[ad_1]

| After | Price | Modify |

|---|---|---|

| 1 day | $ 105.2633 | 0.09% |

| 1 week | $ 106.4772 | 1.24% |

| 1 month | $ 111.2820 | 5.81% |

| 6 months | $ 188.8518 | 79.57% |

| 1 years | $ 386.1129 | 267.13% |

| 5 years | $ 1,488,2100 | 1,315.05% |

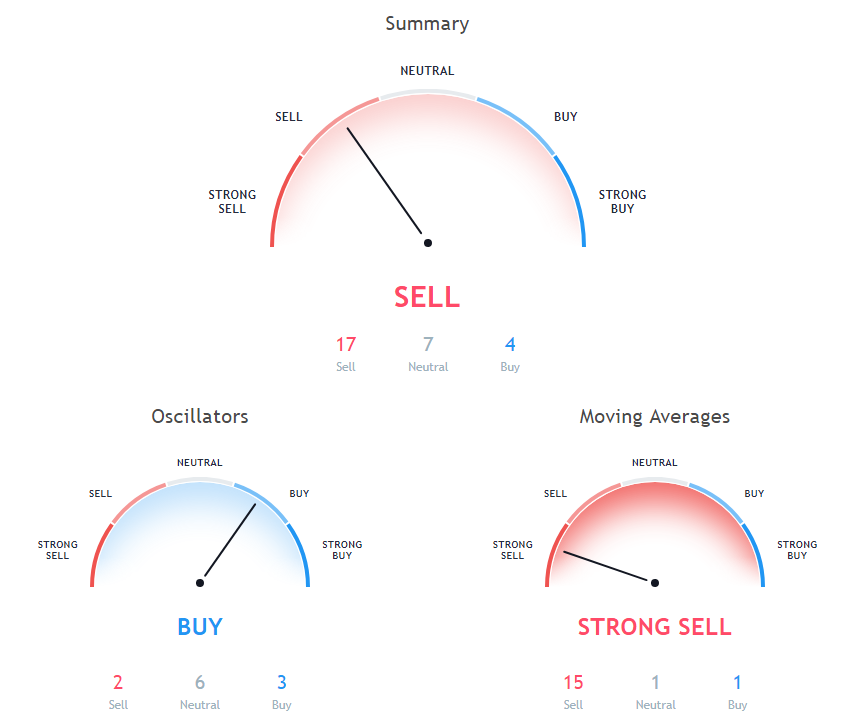

The stochastic oscillator is a momentary oscillator. The stochastic oscillator indicates the Neutral action, with a value of 8.24.

Relative Strength Index (RSI) is an important indicator that measures the speed and change in price movements. Its value ranges from zero to 100. The value around 30 and below is considered oversold region and around 70 and over considered overbought regions. Relative Strength Index is 17.4, which indicates the Buy action.

The Commodity Channel Index (CCI) is a technical trading instrument based on the momentum used to determine when a market is overbought or oversold. Commodity product index is at -107.82, which indicates the Buy action.

The 50-day exponential moving average indicates Sell since Ethereum is trading at $ 105.17, below the MA value of 185.44. 200 days of exponential moving average is at 321.65, showing the sales signal, Ethereum is trading below it at $ 105.17. The 200-day moving average indicates Sell since Ethereum is trading at $ 105.17, below the MA value of 353.73.

20 days of exponential moving average indicates Sell since Ethereum traded at $ 105.17, below the MA value of 152.92. 30-day exponential moving average means Sell since Ethereum traded at $ 105.17, below the MA value of 166.47. 30 day moving average means Sell since Ethereum is trading at $ 105.17, below the MA value of 178.65.

100 days of exponential moving average means a sales share with a value of 233.51, while Ethereum is trading below it at $ 105.17. The moving average of the 9-day hull is at 105.89, showing the Buy signal, Ethereum is trading below this at $ 105.17. 10-day moving average indicates the sale share with value at 130.46, Ethereum is trading below this at $ 105.17.

100 days Simple Moving Average indicates the sale share with value at 214.94, Ethereum is trading below it at $ 105.17. 10-day exponential moving average at 130.86, which shows the sales signal, Ethereum is trading below this at $ 105.17. 5 days of exponential moving average indicates Sell since Ethereum is trading at $ 105.17, below the MA value of 116.33.

50 days of simple moving average means Sell since Ethereum is trading at $ 105.17, below the MA value of 190.1. The 5-day moving average is at 115.27, showing the sales signal, Ethereum is trading below this at $ 105.17. 20 days the weighted mobile volume average is at 144.22, showing the sales signal, Ethereum is trading below this at $ 105.17.

Read also: How to buy and sell Cryptocurrency?

9 days Ichimoku Cloud Base Line indicates Neutral since Ethereum is trading at $ 105.17, below the AM value of 164.04. 20 days of simple moving average means Sell since Ethereum is trading at $ 105.17, below AM's value of 165.06.

Other technical analysis of prices for today:

Bitcoin (BTC) Continuous Price Breakout continues and trades around $ 3710 – Bitcoin Price Analysis – November 27, 2018

The price of Bitcoin Cash (BCH) trades with a positive distortion of over $ 160 – Analysis of the cash price for Bitcoin – 27 Nov 2018

Source link