[ad_1]

[ad_1]

- Bitcoin’s price is close to its all-time high, currently trading at $ 19,300.

- XRP had a massive colossal rise of 242% last week.

- Ethereum’s price also closely follows Bitcoin’s pace.

The top three cryptocurrencies have been posting huge gains in the past few days. However, some on-chain metrics and technical indicators are showing that a potential withdrawal could be underway in the near term.

Bitcoin’s price points to an all-time high of $ 20,000, but it could face intense selling pressure

Bitcoin reached a high of $ 19,418 in the past 24 hours, just a few hundred dollars from its all-time high. The digital asset looks extremely strong but may face a lot of selling pressure as it approaches the critical level.

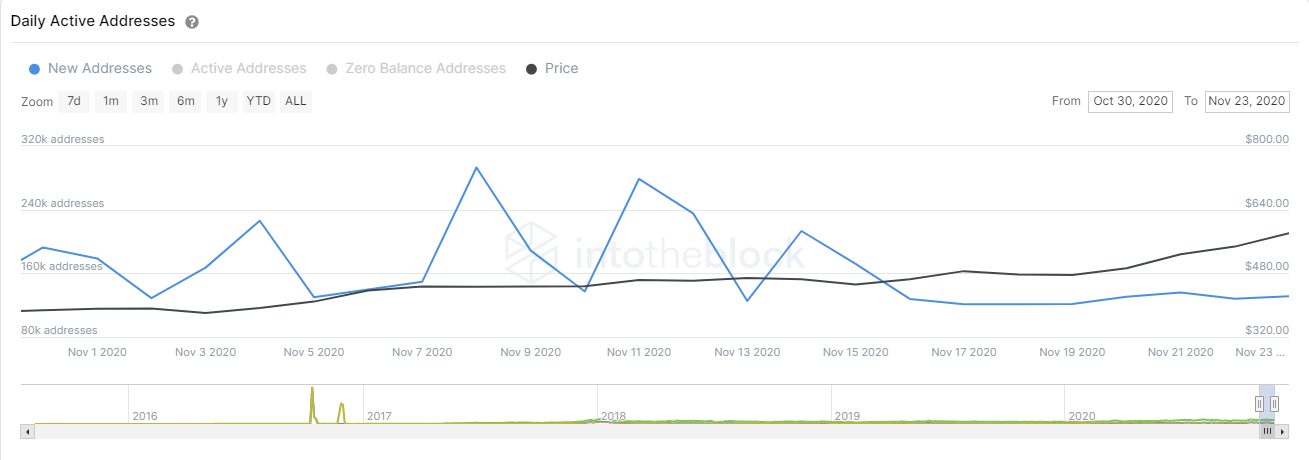

DAA vs Price Divergence Chart

The DAA divergence chart appears to be showing many red bars, which usually indicates that an asset is peaking. In this case, the metric has more strength due to the lack of new addresses joining the Bitcoin network.

[21.37.19, 24 Nov, 2020]-637418485527110605.png)

Distribution of BTC holders

It also appears that the number of whales holding between 100 and 1,000 Bitcoin has dropped from a peak of 13,953 on November 8 to a current low of 13,787, despite the significant rise in Bitcoin’s price.

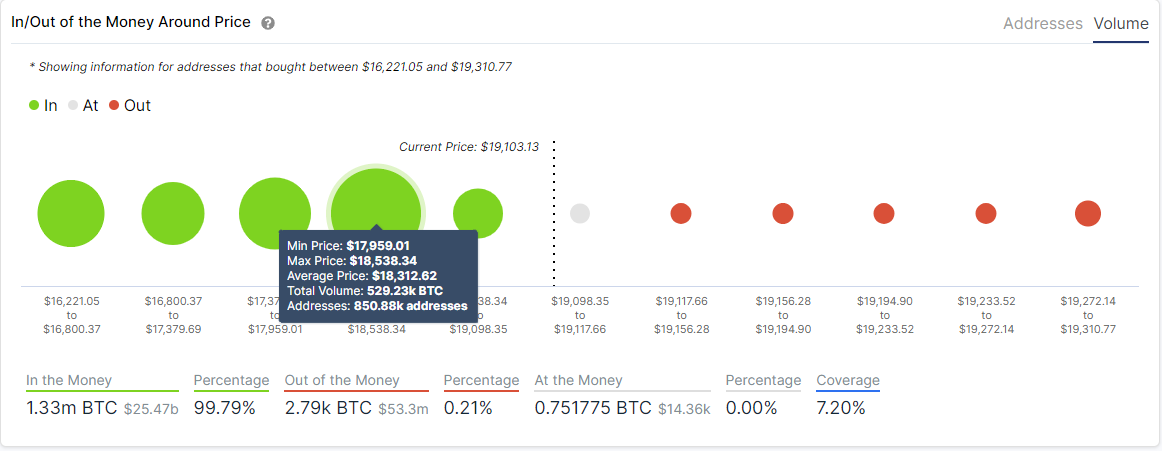

IOMAP BTC chart

This decline would suggest that many investors are currently taking profits and selling, increasing the selling pressure of Bitcoin. The In / Out of the Money Around Price chart shows the next significant support level at $ 18,000, which would be the initial bearish price target in the event of a correction.

Ethereum has no activity within the network

The Eth2 deposit agreement received the required 524,288 ETH and the digital asset surpassed $ 600 for the first time in two years. However, it appears that the number of new addresses joining the network is not increasing.

Graph of the new ETH addresses

After two peaks on November 8 and 11, the number of new addresses has decreased significantly since November 16 and only increased by 2.7% in the past week. This metric could suggest that new investors are still not convinced of Ethereum’s bullish trend.

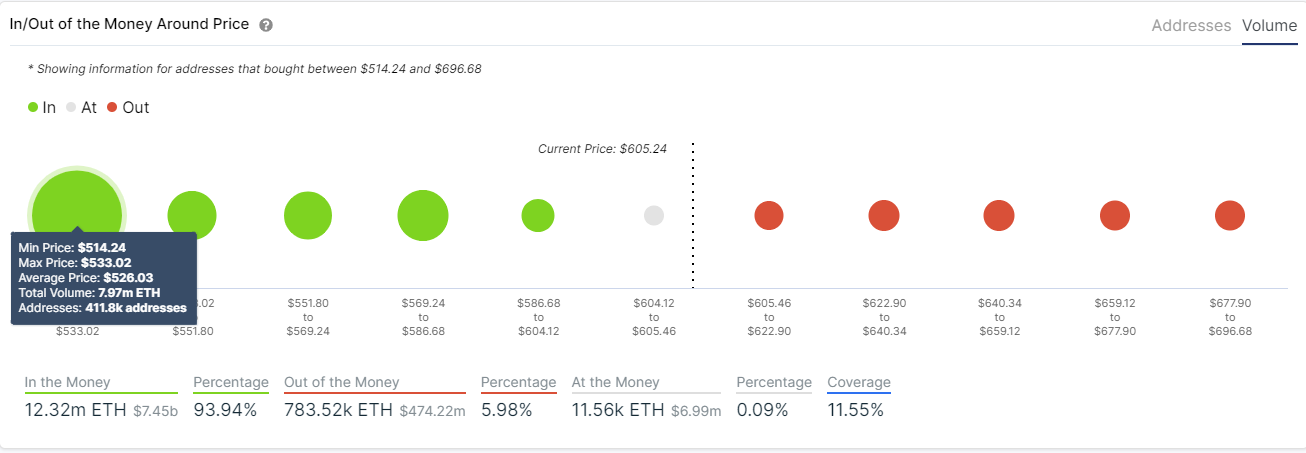

ETH IOMAP chart

The IOMAP chart shows no significant support until 411,000 addresses close to 8 million ETH were purchased in the area between $ 514 and $ 533. This would be the closest bearish price target.

The social sentiment of XRP may be too optimistic

Although XRP has many on-chain and technical indicators in its favor, a critical metric indicates that a local top may be forming. The weighted social sentiment chart provided by Santiment shows a huge spike over the past three days.

Weighted social sentiment chart

The last time XRP saw similar spikes in its holders’ positivity on social media was in October. This latest increase was followed by a steep 10% drop in the price of XRP, indicating that the digital asset may be facing a similar situation now.

.[ad_2]Source link