[ad_1]

Photo: QuoteInspector

Key points:

- The price of Ethereum is in an uptrend;

- the bulls have control of the ETH market;

- the bears have lost control.

ETH / USD long-term trend: bullish

Offer levels: $ 146, $ 164, $ 182

Demand levels: $ 131, $ 109, $ 79

ETH is in its upward trend on long-term prospects. Last week, the cryptocurrency found its support at the $ 79 demand level. A bullish beaded candle formed at this level of demand meant that the bulls managed to break the previous bid level of $ 109 and the currency it has gathered in the north and the goal of last week has been achieved as planned. The demand level of $ 79 serves as a turning point for the currency. Several obstacles have been broken upwards including dynamic support and resistance.

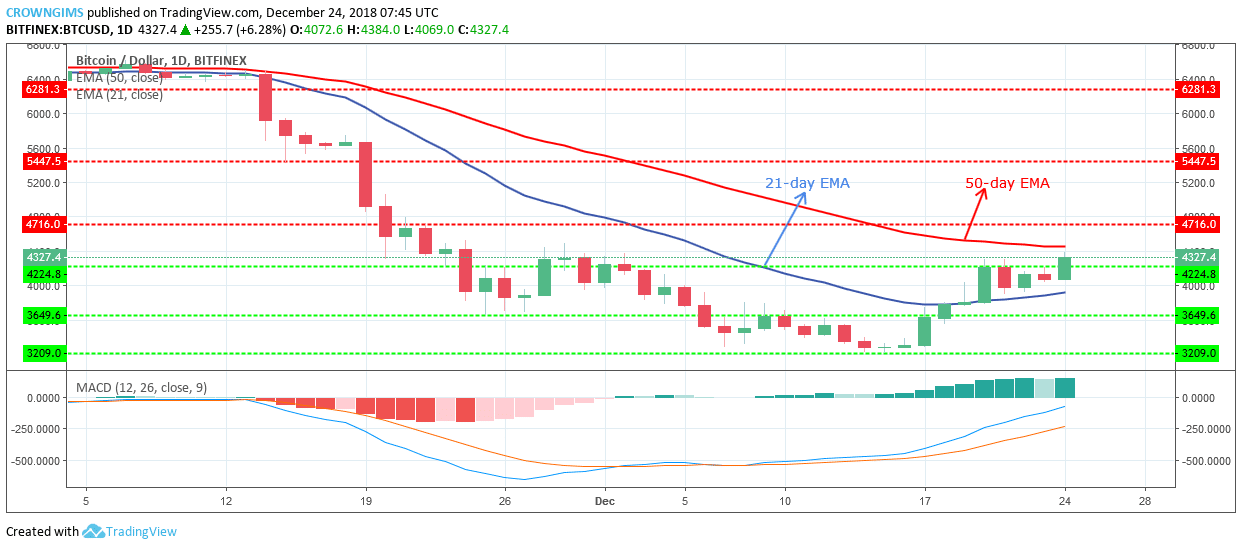

The bulls have conquered the ETH market while the bullish momentum increases with the stronger bullish candles that arrive and place the coin over the 50-day EMA while the 21-day EMA is below which indicates that the bullish momentum is increasing. The currency peaked at $ 164 where the further increase was rejected and the price of Ethereum returned to the broken level.

All indicators confirm the continuity of the upward trend on the daily charts; the MACD period 12 with its histogram above zero levels and the signal line pointing to the north that connotes the purchase signal. Currently, the 21-day EMA is approaching the 50-day EMA to cross the rise.

After the current price correction, the ETH price could resume its bullish move and could reach the target at $ 182.

ETH / USD Medium-term trend: bullish

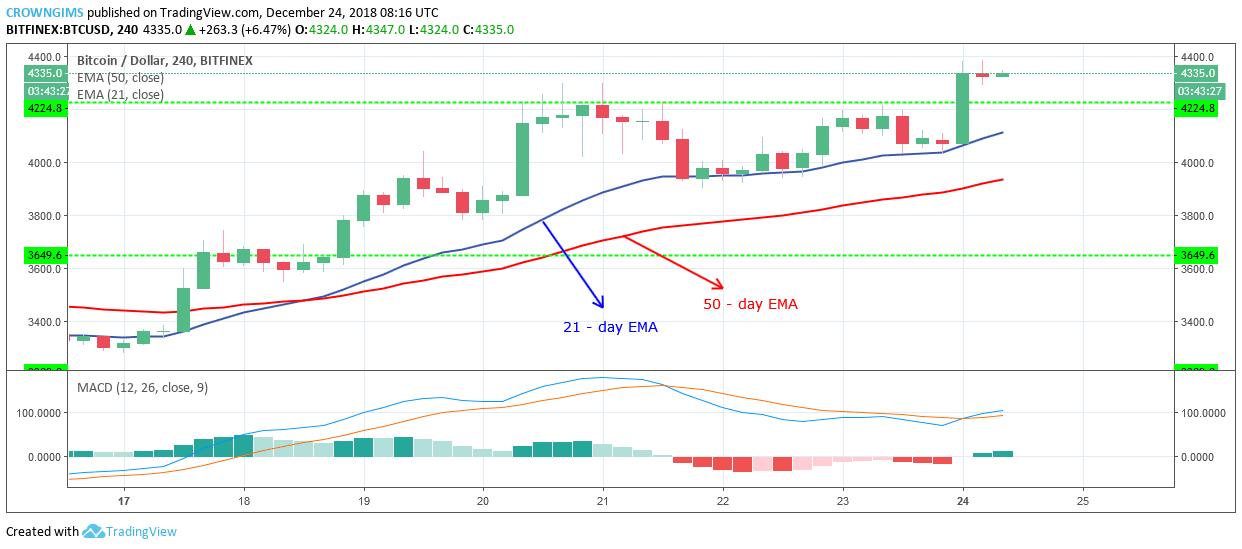

In the medium term, ETH / USD is in an uptrend. The upward trend continues on the 4-hour chart as the ETH price is pushing up the chart. The 21-day EMA surpassed the 50-day EMA rise as evidence of bullish trend and bull dominance on the ETH market.

Yesterday, the price of Ethereum rose to $ 164 and bears defended the level by pushing the ETH price down from the formation of the Doji candle on the tombstone followed by bearish candles, down from previous levels of demand of $ 146 and $ 131 .

In the event that bearish pressure continues and a bearish engulfing candle rupture occurs and a closing below the demand level of $ 121, then Ethereum could have the minimum at $ 98 – $ 109. Meanwhile, the MACD with its histogram is below zero and the signal lines pointing down connote the signal.

Source link