[ad_1]

| After | Price | Modify |

|---|---|---|

| 1 day | $ 107.4378 | 0.81% |

| 1 week | $ 107.7664 | 1.12% |

| 1 month | $ 113.9179 | 6.89% |

| 6 months | $ 186.4249 | 74.93% |

| 1 years | $ 394.7373 | 270.40% |

| 5 years | $ 1,486.4330 | 1,294.79% |

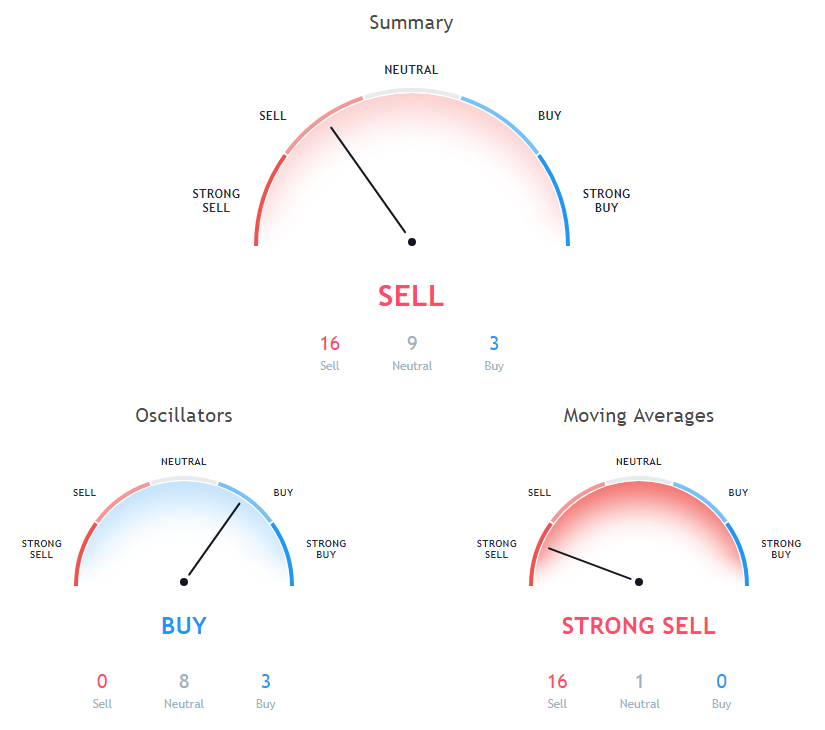

The Relative Strength Index (RSI) is an important indicator for measuring the speed and variation of price movements. Its value ranges from zero to 100. The value around 30 and below is considered an oversold region and over 70 as oversold regions. Relative Strength Index is at 27.71, which indicates the Buy action.

The Commodity Channel Index (CCI) is a technical trading instrument based on the momentum used to determine when a market is overbought or oversold. Index of the goods channel indicates the neutral action, with a value of -80.15.

The stochastic oscillator is a momentum indicator that compares the closing price of a security with the price range in a given period. The stochastic oscillator is at 16.26, indicating the Neutral action.

10-day moving average indicates the sale share with value at 114.3, Ethereum is trading below it at $ 106.57. 200 days of exponential moving average is at 305.8, showing sales signal, Ethereum is trading below it at $ 106.57. 30-day exponential moving average means Sell since Ethereum traded at $ 106.57, below the MA value of 145.11.

The 20-day weighted moving average indicates Sell since Ethereum is trading at $ 106.57, below the MA value of 126.98. 100 days Simple Moving Average indicates the sale share with value at 202, Ethereum is trading below it at $ 106.57. 30 days of simple moving average means Sell since Ethereum is trading at $ 106.57, below the MA value of 155.55.

The 50-day exponential moving average indicates Sell since Ethereum is trading at $ 106.57, below the value of MA 166.19. 5 days of exponential moving average indicates Sell since Ethereum is trading at $ 106.57, below the MA value of 111.56. The moving average of the 9-day hull indicates a sales share with a value of 108.78, while Ethereum is trading below it at $ 106.57.

100 days of exponential moving average is at 216.05, showing the sales signal, Ethereum is trading below it at $ 106.57. The 5-day moving average is at 112.85, showing the sales signal, Ethereum is trading below it at $ 106.57. 10-day exponential moving average means Sell since Ethereum is trading at $ 106.57, below the MA value of 116.77.

9 days Ichimoku Cloud Base Line is at 159.82, showing the Neutral signal, Ethereum is trading below it at $ 106.57. 20 days of simple moving average means a stock sale with value at 129.14, Ethereum is trading below it at $ 106.57. 50 days of simple moving average is 175.19, showing the sales signal, Ethereum is trading below it at $ 106.57.

Read also: Minereum mining pool

200 days of simple moving average means a sale action with value at 330.31, Ethereum is trading below it at $ 106.57. 20 days of exponential moving average is at 131.69, showing the sales signal, Ethereum is trading below it at $ 106.57.

Other technical analysis of prices for today:

The price of Bitcoin (BTC) is close to $ 3870 – Bitcoin price analysis – 5 Dec 2018

Discount in Bitcoin Cash (BCH) price below $ 150 – Bitcoin cash price analysis – 5 Dec 2018

Source link