[ad_1]

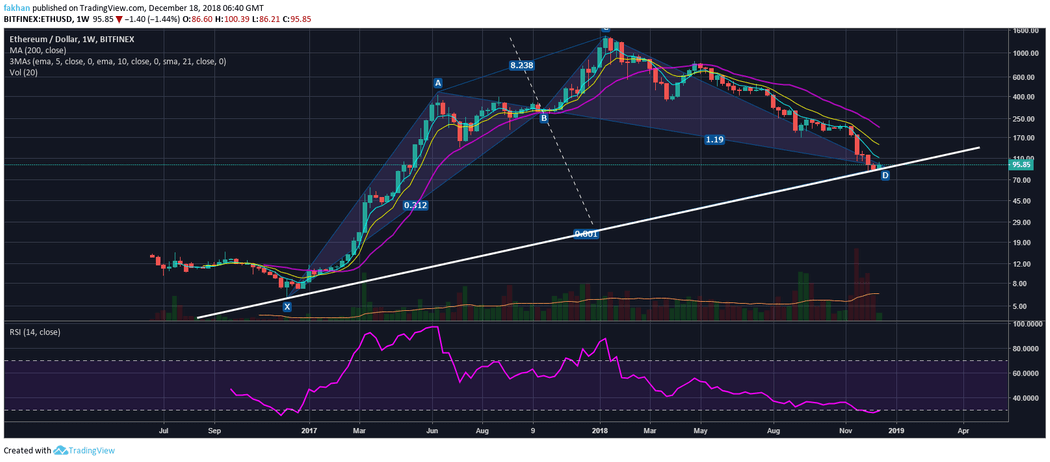

Ethereum (ETH) has just completed the correction and the price has already started to recover. Future prospects for ETH / USD do not look bright as before for a variety of reasons. First of all, Ethereum (ETH) has given it market shares to its competitors. Platforms like Cardano (ADA), Ethereum Classic (ETC), Lisk (LSK) and Quantum (QTUM) are some of its direct competitors who claim to do what Ethereum (ETH) can and much more. Secondly, Ethereum (ETH) has just lost its second place in terms of market capitalization in Ripple (XRP). This sends a clear message that Ethereum (ETH) no longer has the muscle to react on its own. The interest in Ethereum (ETH) is not the same as it used to be. However, there are other reasons to believe that this cryptocurrency can reach its historical high in 2019.

As a platform, Ethereum (ETH) is no longer the hottest investment on the market. However, as a cryptocurrency to raise funds for ICO, Ethereum (ETH) has not yet lost its place. As the bear market draws to a close, many new ICOs are preparing to flood the market. Almost all ICOs are raising funds in Ethereum (ETH). This means that a large number of cryptocurrency investors participating in these ICOs will first have to purchase Ethereum (ETH). This will increase the demand for Ethereum (ETH) in the near future. As long as the market remains long, we will continue to see new ICO entering the market. Most of these ICO companies will not cash in early because they would like to take advantage of the bull market, hoping that the ETHs they raised will grow in value in the coming months.

Only the ICO factor alone could increase the demand for Ethereum (ETH) like never before. We have seen in the past how Ethereum (ETH) rose from $ 15 to $ 1500 in a year. All of this is due to ICOs collecting millions of dollars through Ethereum (ETH). When those ICOs were made raising funds, they started to unload their coins for fiat and we saw the price of Ethereum (ETH) fall to $ 83. The companies that sold early are still afloat; those who hold bags of Ethereum (ETH) hoping that the price will recover soon have already declared bankruptcy.

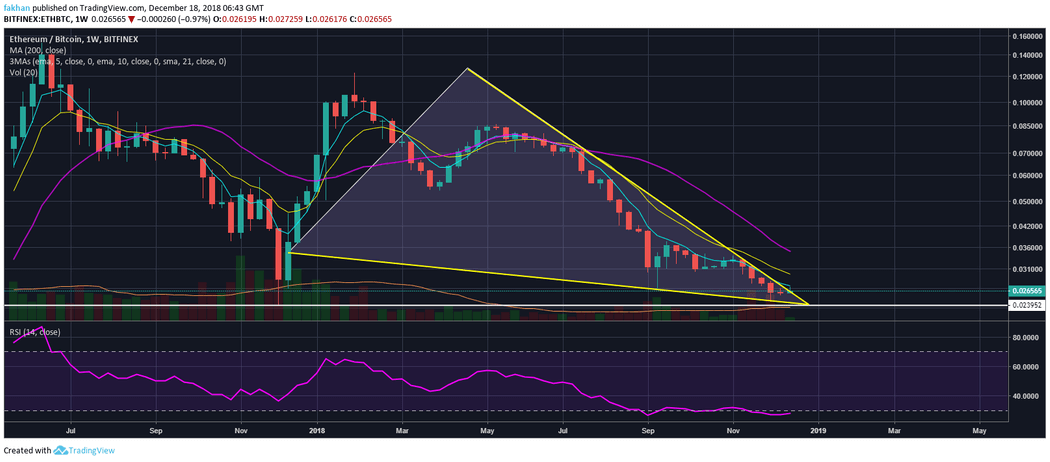

Ethereum (ETH) has now hit the bottom against Bitcoin (BTC) and has already started to recover. The weekly chart for ETH / BTC shows that the price is now destined to rake up hard against Bitcoin (BTC) in the coming weeks. The price is ready to overcome the EMA resistance of 5 weeks since it has already broken out of the falling wedge. Ethereum (ETH) has long been due to a recovery against Bitcoin (BTC). In the weeks ahead, when bullish momentum prevails, it is likely that we will see the gain of Ethereum (ETH) against Bitcoin (BTC). However, the actual trend reversal is expected when the price exceeds 21 weeks. This is the moment when we expect the price to rise to the historical high of 2019.

Source link