[ad_1]

Photo: QuoteInspector

Key points:

- Consolidation is underway;

- The fall in the price of Ethereum is imminent;

- there is a probability that bears will take control of the ETH market.

Long-term trend ETH / USD: variable

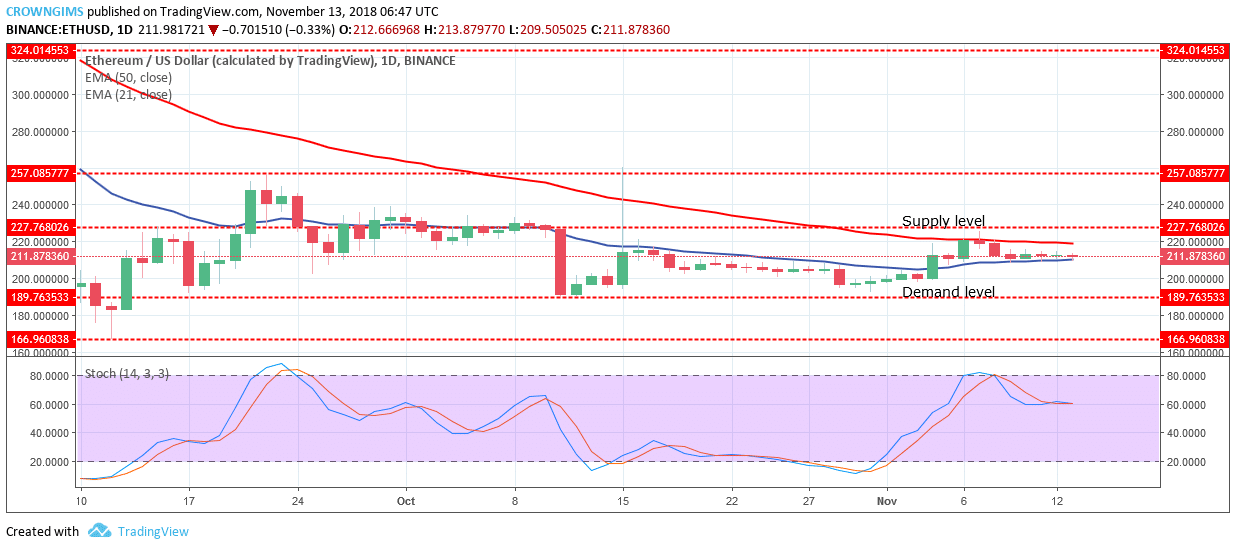

Offer levels: $ 227, $ 257, $ 324

Demand levels: $ 189, $ 166, $ 147 Ethereum has a long-term vision. The cryptocurrency is in consolidation mode from October 15th. The ETH price is intended to cover an interval between the bid level of $ 227 and the demand level of $ 189. The oscillating movement started when the bulls gained momentum on October 15th and the ETH price suddenly increased to $ 257, the price level lost the pressure to the point and the bears rejected the further increase in the ETH price pushing it below the bid level of $ 227 and the consolidation began

Ethereum has a long-term vision. The cryptocurrency is in consolidation mode from October 15th. The ETH price is intended to cover an interval between the bid level of $ 227 and the demand level of $ 189. The oscillating movement started when the bulls gained momentum on October 15th and the ETH price suddenly increased to $ 257, the price level lost the pressure to the point and the bears rejected the further increase in the ETH price pushing it below the bid level of $ 227 and the consolidation began

Neither the bulls nor the bears were able to push the ETH price to gather either to the North or to the South, respectively. The ETH price is currently between the 21-day EMA and the 50-day EMA with the two neighboring EMAs one at the other; which indicates that consolidation is underway.

If the bulls gain enough momentum and break the supply level of $ 227, the ETH rally in the north and could have the bid level of $ 257 as a target. On the other hand, in the event that bears gain enough pressure and lower the demand level of $ 189, the currency will find its minimum at $ 166 in demand.

Furthermore, the period of the stochastic oscillator 14 is at 60 levels with the interlocked and parallel signal lines without direction confirming the consolidation in progress. The breakout is imminent, for now it is not logical to take any position on the Ethereum market until the break.

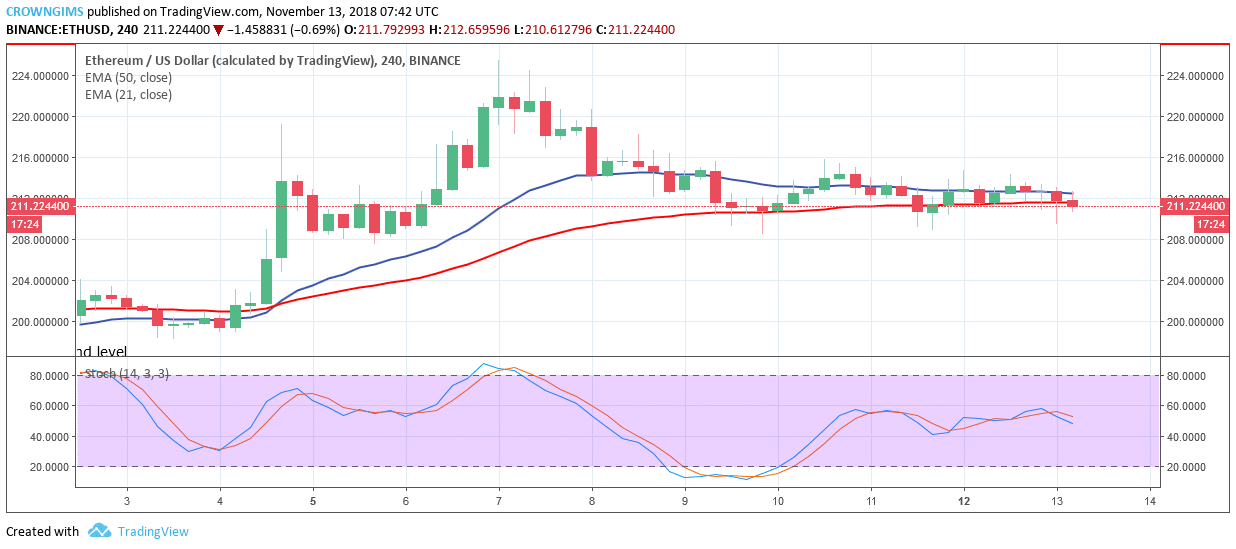

AndTH / USD Medium-term trend: variable

ETH / USD is going on the 4-hour chart. The bearish wreath candle formed on November 9th brought the coin into the consolidation phase. The price was exchanged within the two dynamic resistances and support (EMA of 21 days and EMA of 50 days) for more than 3 days which characterizes the consolidation.

ETH / USD is going on the 4-hour chart. The bearish wreath candle formed on November 9th brought the coin into the consolidation phase. The price was exchanged within the two dynamic resistances and support (EMA of 21 days and EMA of 50 days) for more than 3 days which characterizes the consolidation.

Meanwhile, the period of the stochastic oscillator 14 is at 50 levels with the signal lines facing south indicating a sales signal.

Source link