[ad_1]

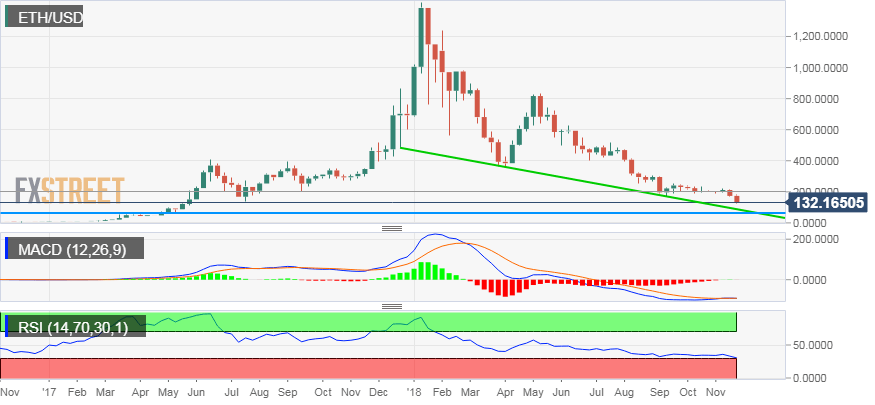

• The cryptography market suffered another round of downward sales on Tuesday, dragging Ethereum (ETH / USD) to a low intraday of 124.25, the lowest since May 2017.

• The short term oversold conditions have helped the digital currency rebound against the lows, which makes it difficult to technicalize an extension of the consolidated downtrend.

• Given last week's bearish turnaround in a consolidated trading range, a weakness under the $ 200 mark was seen as a key factor for bearish traders.

• A sale subsequent to the July 2017 lows has now prepared the basis for a test of a downward support of the trend line, which extends from the minimum established at the end of December 2017, April and September 2018.

Weekly chart of Ethereum

ETH / USD

Overview:

Latest price: 132.66

Daily change: -1.5e + 3 pips

Daily change: -10.5%

Daily opening: 148.15

trends:

Daily SMA20: 197.77

Daily SMA50: 204.99

Daily SMA100: 227.85

Daily SMA200: 378.57

levels:

Daily high: 177.53

Low daily newspaper: 144.94

High weekly: 213.44

Weekly minimum: 168.54

Maximum monthly: 235.43

Minimum monthly: 186.8

Daily Fibonacci 38.2%: 157.39

Fibonacci daily 61.8%: 165.08

Daily Pivot Point S1: 136.21

Daily Pivot Point S2: 124.28

Daily Pivot Point S3: 103.62

Daily Pivot Point R1: 168.81

Daily Pivot Point R2: 189.46

Daily Pivot Point R3: 201.4

Source link