ArbiSmart is the regulated app that is redefining cryptocurrency investments. In minutes, you can start earning up to 45% interest per year with close to zero risk and effort!

Fund company

ArbiSmart is an EU licensed and regulated financial services provider, based in Estonia in early 2019. The company’s offering includes a fully automated crypto arbitrage trading platform and an interest-bearing portfolio.

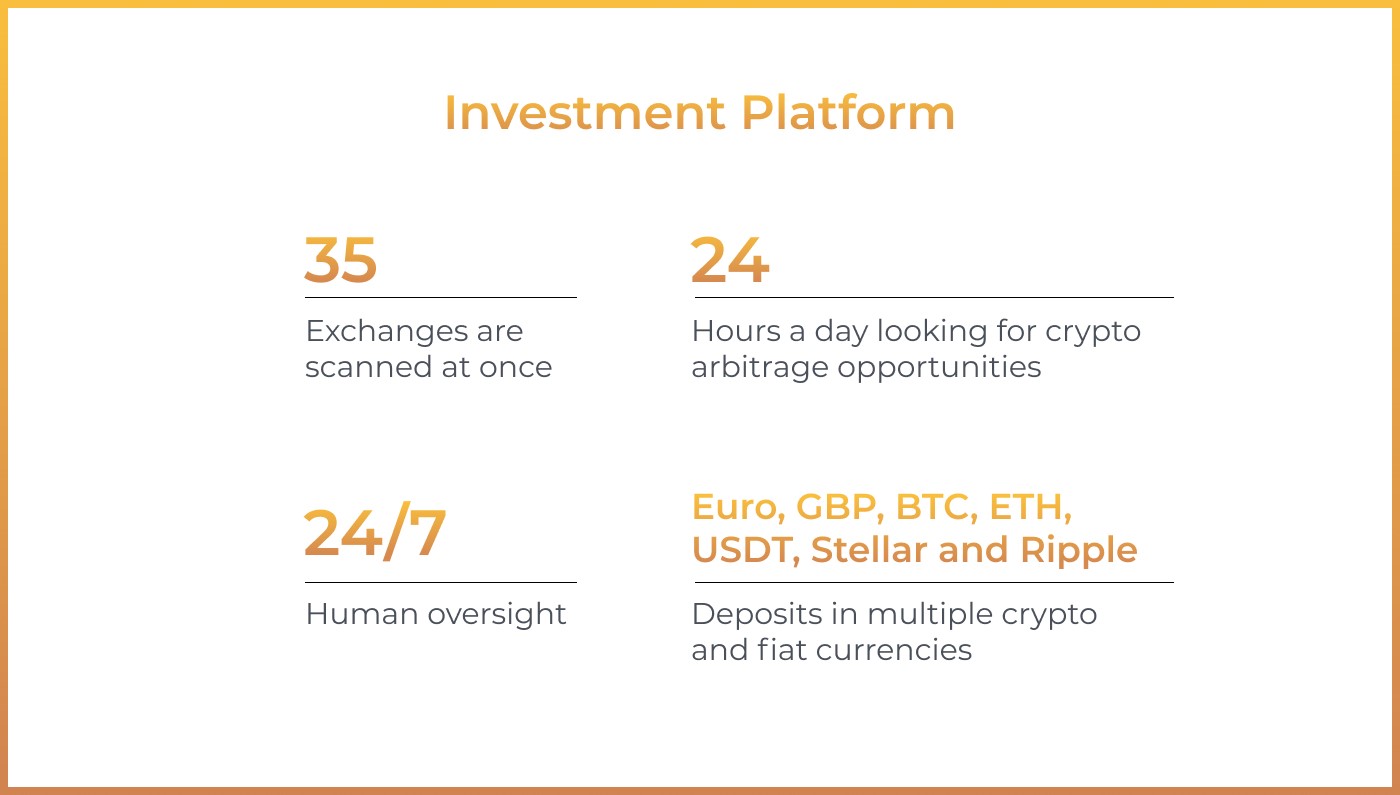

Investment platform

The ArbiSmart platform performs crypto-arbitrage trading on behalf of the investor. Crypto arbitrage, an exceptionally low-risk investment strategy, involves exploiting pricing inefficiencies on global crypto exchanges. For a short time, a single digital currency may be available on multiple exchanges at different prices at the same time, until the market adjusts and the temporary price difference eventually resolves itself.

ArbiSmart’s automated platform scans 35 trades simultaneously, 24 hours a day looking for crypto arbitrage opportunities. When he finds one, he buys the coin where it is sold at the lowest price and then instantly sells it on the exchange where it is available at the highest price, at incredible speed, to make a profit on the spread.

While the platform is fully automated, a risk management team monitors the market and platform 24/7 to provide human oversight and an extra layer of security.

The platform accepts deposits in multiple cryptocurrencies and fiat currencies, including Euro, GBP, BTC and ETH, USDT Stellar and Ripple, and investors can withdraw their profits at any time in EUR.

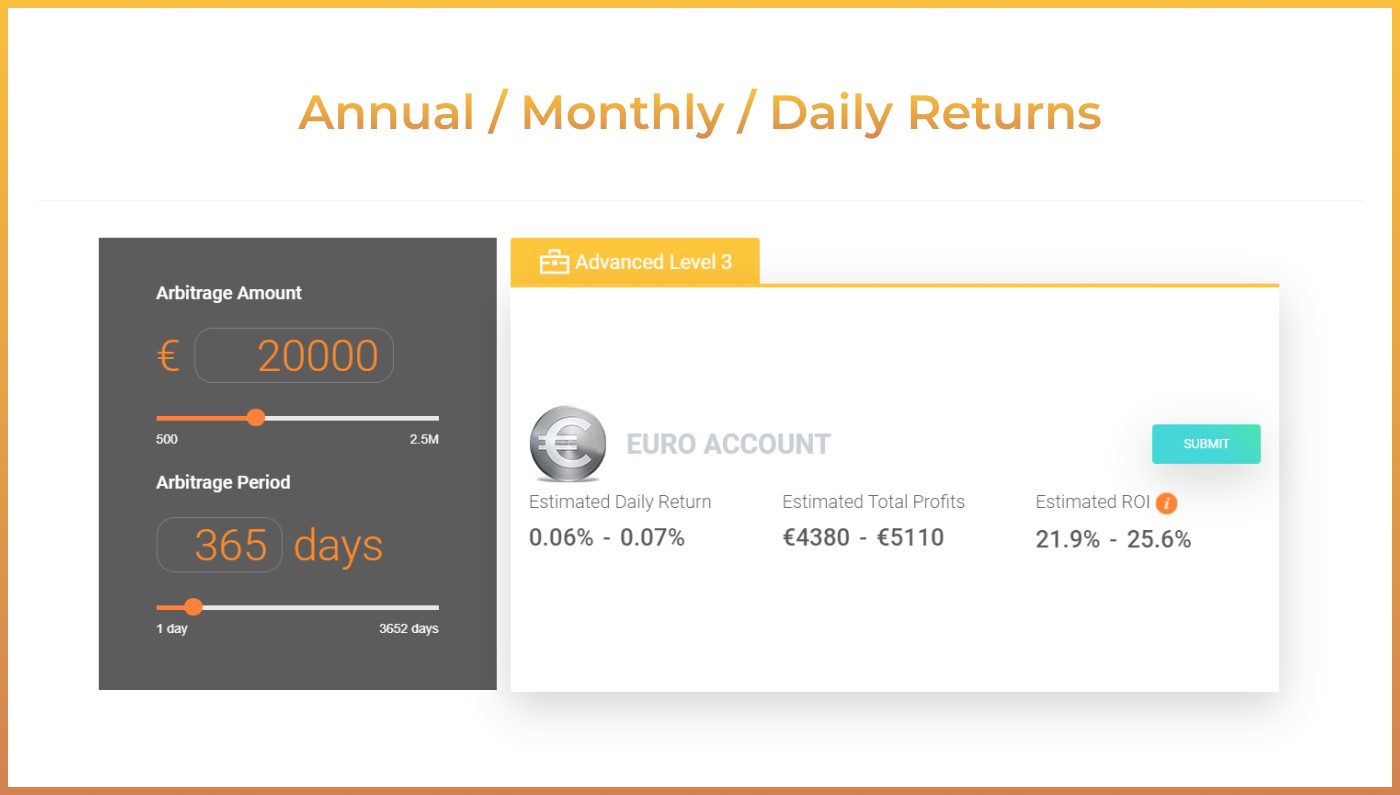

Annual / monthly / daily returns

The ArbiSmart platform offers guaranteed

returns ranging from 10.8% to 45% per annum, depending on the amount deposited. On the company’s accounts page, potential investors can see exactly how much they can expect to earn on a monthly and yearly basis.

For example, if a customer invests € 20,000 on a monthly basis, they will earn at least € 400 in interest per month and € 4,800 per year, not including capital gains resulting from the increase in the value of the RBIS token.

Although profits are outlined on the website per month and year, they are earned on a daily basis, so when an investor withdraws the funds they are paid out until the day of withdrawal.

RBIS token

ArbiSmart’s native token, RBIS, powers the platform. When a client signs up and deposits funds into their account, the money is automatically converted to RBIS and then used for crypto arbitrage trading. The profits that the investor has earned can be kept in RBIS to continue generating capital gains, or they can be withdrawn in EUR at any time.

Since its introduction last year, the value of RBIS has already increased by more than 120% and is projected to increase by 3,000% by the end of next year. The token has followed a steady upward trajectory in line with the growing global reach and growing popularity of the platform.

Customers can access and check the current token value on the dashboard at any time.

Regulatory state

The ArbiSmart platform is authorized and regulated by the EU. This means that the company complies with strict legislation regarding the protection of the integrity of the customer’s account.

ArbiSmart must undergo regular external audits and must demonstrate that it has sufficient working capital at all times to ensure that it will be able to pay profits to customers and must maintain an insurance fund to be used as collateral in an emergency.

The company must also implement a set of rigorous data security protocols and undergo frequent high-level IT security audits to test the strength of the platform’s data encryption and account login procedures.

Furthermore, ArbiSmart is subject to criminal controls of all persons connected with the company. It must also protect against fraud or terrorist activities from the outside, through the implementation of anti-money laundering practices and customer due diligence, with identity verification and screening against UN, EU, OFAC sanctions lists.

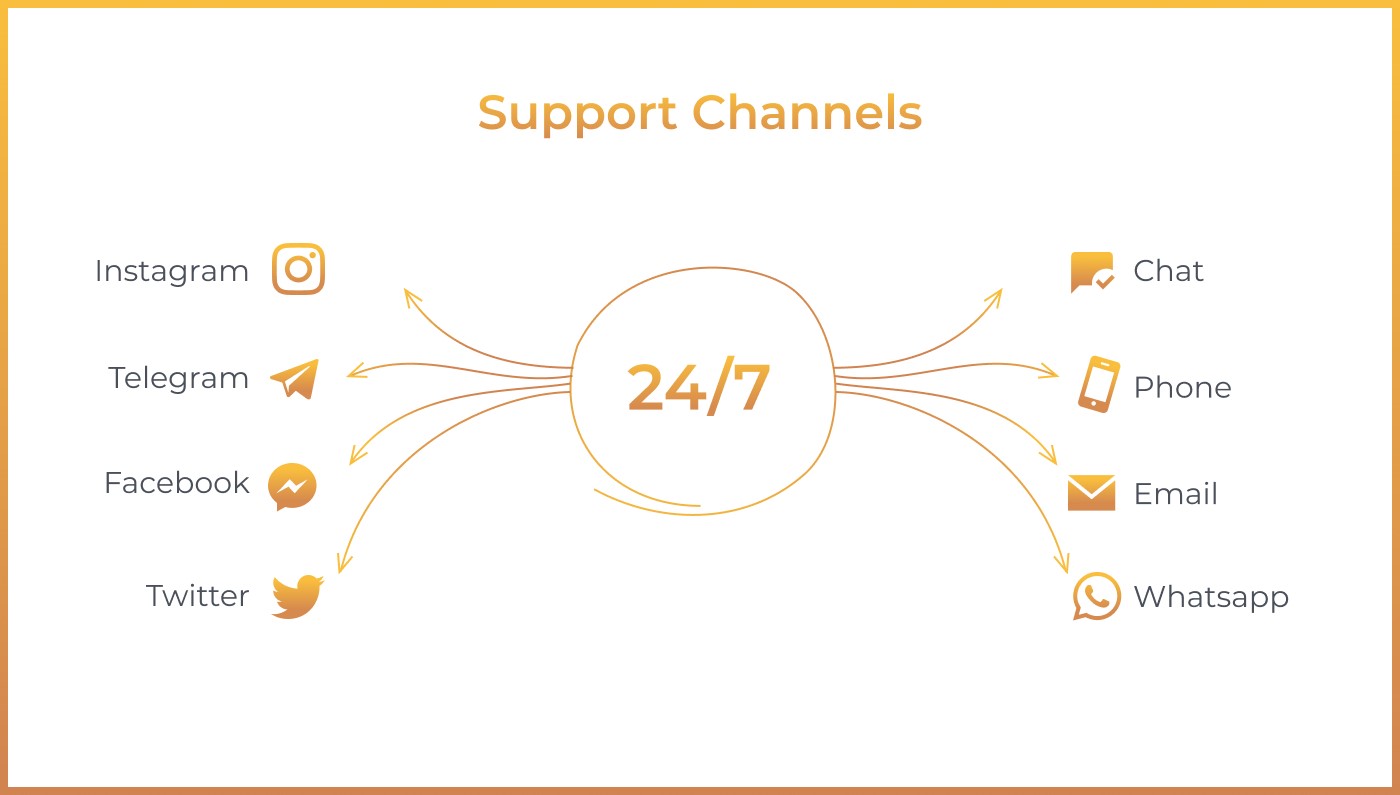

Support channels

The ArbiSmart platform offers multiple support channels, accessible 24 hours a day. Customers can contact the company with a question or concern to receive dedicated personal support via chat, phone, email and Whatsapp, as well as social channels including Instagram, Telegram, Facebook and Twitter.

Other products and services

Over the next two months, the company will launch the ArbiSmart interest-bearing portfolio.

The wallet will offer interest up to 45% per year, depending on a number of factors, such as the account currency, the deposit amount and the type of account. For example, users will be able to deposit funds in a range of cryptocurrencies, fiat and currencies, but holding currency in RBIS will earn a higher return. Additionally, if the account holder chooses to deposit their funds into a locked savings account for a specified period, they receive a better interest rate, which improves the longer the funds are locked.

Industry response

ArbiSmart has received great media enthusiasm, and a quick glance at the company’s press page reveals that it has received positive attention in all of the industry’s leading publications.

The company also has a 4.5 out of 5 rating on Trustpilot, the popular customer review site among the crypto community.

To start

ArbiSmart’s website is packed with valuable data for beginners and more experienced investors, with a blog providing free educational content on cryptocurrency investing, as well as a wide range of crypto and blockchain related topics.

Registering with ArbiSmart and funding your account will take no more than 5 minutes. Then put your feet up and let the platform do the rest.

Disclaimer:

This is a paid item provided by the company itself and is not an investment recommendation from CryptoTicker. Investing is always associated with risks, usually the higher the promised returns, the greater the associated risks. A total loss cannot be completely ruled out with any investment. CryptoTicker assumes no responsibility for the accuracy of the information in this article. The article also does not in any way reflect the opinion of CryptoTicker or its employees.

Nexo – Your Crypto Bank Account

Instant Crypto Credit Lines ™ alone gives 5.9% APR. Earn up to 8% interest per year on your Stablecoin, USD, EUR and GBP. $ 100 million in custodial insurance.

A.D

This post may contain promotional links that help us fund the site. When you click on the links, we get a commission, but the prices don’t change for you! 🙂

Disclaimer: The authors of this website may have invested in cryptocurrencies themselves. They are not financial advisors and only express their opinions. Anyone considering investing in cryptocurrencies should be well informed about these high-risk assets.

Trading with financial products, especially with CFDs carries a high level of risk and is therefore not suitable for security conscious investors. CFDs are complex instruments and come with a high risk of losing money quickly thanks to leverage. Keep in mind that most private investors lose money if they decide to trade CFDs. Any type of trading and speculation in financial products that can produce an unusually high return is also associated with an increased risk of losing money. Note that past earnings are no guarantee of positive results in the future.

You may also like

More from Crypto

Bitcoin Price Prediction: BTC aims for $ 100,000 by 2021 according to this financial model

Published November 6, 2020

0

Bitcoin’s current rally is defying all logic, still trading at $ 15,490 after hitting $ 15,960 on Binance and even $ 16,000 on …

Square’s Bitcoin revenue grows 1100% in the third quarter

Published November 6, 2020

0

Square Inc., a payments company founded by Twitter CEO Jack Dorsey, has heralded a dramatic increase in bitcoin revenue in the …

Is now the best time to start mining Bitcoin?

Published on November 5, 2020

0

One of the most ingenious ideas in the Bitcoin network is the adjustment of the difficulty, which guarantees the average production of blocks …

[ad_2]Source link