[ad_1]

Bitcoin, Ether, XRP Bets Gone Wrong

While Mike Novogratz is unquestionably one of the main players in this sector, not even he, a former institutional banker who became an irreducible Bitcoin, was safe in the bearish market of 2018. Because the centric bank Galaxy Digital, born from an idea of Novogratz, was listed in Toronto, the Canada Stock Exchange (TSX) as GLXY, the startup has been mandated by the law to disclose its financial statements.

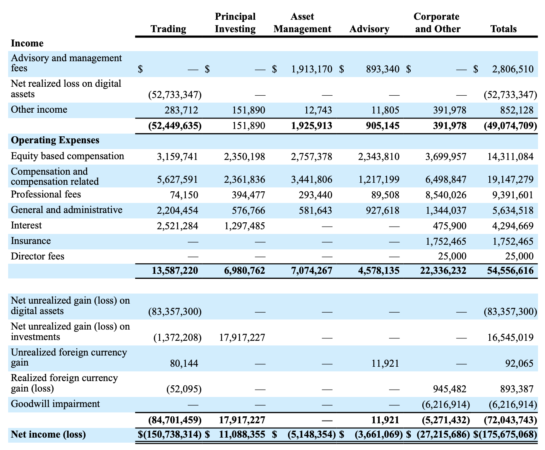

And while public disclosure rules have been made benevolence, such laws have damaged Galaxy Digital in its relatively short history on public markets. For Bloomberg and The Block, Galaxy's commercial operations recorded a loss (amalgamated realized and unrealized losses) of 41 million dollars in the third quarter (from 1 July to 30 September), equal to – 136 million dollars in 2018 until now.

For Bloomberg, the Galaxy listed in Toronto, its losses stem mainly from the loss of positions in Bitcoin (BTC), Ethereum (ETH) and XRP. And taking into account the losses reported by the galaxy, it can be assumed that its holdings, including XRP, are and have been quite robust.

More specifically, as noted by The Block, the losses realized for 38.1 million dollars were in particular for the sales of Ether, in contrast to the relatively small losses through the positions of BTC and XRP.

Curiously, potentially responding to a new outcry surrounding Ethereum Classic, the company held a small position in ETC, even managing to raise a $ 1.9 million gain through the popular Ethereum alternative.

However, commenting on the data, business representatives found a low volume of trade in cryptocurrency markets and greater competition in arbitrage scenarios, they were two key factors behind the sad performance of its fund. An official deposit noted:

As we continue to improve and strengthen our businesses, the lack of overall trading volume in cryptocurrencies has been an unfavorable factor.

While multi-million dollar losses would have annoyed almost all the most committed cryptic investors, Galaxy remains a bit impassive, maintaining a capital endowment of $ 90.6 million in crypto on September 30 with a net cost of $ 172 , 7 million.

This, of course, indicates that as its fearless leader, the Galaxy board and the top brass are still sold on cryptocurrencies, and are not ready to move anytime soon, that's for sure.

Although Galaxy's admiration with cryptography should not be overlooked, the New York-based newcomer continues to burn millions of dollars, bringing back $ 19.2 million paid (equity, money included) for package deals. compensation for employees.

Galaxy Digital (GLXY) engaged in the encrypted bear market

Taking into account the sad performance of the company, it should come as no surprise that Monday, GLXY.V, fell by 18.6% in the Canadian trading session, with the TSX which quickly stopped trading for the company. equity to prevent further bleeding. In a press release responding to the tumultuous price action, the company cried out that there had been no "substantial change" with regard to the operations of the company due to the downward-encoded market conditions.

And while Bitcoin, XRP and the most important activities of this market rebounded on Tuesday, even GLXY rose by 11% in a move comparable to the micro-run of 13% of BTC.

Once again, this price action comes just days after Mike Novogratz told the Financial Times that his company struggled in 2018, as reported by Ethereum World News.

The forward-thinker explained:

2017 was simply fun, it was almost stupid. [But] this year has been challenging. It sucks to build a business in a bear market. [Staff] anxiety levels increase when the crypt goes down … In most traditional businesses, [such as] Goldman Sachs, do not worry. There is no existential threat out there.

The multinational has also recently stopped its Vancouver office dedicated to the advisory, before letting go of many executives and hiring others in New York. Sources have even said that the Galaxy advisory arm had been sued by American regulatory authorities, adding to the serious situation of the company.

Title Image Courtesy of Vincentiu Solomon on Unsplash

Source link