[ad_1]

Crypto meets the composite platform supported by Coinbase

For a post on the official media blog, Compound, an emerging cryptocurrency platform and investment platform, has finally been launched after several months of development. For those who are not aware, San Francisco Compound is a startup that intends to revolutionize the way money moves in crypto creating liquid cryptocurrency markets through algorithms, which will initially allow users to borrow and sell short-tokens based on Ethereum.

As a result of the company's unique vision and high-level ambitions, it quickly raised over $ 8 million in financial support from juggernauts in this budding industry, including Coinbase, a16z cryptographic fund by Andreessen Horowitz, Polychain Capital and Bain Capital Ventures, all of which are based in California quite interesting.

The initial goal of Compound was to launch its platform in October, but as we can see now, the start is a little later than its program, starting on September 27, 2018, with surprise of some investors.

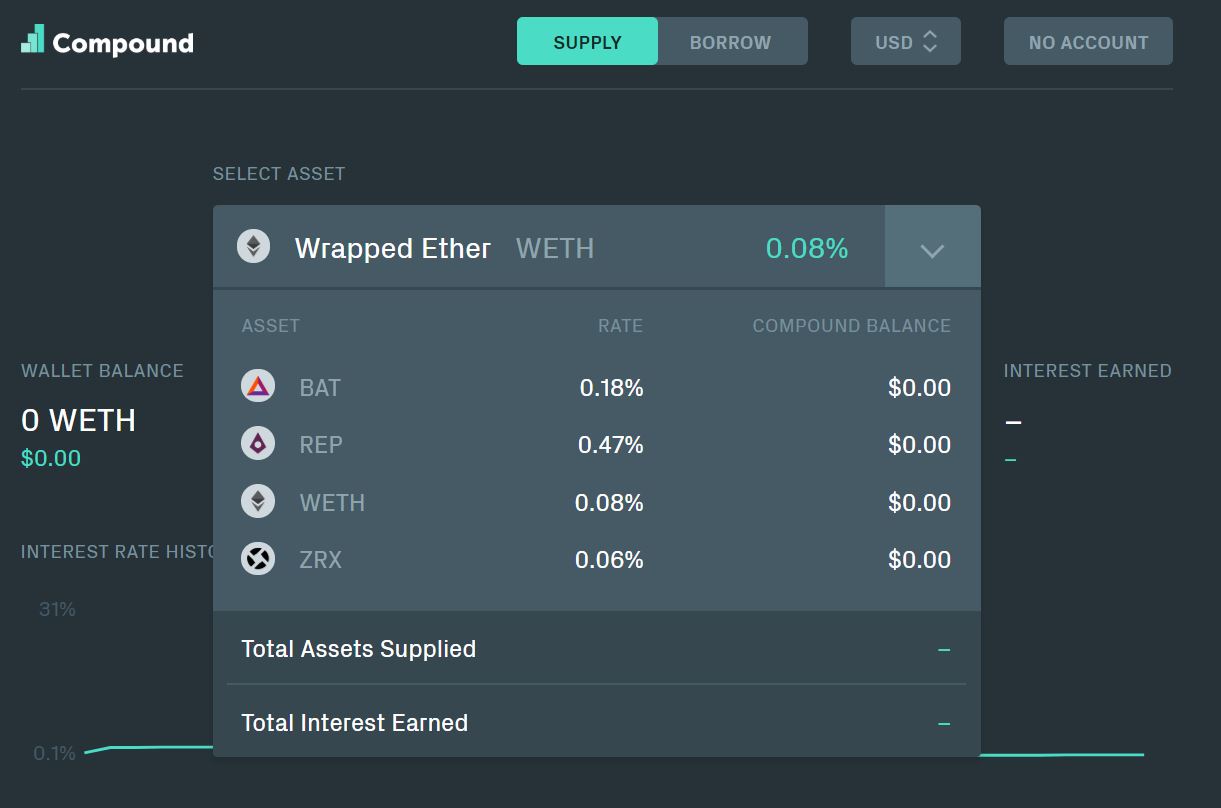

Users will now be able to sell four cryptocurrencies briefly, including Ethereum (ETH), 0x (ZRX), Basic Attention Token (BAT) and Augur (REP) via its easy-to-use minimalist website (see below) that uses Web3 and MetaMask (or similar DApp browsers – Coinbase Wallet) to complete functions and operations.

In addition to offering short sales, users who do not wish to bet against an encrypted resource can lend any amount of the aforementioned tokens to earn interest, which is a great way for investors to get a passive reward over time. Speaking to TechCrunch journalists, the startup CEO noted that "if / when Compound scales, it will lead to some really interesting improvements in the market structure, that is, fairer prices".

So you might ask, what kind of returns can I expect by lending my cryptocurrency? Well, as pointed out by the aforementioned technology publication, the interest rate may vary, as it is currently based on an algorithm that weighs supply and demand. While Compound intends to implement a system of governance in the future, the APR for loans on the platform currently ranges from 5 to 45 percent, which is better than letting the cryptocurrencies "accumulate" in the chosen portfolio.

While the concept of short-circuiting cryptocurrencies might seem bizarre and risky, the startup platform reported receiving a security check from Trail Of Bits, which confirmed that the platform is ready for publication at the time. In addition, the company has received support from over 26 hedge funds that will use the platform, which includes the Digital Asset Fund, AlphaLab, Wyre and Ikigai, which will be launched in the coming days as previously reported by Ethereum World News.

Following the successful release of short selling and lending product, Compound intends to build and launch its own internal stablecoin in an attempt to get financial institutions to use its own protocol, which will increase liquidity levels, thereby improving Overall customer experience.

Expressing his excitement about the release of this product, Compound's founder and CEO, Robert Leshner, said in the aforementioned blog post:

Blockchain activities are new and exciting, but lack the most fundamental financial infrastructure: efficient interest rates. Over time, hundreds of billions of dollars of assets will be tokenised, but the institutions that implement them will require the benefits of traditional financial markets: today's launch is only the first step.

Photo by Mark Finn on Unsplash

Source link