[ad_1]

[ad_1]

| After | Price | Modify |

|---|---|---|

| 1 day | $ 0.3753 | 0.35% |

| 1 week | $ 0.3759 | 0.52% |

| 1 month | $ 0.3841 | 2.69% |

| 6 months | $ 0.4345 | 16:16% |

| 1 years | $ 0.8146 | 117.82% |

| 5 years | $ 2.1976 | 487.58% |

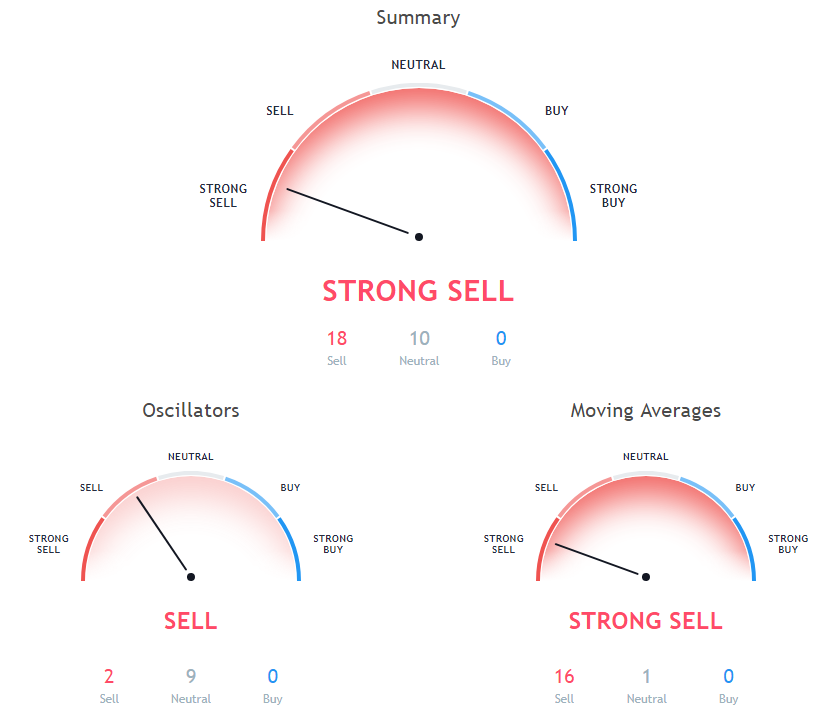

The stochastic oscillator is a momentary oscillator. The stochastic oscillator shows the Neutral signal, with a value of 27.6.

The Commodity Channel Index (CCI) is a momentum oscillator used in technical analysis to measure the deviation of an instrument from its statistical average. Index of the goods channel is at -89.01, indicating the neutral action.

Relative Strength Index (RSI) is an important indicator that measures the speed and change in price movements. Its value ranges from zero to 100. The value around 30 and below is considered oversold region and around 70 and over considered overbought regions. The relative strength index is at 35.97, which indicates neutral action.

Moving averages are available in many forms, but their use remains the same: helping economic operators to identify asset trends, mitigating daily price fluctuations.

9 days Ichimoku Cloud Base Line indicates a neutral action with a value of 0.45, Ripple is trading below it at $ 0.374. 100 days of exponential moving average is at 0.45, showing the sales signal, Ripple is trading below it at $ 0.374. The 50-day exponential moving average is at 0.45, showing the sales signal, Ripple is trading below it at $ 0.374.

Exponential moving average of 10 days is at 0.4, showing the sales signal, Ripple is trading below it at $ 0.374. 30 days of exponential moving average is at 0.44, showing the sales signal, Ripple is trading below it at $ 0.374. 30 days of simple moving average means Sell because Ripple trades at $ 0.374, below the MA value of 0.46.

10 days of simple moving average means a sales share with value at 0.39, Ripple is trading below it at $ 0.374. 5 days of exponential moving average means a sales share with value at 0.38, Ripple is trading below it at $ 0.374. The 100-day moving average is at 0.43, showing the sales signal, Ripple is trading below it at $ 0.374.

9 days moving average of the hull indicates Sell since Ripple trades at $ 0.374, below the MA value of 0.38. 20 days The weighted average volume average indicates Sell as Ripple trades at $ 0.374, below the MA value of 0.44. The 50-day moving average is at 0.46, showing the sales signal, Ripple is trading below it at $ 0.374.

The 200-day moving average is at 0.46, showing the sales signal, Ripple is trading below it at $ 0.374. 200 days of exponential moving average indicates a sales share with value at 0.49, Ripple trading below it at $ 0.374. 20 days of exponential moving average indicates a sales share with a value of 0.43, Ripple trading below it at $ 0.374.

Read also: 10 best Ripple portfolios of 2018

5 days of simple moving average means a sales share with value at 0.38, Ripple is trading below it at $ 0.374. The 20-day moving average is at 0.44, showing the sales signal, Ripple is trading below it at $ 0.374.

Other technical analysis of prices for today:

Bitcoin (BTC) Price experience Correction of the fall and trade around $ 4200 – Bitcoin price analysis – November 30, 2018

The price of Ethereum (ETH) is being negotiated with a short-term downtrend channel of more than $ 115 – Ethereum price analysis – 30 Nov 2018