[ad_1]

[ad_1]

In its latest report published on December 7, the European Union Blockchain Observatory and Forum (EUBOF) made a case for a digital identity system based on blockchain and digital versions of national currencies.

The report was prepared by the blockchain software software company ConsenSys AG on behalf of EUBOF, and focuses on the analysis of which blockchain properties could be beneficial and beneficial to governments.

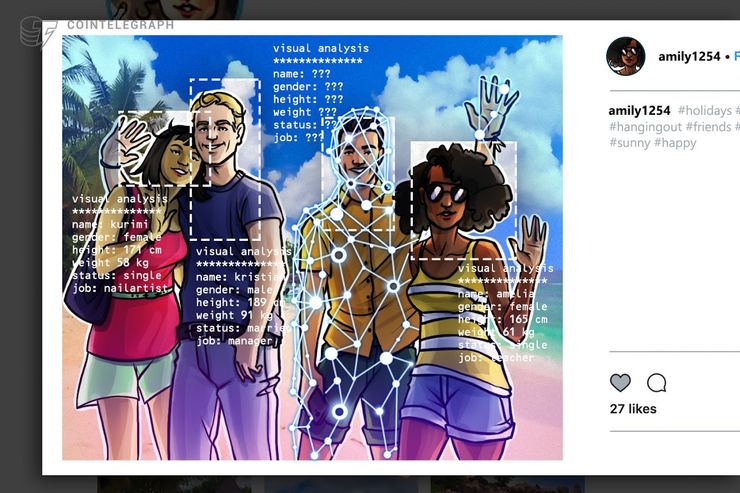

EUBOF suggests that governments should develop self-managed and "user-controlled" "identity capabilities" to create secure, private, unique and verifiable identities that provide sufficient proof of identity without disclosing more data than is necessary for a transaction . The report recognizes that this has proven difficult to achieve with centralized technologies.

While the idea behind self-sufficient blockchain identity is that individuals could personally keep personal information verified, instead of third parties, EUBOF notices potential challenges for governments.

The report states that we must first develop standards and frameworks of identity, as well as define to what extent people want the identity systems to be decentralized. He adds:

"They [governments] will have to take into account how identity attributes change over time during a person's natural life cycle and will have to offer different levels of transparency depending on the context (for example, verify that someone is over 18 without providing a date of birth ). Identity platforms must also include all citizens, including those who, for whatever reason, do not have access or are unable to use the technology. "

Another important issue raised in the report is the digital versions of national currencies on a blockchain, or the ability of governments to "put legal currency on the chain". The report also states:

"Putting digital versions of national blockchain currencies means that they could become integral parts of smart contracts, which would unlock much of the potential blockchain innovation by allowing parties to create automated agreements, including direct transactions in these currencies, instead of having to use a cryptocurrency as a proxy. "

The report cites plans and initiatives of central banks for the monetization of national currencies, or interbank payments with distributed registers to make transaction processes more transparent, resilient and economically efficient. In addition, governments could presumably use blockchain-based tokens in non-monetary ways, such as an e-voucher that can be exchanged for government services.

This week, Malta, France, Italy, Cyprus, Portugal, Spain and Greece issued a statement asking for help in promoting the use of Distributed Ledger Technology (DLP) in the region, claiming it could be a "game changer" for the southern economies of the EU. Among other things, the group also cited the use of blockchain technology to protect citizens' privacy and make bureaucratic procedures more efficient.

[ad_2]Source link