[ad_1]

[ad_1]

By the end of this year, the leading cryptocurrency lender Nexus (NEXO) aims to launch an internal exchange, while they are also working on prime brokerage and commercial banking capabilities as the company aims to become “a full-fledged bank,” said Antoni Trenchev, co-founder and Managing Partner of Nexo Cryptonews.com.

Internal trading will allow users to trade between different asset classes from their Nexo wallet, as well as change collateral, he said.

Another business direction is the Nexo Mastercard, which is currently limited to Europe, but which the lender also wants to make available in the US and Asia. “This will be a huge boost for the entire company,” Trenchev said. Instead of selling cryptocurrency for fiat, the card allows you to take out a loan against your cryptocurrency in real time: “So you can hold your cryptocurrency and get your milk to Starbucks. ”

The company has crossed the 1 million mark, he added, with tens of thousands of people interacting with the platform on a daily basis. And while he couldn’t share the exact numbers, about “half of the people make money in fiat currencies and half of the people make money in their own cryptocurrencies,” the co-founder said, adding that the company has processed more than $ 3 billion to their users in more than 200 jurisdictions.

The two most popular products so far have been the cryptocurrency backed loans the company started with and the Earn Interest product. “You can stack any asset you have and you can earn interest on it,” Trenchev said, including cryptocurrency and Pax Gold (PAXG), a gold-backed token. The company saw “huge demand immediately” and the product “was overwhelmingly popular”.

Litecoin, decentralization and the United States

Additionally, Nexo has had a longstanding relationship with Litecoin (LTC) and its founder Charlie Lee, Trenchev said, with the “highlight” of their partnership giving credit lines against LTC in late September. “And what we have seen is a spike in litecoin deposits. I think it rose to something like 40% the week after we announced it, so these have been tangible results of this partnership, “he said.

Meanwhile, the company is also “exploring a number of different decentralized products and services to be launched in the future.”

“But right now, we are focused on generating the highest possible return for our clients and investors in a way that we are pretty sure is very safe for them,” Trenchev said, adding that the decentralization of their services is on the way. “there are sustainable solutions” that will enable security.

Regarding geographic expansion, Nexo is looking to expand to the United States with an office in San Francisco. But this was put on hold due to the COVID-19 pandemic.

Also, according to the co-founder, the Nexo token itself would most likely be classified as a US stock, which prevents the company from offering certain services to US citizens. “However, this is like a single percentage of our overall product portfolio that we can’t serve in the US. So I don’t think we have major regulatory challenges,” he said.

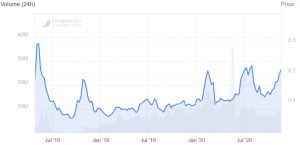

At the time of writing (15:26 UTC), NEXO, ranked 91st by market cap on Coinpaprika.com, is trading at USD 0.21 and is up 5% in one day and 28% in a week. The price also increased 45% in one month and 90% in one year.

NEXO price chart:

The company will block some of the tokens that have been acquired for at least another year, as the team wants to show they “believe in its token and its positive long-term prospects.” So, as a team, they haven’t sold any tokens and aren’t looking to sell any amount of tokens, the co-founder said.

The lender also launched Nexonomics, which Trenchev describes as “a review of the way the Nexo token works.” As part of this review, the company is working on regular feature announcements that add to the token’s utility, such as the introduction of Earn in NEXO, with rates up to 12% APY (annual percentage return).

“Soon rather than later we will be like a real bank, in the traditional sense of the term”, concluded Trenchev.

___

To know more:

See decentralized insurance as another emerging DeFi trend

Bitpanda Watches New Markets, Assets As Regulators Move ‘In The Right Direction’

Norwegian block exchange to tokenize the crown before going global

Crypto is worth playing for a long time – and this is proof