[ad_1]

[ad_1]

By managing to overcome the sell-off at the market level today, most altcoins recorded some losses on their trading charts, with Bitcoin trying to stay just above the $ 13,100 level at press time.

Litecoin was seeing selling pressures, which pushed the digital asset below two of its short-term moving averages. Following the negative sentiment, IOTA also remained bearish.

Synthetix, on the other hand, up nearly 2% since yesterday, has seen some buying pressure and could break to the upside after its one-week downtrend channel.

Litecoin [LTC]

Source: LTC / USD on TradingView

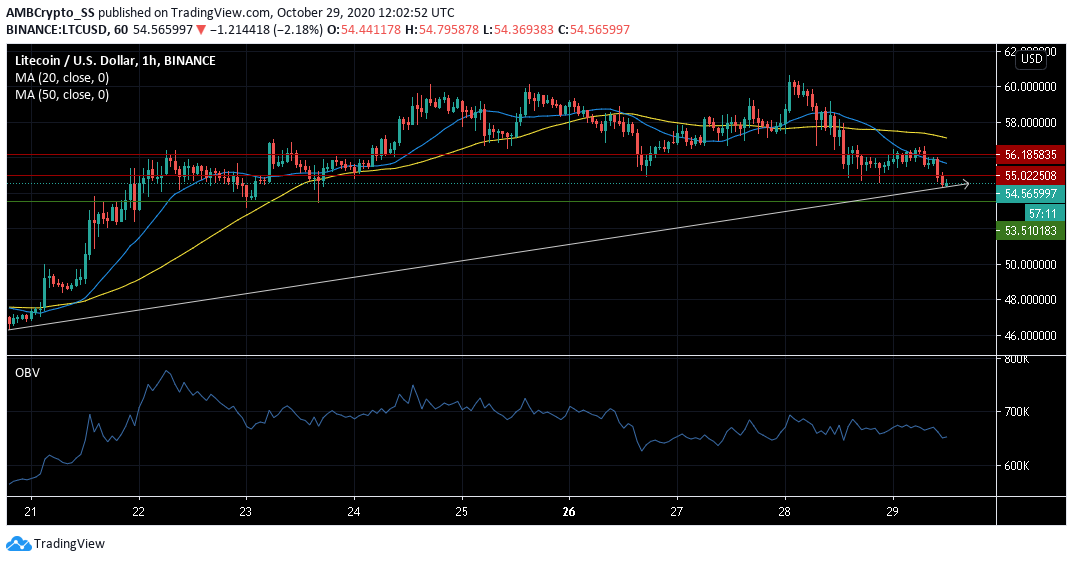

At the time of writing, Litecoin was trading at $ 54.56 as it fell below its support and shot the resistance level at $ 55.022. In fact, posting a drop in prices, LTC has dropped more than 3% since yesterday.

The digital asset has remained fairly bearish according to its technical indicators – period 20 Simple moving average (blue) was below 50 SMA (yellow) – a sign of selling sentiment.

The drop in prices below the 20 SMA further indicated that the bears have not respected the short-term trend line. While the downward trend was visible from its moving averages, the immediate drop in prices coincided with a neutral view taken from the OBV indicator.

That said, a shift in price action for LTC would follow Bitcoin’s price movement in the upcoming trading sessions.

IOTA

Source: IOTA / USD on TradingView

After a visible drop in IOTA’s price over the past 48 hours, it looked like it was facing another selling pressure as IOTA has fallen below its trendline losing nearly 4% since yesterday.

With an increase in its volatility level, IOTA showed a downtrend towards the $ 0.258 support level. The divergence of Bollinger bands confirmed a spike in the level of volatility and price action appeared to be on the bear’s side as prices moved along the lower band.

Furthermore, the bearish crossover indicated by the MACD the line that falls below the signal line also confirmed a downtrend, which could continue in the next trading sessions.

Synthetix [SNX]

Source: SNX / USD on TradingView

While Synthetix traders have been betting on its downtrend in recent weeks, the digital asset has seen some gains of up to 2%, breaking its downtrend channel. The Chaikin money flow indicator, above the zero line, indicated a bullish trend.

As capital inflows are greater than outflows, fresh liquidity entering the SNX market added to the buying pressure. Parabolic SAR remained neutral for now. However, the price has moved south, with a small price correction seen, at press time.

Should SNX rally, continue to hold price levels above the $ 3.463 support level, the digital asset could rally positive, following the declining channel seen over the past week.