[ad_1]

[ad_1]

Today I'll show you some charts you may have never seen before. Some of them are mine and some are not. Each presents a new way of thinking that can enrich your depth of understanding in the Bitcoin (BTC-USD) (OTCQX: GBTC) (COIN) ecosystem.

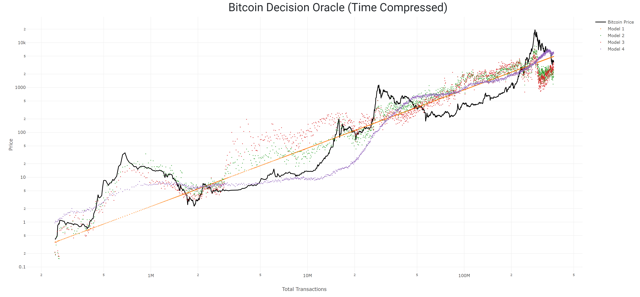

Tamas Blummer is a software developer and author who writes about Medium. Recently, he came out with this article called Liveliness of Bitcoin. He explains:

Vividness is a new quantitative measure that gives an idea of changes in HODLing's behavior.

Liveliness would temporarily reach 1 if all coins moved within a single block and remained at 0 for a blockchain that has not yet had a transaction other than issuance. The liveliness will tend downwards for a blockchain with sleeping units and upwards for a vivid ecosystem. A reading between 0 and 1 can therefore be understood as a measure of Liveliness.

Source: Tamas Blummer via Medium

Source: Tamas Blummer via Medium

Based on this research, Bitcoin has become more vibrant over time, which suggests very positive things in the future if we buy the fact that the value comes from the network (which I suggest you do).

Cap realized

The realized Cap of Bitcoin is the value of the network based on the last time the coins were moved. For example, if I had extracted some Bitcoins and then sat down, the value would have been taken at the time the coins were mined, not the price of coins in market conditions today.

Things start to get interesting when you compare market capitalization with the Cap realized.

This chart suggests that we may have already touched the bottom of the Bitcoin. However, there are many other things to consider.

Plan B

You might think that "Plan B" is a form of birth control, but in this case, I'm talking about the master of Bitcoin charts that is popular on Twitter. Recently, he published this beauty, which shows the price at the top of the 200-week moving average.

For sure, I will keep this metric eyeful. The coming months could confirm this observation which seems to have marked the bottom of the Bitcoin price three times.

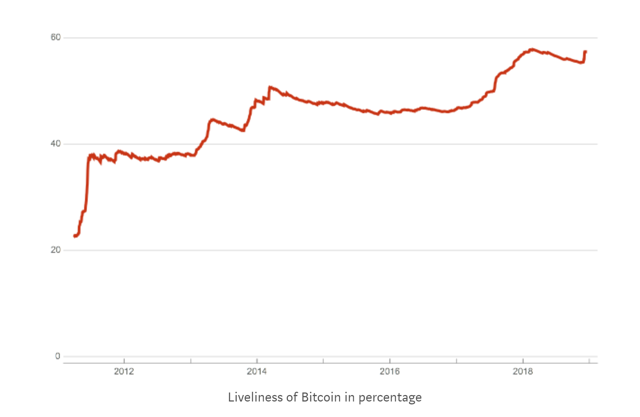

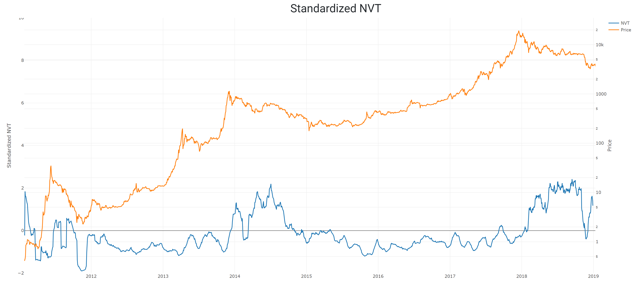

NVT standardized

Willy Woo is well known for coming with NVT. But as I pointed out, this metric can be quite unreliable. My approach to this model was to standardize the NVT in the same way I standardized most of my other charts, using a z score.

Source: My charts – data from blockchain.com

Source: My charts – data from blockchain.com

That wild swing at the end of 2018 makes little sense from an investment or trading point of view. To illustrate this point, look at the table below. Note the red boxes.

Source: My charts – data from blockchain.com

Source: My charts – data from blockchain.com

If you had bought in the lower red box, you would have bought Bitcoin for $ 4,300. If I sold in the next red box, you would have sold for $ 3,800. I do not know about you, but it's not a business that seems very appealing to me.

To sum up, NVT should be used with caution.

Bitcoin Bands of Kalitchkin

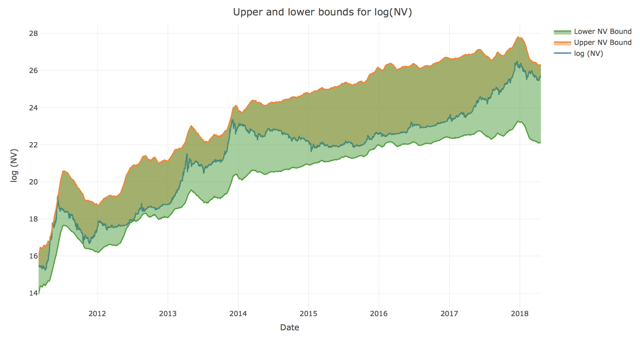

Dmitry Kalitchkin published a very powerful article on Medium last year. In fact, I wrote about this article and its models here in one of my reviews on pricing models. There are many topics covered in this article, but my two biggest take-aways were the network and NVM value bands.

Source: cryptolab.capital

Source: cryptolab.capital

The upper band is represented by the Metcalfe law. The lower band is represented by Odlyzyko's law (with some modifications).

But there's one annoying thing about those network bands. This is the fact that they tend to become larger over time. Fortunately, I found a solution.

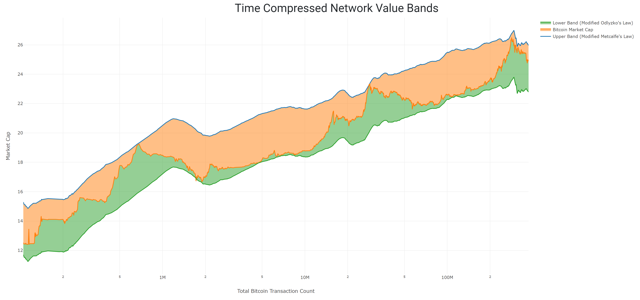

Applying the same type of modifications applied to Odlyzyko's Law (moving the band to a position of better adaptation without changing its shape) and using them on Metcalfe's Law, and thus compressing the time, we find ourselves with a much more coherent band structure. See the result below.

Source: My charts – data from blockchain.com and coinmetrics.io

Source: My charts – data from blockchain.com and coinmetrics.io

I'm really happy with how this graph emerged, but you may have noticed that it has some implications to consider. This is the fact that we are still a little closer to the upper band.

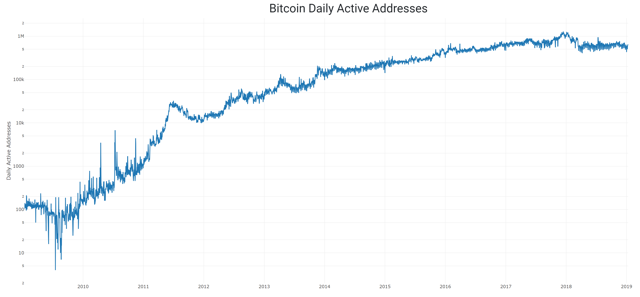

The upper and lower bands are linked to the figure of the daily active addresses, which you can see below.

Source: My charts – data from coinmetrics.io

Source: My charts – data from coinmetrics.io

Daily active addresses and unique addresses in use

The daily active addresses and the unique addresses in use are essentially two approaches to the same problem. The source data all come from the blockchain, but aggregation, deduplication and noise filtering are a complicated process involving some proprietary calculations.

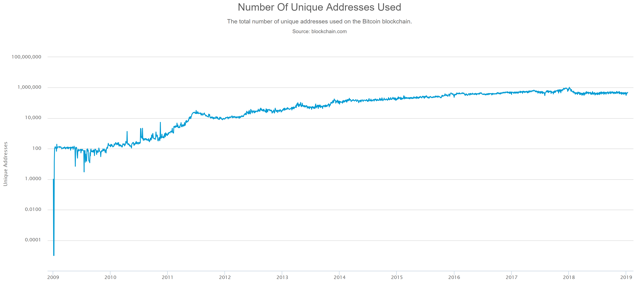

The unique addresses in use come from blockchain.com, which you can see below.

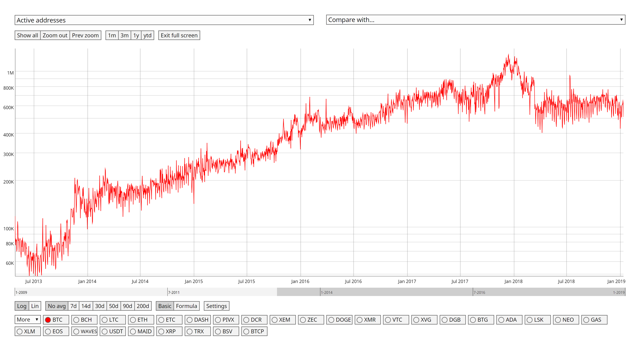

Source: blockchain.com

Source: blockchain.com

This chart looks very similar to the daily active addresses, which come from coinmetrics.io.

Source: coinmetrics.io

Source: coinmetrics.io

The Daily Active Addresses or DAA is most commonly used to calculate the network value.

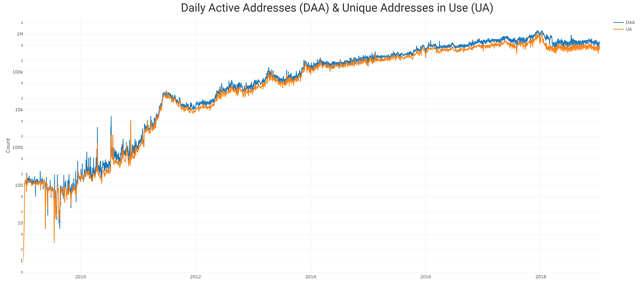

I was curious about the difference between these two figures, so I wrote a program that collected data from both sources and I entered it in my database. Then I put them side by side for comparison. Look down:

Source: My chart, data from coinmetrics.io and blockchain.com

Source: My chart, data from coinmetrics.io and blockchain.com

As you can see, DAAs almost always arrive a little higher, while Unique Addresses, UA, are more conservative than most times. Honestly I do not know which is more precise. I just wanted to illustrate it for clarity.

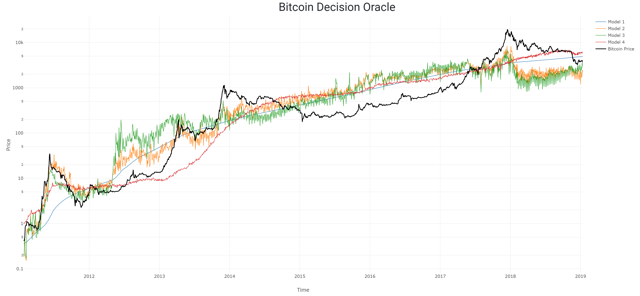

Bonus material

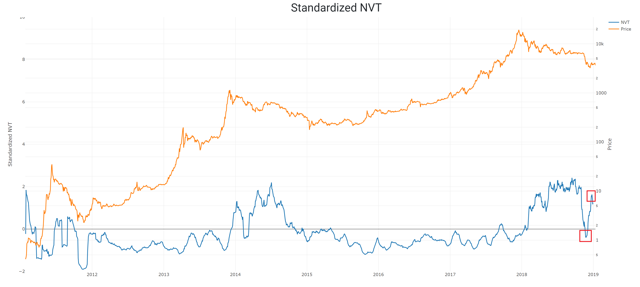

This is the first time I have shared this next chart. I call it the Bitcoin Oracle decision. Compare the Bitcoin price with four different price models. The Bitcoin price is the thickest black line and each color is a different model.

Source: My charts, data from blockchain.com

Source: My charts, data from blockchain.com

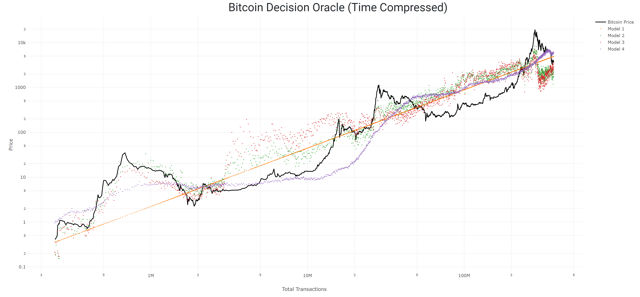

As you can see from this model, the price of Bitcoin is now halfway between two higher forecasts and two lower forecasts. Compress the time and change that curve.

Source: My charts, data from blockchain.com

Source: My charts, data from blockchain.com

I like the way this chart appears. The purple line forms something of a sinusoidal wave while the yellow line basically transforms into a trend line. Nice stuff, eh?

Conclusion

I hope you enjoyed this ranking. Feel free to leave a comment below and ask any questions you may have.

This article was first published in Crypto Blue Chips.

Revelation: I am / we are long BTC-USD. I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link