[ad_1]

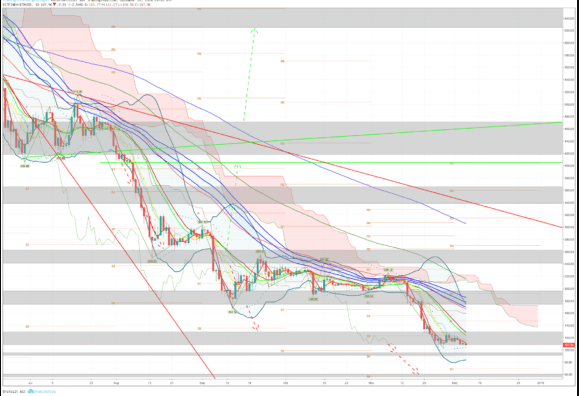

The price of Ethereum simply can not get rid of its risky situation. After the latest updates pointed to the weakness of the currency again and again, Ethereum does not seem better today. The lower limit for a renewed downward push is 108 US dollars. Ethereum was able to prevent this and repeatedly by means of a daily closing price. The cloud of Ichimoku-Kinko-Hyo-Indicator is still very far, currently at 55 percent. The signal for the sale of moving averages was activated by 204 US dollars. Until this is resolved, a substantial push towards the top is required.

Bullish variant:

The 108 US dollars can be defended. As a result, the movement is now starting. The fund is formed at rates above USD 129. The first objective at the top is therefore 175 US dollars. Here the signal of sale of moving averages should be broken. The following objectives are set for 196 US dollars:

241 US dollars

338 US dollars

Bearish variant:

A daily closing price is generated well below 108 US dollars. Ethereum slips further and reaches a two-digit price. The prices on the lower side are as follows:

95 US dollars

60 US dollars

The development of Ethereum is skyrocketing

The price is sinking, but Ethereum is emerging on the technological front, hundreds of world-class developers are leading the way for Ethereum to become the world's supercomputer and operating system.

Ethereum and all its Dapps are the showcase for what Blockchain is and what it can do and how it can change the world.

The Ethereum dApps start to move forward

Undoubtedly, there were many toxic ICOs who obstructed Ethereum, robbed their investors and gave ETH a bad reputation in 2017. However, these unfortunate and worthless projects are rooted in total incompetence and legal non-compliance and good ones. they are bursting. on and get traction between users.

"Millions of people use the Brave browser and will be exposed at some point BAT (an Ethereum token). 3d artists are using Ethereum Blockchain through Golem to make 3d projects. dYdX allows you to make margin trading in a completely decentralized way by buying some long or short tokens, I just acquired some leveraged tokens in expo (based on dYdX) and I am amazed .. "

There are many other dApps that deserve to be mentioned, but this goes beyond the scope of this article, so we will briefly discuss only some of the most known and working dApps.

Augur it is functioning as a fully decentralized and open source forecasting market platform based on the Ethereum blockchain for all predictive markets. luna park is a decentralized gaming technology platform that uses Ethereum's blockchain, smart contracts and its own destiny channels (state) to provide casino solutions with "fun, fast and fair" games. FunFair has been launched for many months and they are working to obtain legal licenses in different jurisdictions.

Golem he called himself "the world supercomputer." Golem Brass beta was released on the mainnet in the second quarter, allowing users to sell their computing power and earn real GNT for the first time. OmiseGo it is the decentralized plasma exchange, which houses an open source digital wallet platform created by the parent company, Omise, which links traditional payments, cross-border remittances and much more. They have had their public release of White Label Wallet SDK which is one of the most useful tools in the developers' arsenal.

Join our Telegram channel

The writers and authors of CapitanAltcoin may or may not have a personal interest in any of the projects and activities mentioned. None of the contents on CaptainAltcoin is an investment advice, nor does it replace the advice of a certified financial planner.

The opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com

[ad_2]

Source link