[ad_1]

[ad_1]

XRP USD

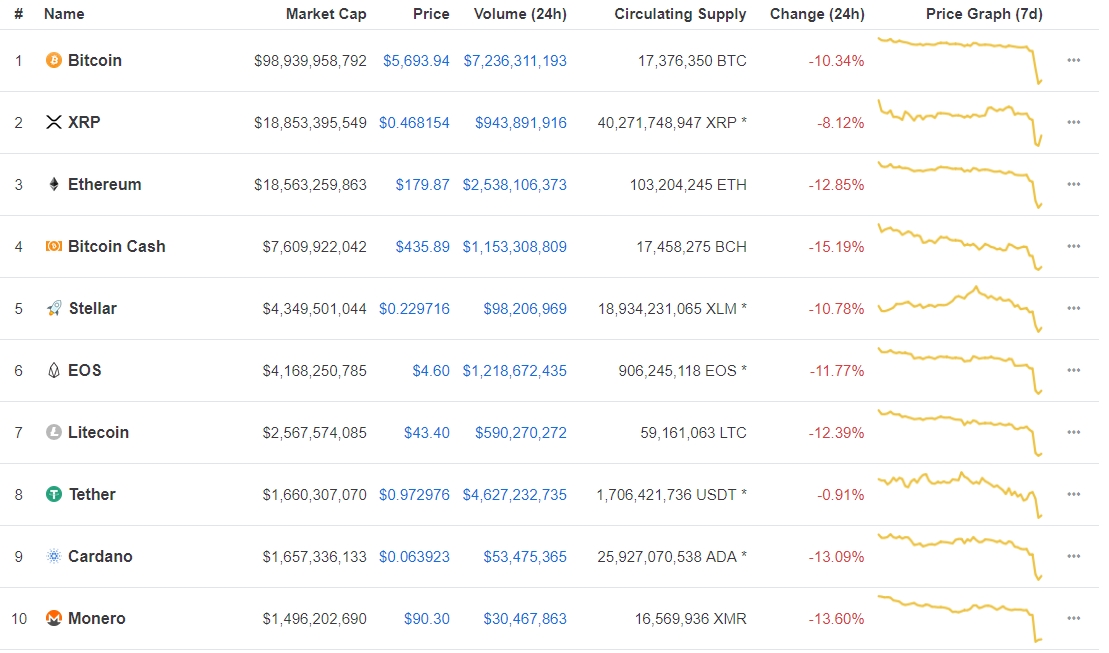

On Bitcoin [BTC] fall below the annual minimum, the market follows and dives deep into red leaving many words HODLER speechless while the early breakout has gone Wrong way. Of all the major currencies that record double-digit falls, the fast XRP is only 8.00% in red for the last 24 hours, which ended with the digital asset that exceeded the second position of well-cemented Ethereum and is found only behind Bitcoin.

In relation to the decline in prices, read:

Bitcoin (BTC) Crash! The price falls to one year since the cryptocurrency market turns red

By hour of writing, the XRP / USD pair is changing hands just below the $ 0.5000 to $ 0.4681, which is a similar case for all currencies.

Latest news on the main currencies

Ethereum – During Devcon4 [most important event on Ethereum’s yearly calendar] Ethereum 2.0 or Serenity has been mentioned and talked about on various points when it comes to the problem of network scalability:

"It contains several new radical ideas, part of which is around a passage from Pole Test (POV) away from POW, and the other big idea is sharding, so scalability: having a thousand fragments compared to only one fragment. "

Ethereum 2.0, Casper pure and never seen before scalability – Vitalik Buterin

Co-founder of the second largest coin – Vitalik Buterin, spoke about the most anticipated update – Progetto Ethereum 2.0 Serenity during the Ethereum Devcon 4 developer conference in Prague. According to Mr. Buterin, the project contains various characteristics that the team has spoken and worked for three to four years.

"… a combination of a lot of different characteristics we have talked about over the last few years, we are actively researching, building and now finally getting together."

XRP – During an interview with Bloomberg TV – Brad Garlinghouse, CEO of RippleLabs, highlighted that his blockchain-based company is able to get customers at a fast rate compared to the market because financial companies are looking for faster technology and more modern of the one currently offered through entrenched SWIFT fintech companies.

"The technologies that banks use today that Swift has developed decades ago have not evolved or kept pace with the market … Swift said that not so long ago they did not see blockchain as a solution for the corresponding banking system. 100 of their customers claiming that they are not in agreement. "