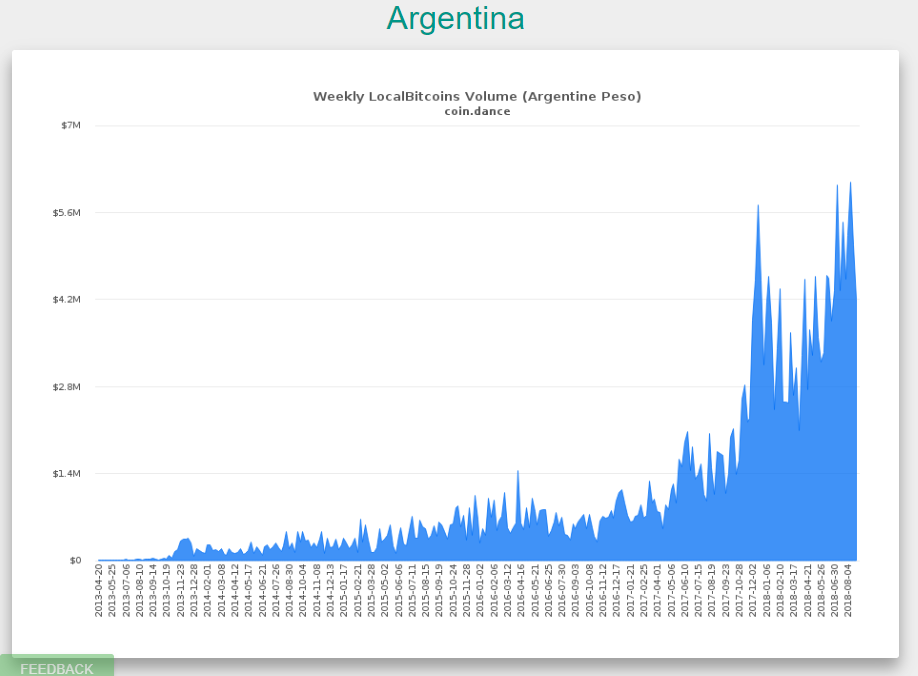

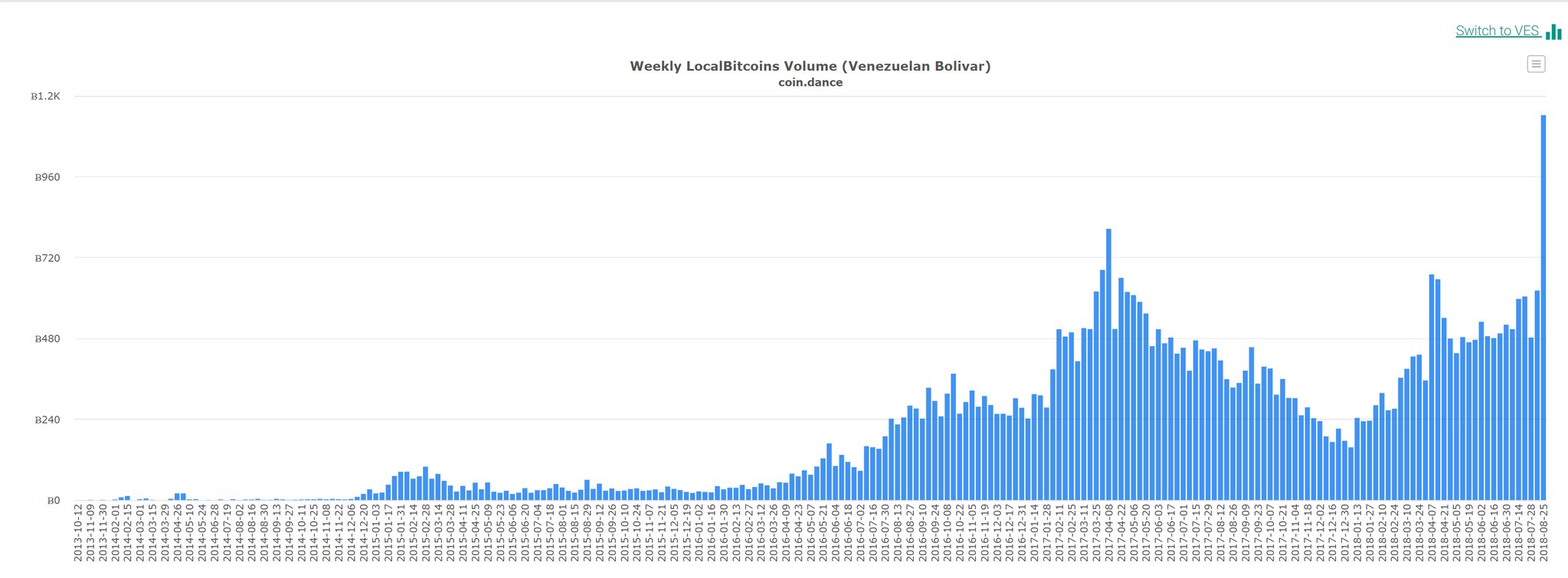

One of the best ways to see it is to look at the coin.dance charts, which show the volume of transactions on the popular bitcoin trading site of P2P LocalBitcoins.com.

From this, it becomes immediately clear that several South American countries are increasing their purchases. Peru, Colombia and Argentina are constantly increasing their volumes.

The real outlier is Venezuela. Because we know the economic crisis, citizens have tried to find refuge in many places. When it comes to storing value, Venezuelan citizens are turning more and more towards the crypt.

Here we can see that the number of BTCs exchanged in Venezuela last week almost doubled the already high levels seen in the previous week.

Wishing you and yours a wonderful day ahead. As always, let me know if you have questions, comments or feedback.

[ad_2]Source link