[ad_1]

[ad_1]

- The entire cryptocurrency market has wiped out over $ 80 billion in market capitalization in the past 24 hours.

- XRP, Stellar, and Verge are some of the hardest hit altcoins.

Total market capitalization peaked at $ 580 billion on November 25 before the massive crash of the past 24 hours. XRP was down by 26%, Stellar by about 25% and Verge by 32%. Is it the bottom for these coins or will they keep going down?

XRP undergoes a strong 42% correction

XRP was one of the few cryptocurrencies that remained unchanged for most of November as the market was bullish. However, on November 21, the XRP price saw a massive 43% explosion, followed by an even greater continuation on November 23. The price went up 137% in just four days.

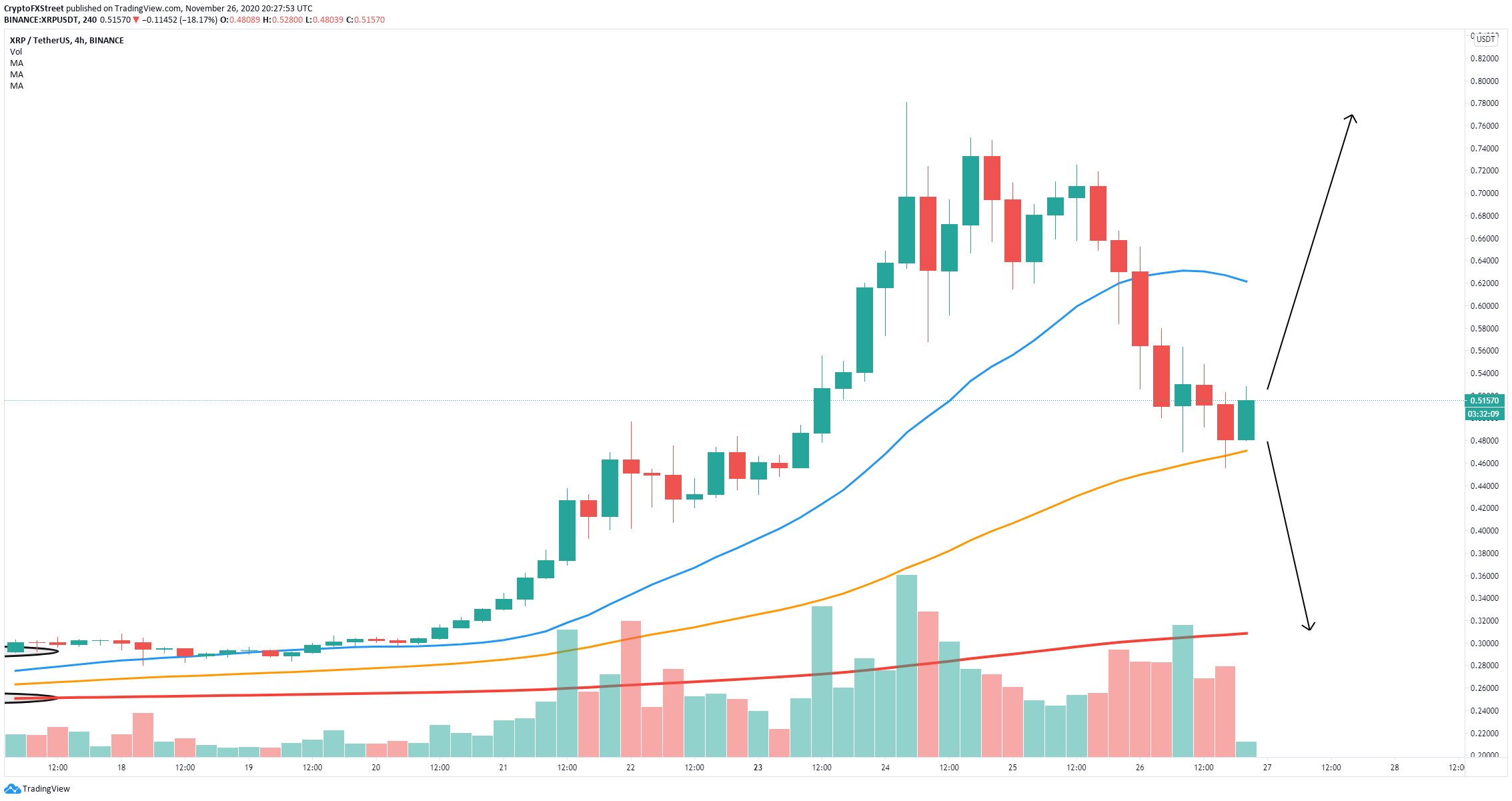

XRP / USD 4-hour chart

On the 4-hour chart, the XRP bears have established a downtrend and broken out of the 100 SMA at $ 0.625. The 50-SMA at $ 0.471 is the last support level. A breakdown from this point could quickly drive the price of XRP towards the psychological level at $ 0.40 and possibly $ 0.30 where the 200-SMA is.

On the other hand, a 50-SMA defense in a rebound could push the XRP price back towards the 100-SMA. A further breakout above $ 0.62 would take the digital asset to its 2020 high.

The stellar bulls try to buy the dip

XLM suffered a similar drop of 37% to a low of $ 0.145 by losing the 100-SMA but holding the other two SMAs. It appears that the bulls are buying the bears by establishing $ 0.145 as a strong support level and forming two bullish candles on the 4-hour chart.

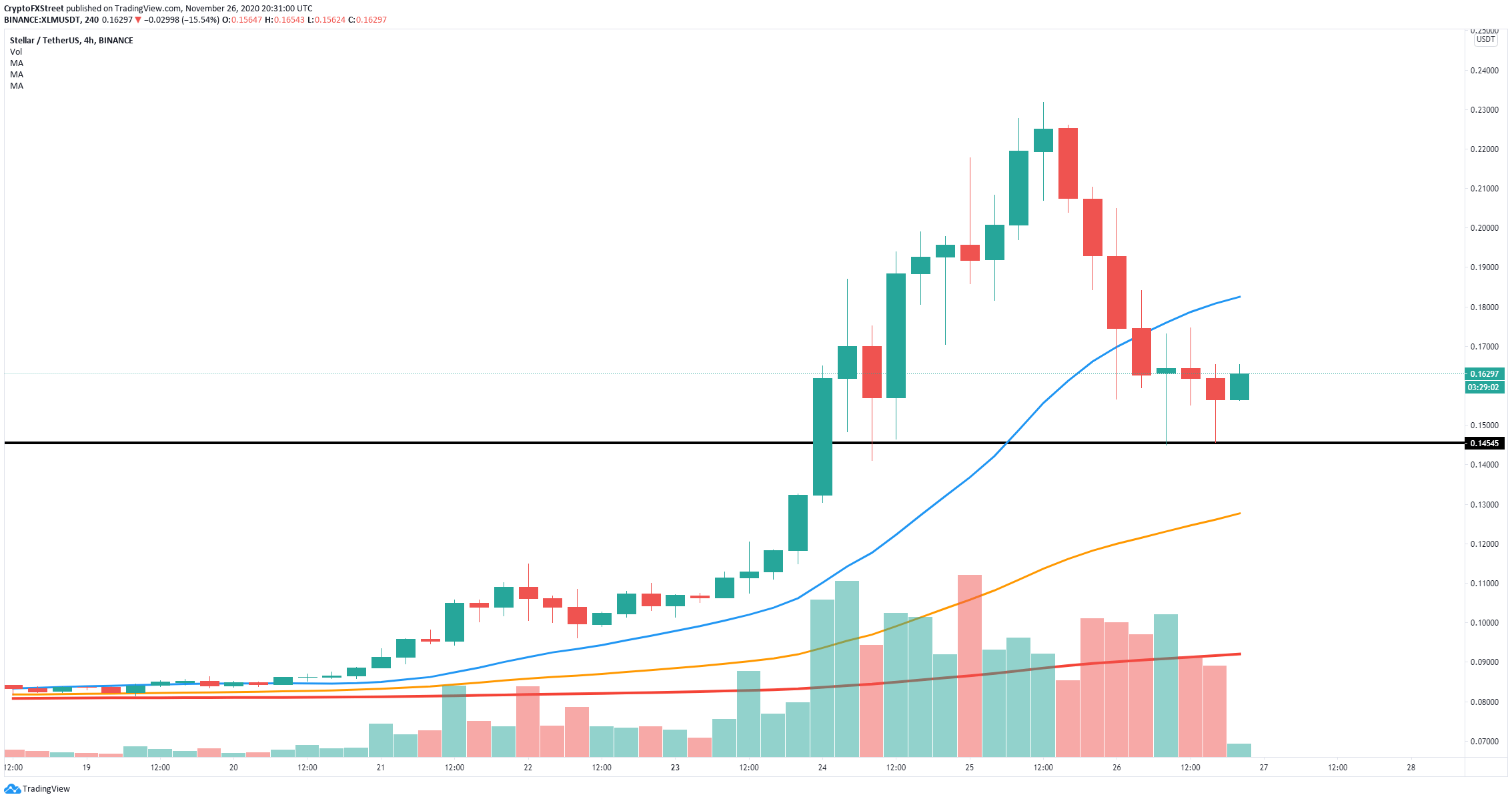

XLM / USD 4-hour chart

If Stellar’s price can rise towards the 100-SMA at $ 0.183 and see a breakout above it, it could quickly jump towards the 2020 high of $ 0.2317 as there is hardly any resistance on the upside due to the extent of the collapse.

On the other hand, failure to defend the critical support level at $ 0.145 would cause Stellar’s price to plunge towards the 50-SMA at $ 0.127 and possibly the 200-SMA all the way down to $ 0.092.

Verge flashes buy signal despite market weakness

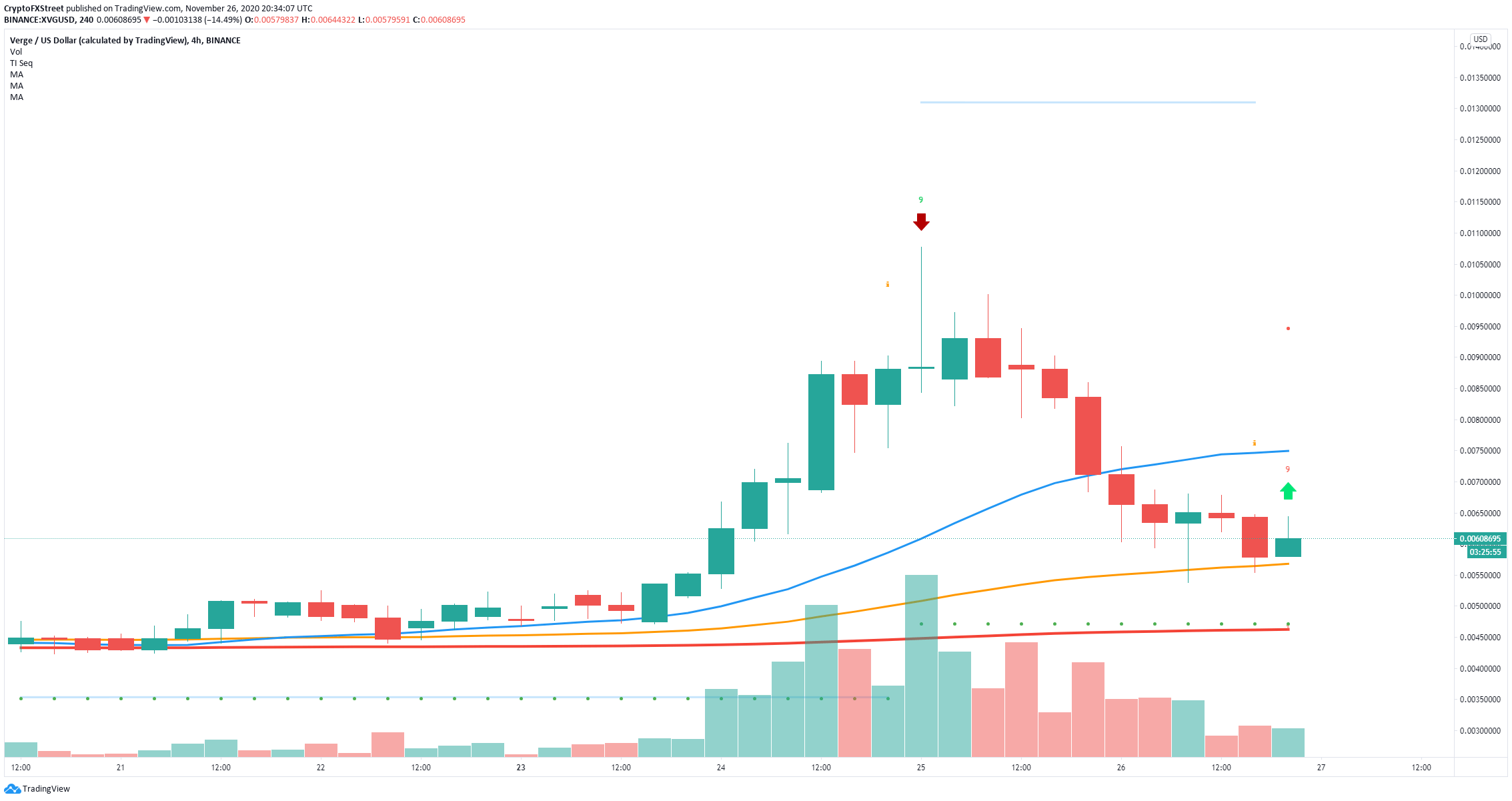

Although Verge has lost 50% of its value in the past 48 hours, the TD Sequential indicator has just posted a buy signal on the 4-hour chart right after the bulls managed to defend the 50-SMA support level at 0. , 0056 $.

XVG / USD 4-hour chart

Bears need to break out of the $ 0.0056 support level to push Verge’s price towards the 200-SMA at $ 0.0046. A break below the 50-SMA would most likely invalidate the buy signal

.[ad_2]Source link