[ad_1]

[ad_1]

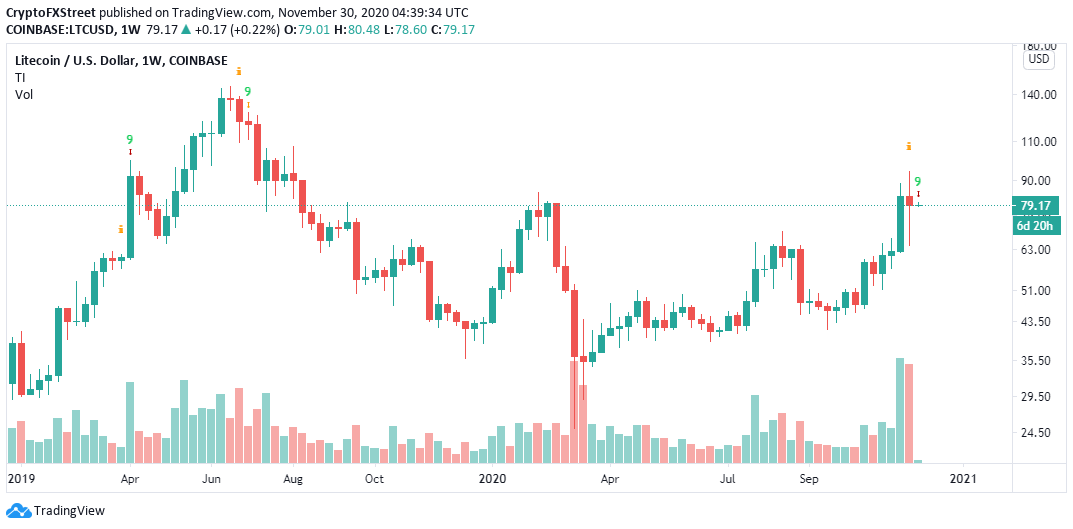

- Litecoin is on the verge of a $ 100 breakout, especially if the $ 80 seller congestion is overcome.

- The bullish narrative could be invalidated if the sell signal of the TD sequential indicator on the weekly chart is confirmed.

Litecoin is in the midst of a recovery mission after bouncing off the $ 64 support. The digital asset is trading at $ 79 as it battles resistance at $ 80. A break above $ 80 is likely to catapult LTC into the $ coveted $ ranges. 100.

Litecoin prepares for rally to $ 100

Holding above the 50-day simple moving average was a critical bullish indicator that the bullish trend would continue. Furthermore, the Relative Strength Index reached support on the midline and bounced back towards the overbought region.

As the resistance at $ 80 becomes an uphill battle, the RSI begins to level off, suggesting a consolidation. However, a spike above $ 80 would require more buy orders, creating enough volume for earnings above $ 90 and $ 100 respectively.

%20(12)-637423089166188939.png)

LTC / USD daily chart

The 4-hour chart confirms the selling pressure at $ 80, but if Litecoin closes the day above the 50 SMA, a breakout could occur, targeting $ 90 and $ 100. On the downside, immense support at the 100 SMA is expected. to help refocus LTC in case of obstacle correction.

%20(13)-637423091236681340.png)

LT C / USD 4-hour chart

IntoTheBlock’s IOMAP model reveals a relatively smooth path up to $ 90. Meanwhile, buyers need to focus on breaking the resistance between $ 81.5 and $ 84. Here, around 43,600 addresses had previously bought nearly 1.2 million LTC. . With sufficient buying pressure, LTC could extend the uptrend to $ 100.

-637423089332604715.png)

Litecoin IOMAP chart

On the downside, the immense support behind the cryptocurrency shows that the uptrend may remain intact. The most robust shopper congestion zone ranges from $ 69.7 to $ 72. Here, approximately 45,000 addresses had previously purchased approximately 4.1 million LTC. It is doubtful that the bears will break out of this support range to retest last week’s anchor at $ 64.

LTC / USD weekly chart

It is worth mentioning that the TD sequential indicator presented a sell signal on the weekly chart. The call manifested in a nine green candlestick. If the signal is validated, Litecoin could drop one to four candles per day. Additionally, an increase in LTC supply could see the price revert to the earnings reduction exercise where losses could exceed the support at $ 64.

.[ad_2]Source link