[ad_1]

Key points

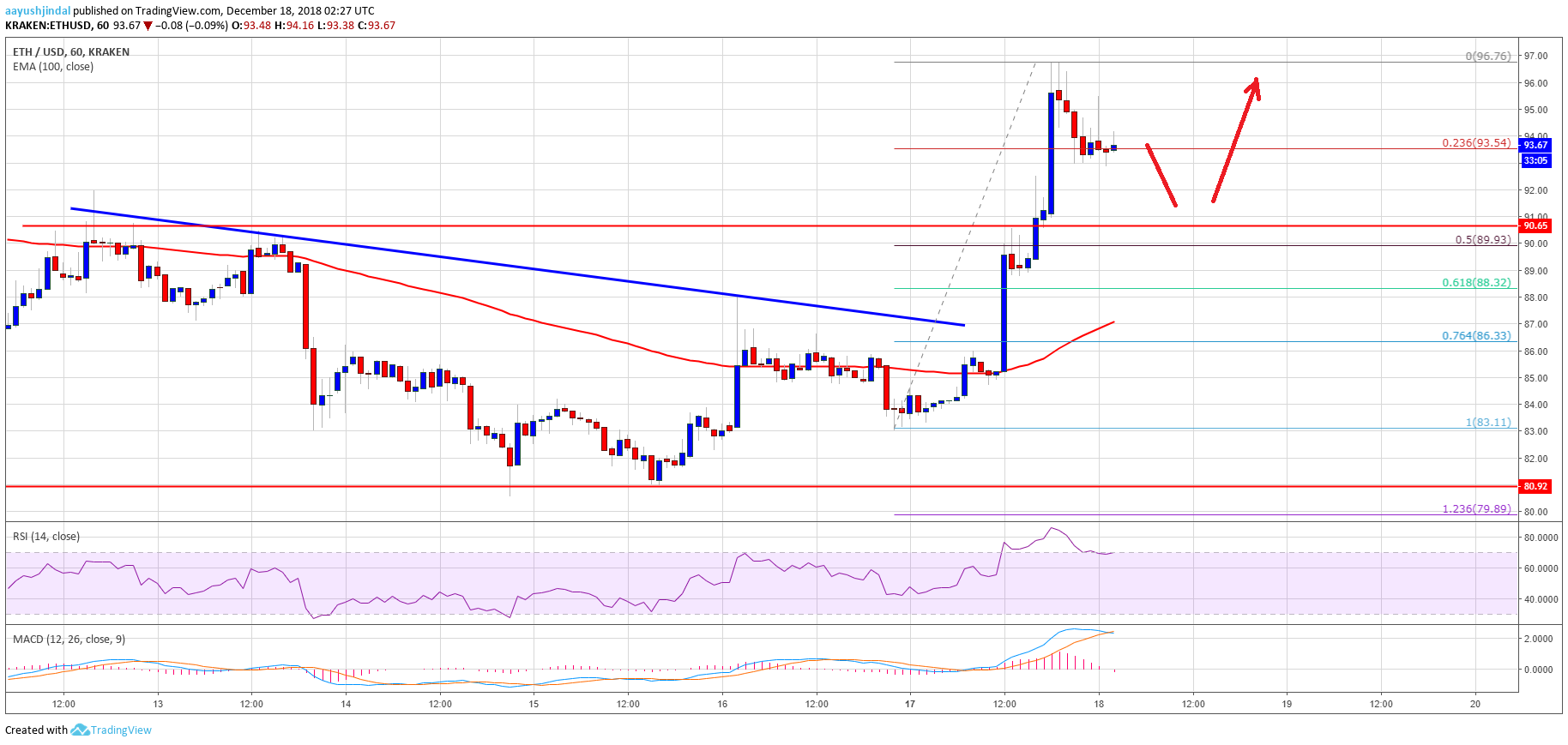

- The ETH price rose higher recently and broke the resistance area of $ 89-90 against the US dollar.

- There was a break above a crucial bearish trend line with resistance to $ 87 on the hourly table of ETH / USD (data feed via Kraken).

- The pair traded up to $ 97 and is currently consolidating earnings above $ 90.

The price of Ethereum made a nice bullish move against the US dollar and bitcoin. The ETH / USD now trades in a bullish zone and could find strong support near $ 89-90.

Price analysis of Ethereum

After a slight downward correction from $ 88, the ETH price found support close to $ 83 compared to the US dollar. The ETH / USD pair formed a support base near $ 83 and then started a solid upward move. It has exceeded the resistance of $ 86 and the simple moving average of 100 hours. The upward move was strong as the price even managed to overcome a significant barrier near the $ 89-90 zone.

Also, there was a break above a fundamental bearish trend line with resistance at $ 87 on the hourly chart of Eth / USD. The pair rose above the $ 95 level and traded near $ 97. It is currently correcting below the below $ 95 level. The price is trading near the Fib retracement level of 23.6% of the last wave from the low of $ 83 to $ 97 high. However, there are many supports on the negative side near the $ 89-90 zone. The previous resistance near $ 90 is likely to act as a strong support. In addition, the 50% fiber retracement level of the last wave from the low of $ 83 to $ 97 is close to $ 90.

Looking at the chart, the ETH price has clearly risen above the key obstacles close to $ 90, which can now serve as support. On the upside, a break above $ 96-97 could push the price down to $ 100 and $ 105 resistance levels.

MACD time – The MACD is slowly returning to the bearish zone.

RSI timetable – The RSI is currently well above level 60.

Main support level: $ 90

Main resistance level: $ 97

Source link