[ad_1]

[ad_1]

Last month the price of BTC / USD (BTC-USD) fell below its long-standing support price of $ 5.800, on the back of the Bitcoin Cash hard crossroads (BCH-USD) which only produced impulse necessary for sellers to push prices below this level of support. This price move is not unexpected, as it is part of the downward resolution of price movement below the downward triangle on the weekly chart.

The question that the Bitcoin traders are now facing is this: have we reached the bottom, or is it even worse? This piece of analysis attempts to examine the price of BTC / USD in an attempt to answer these questions.

Basic Outlook

Basically, the market provided a bearish final for a volatile year in Bitcoin. It looks like it will end the year under $ 4000 – after reaching the all-time high near $ 19,000 at the start of 2018.

2019 promises to be a year for institutional investments. Bakkt, the encrypted company produced by the Intercontinental Exchange, has just announced a round of funds of $ 182.5 for the collection of investment funds. This comes from 12 companies, some important names in venture capital.

2019 will also see BTC continuing to challenge national regulatory bodies. If and as countries can provide an adequate regulatory framework, BTC prices could see stability and potentially rise on a growing demand and a limited supply. For now, here are the technical data related to 2019 for BTC on the trading pair in USD.

Technical perspectives

The weekly table BTC / USD is shown below, and we can see that after recording some slight gains in the week leading up to Christmas, the weekly candle is falling. Most of the cryptos have lost ground in the current week and Bitcoin is at the forefront. The long-term outlook indicates that a further test of the support level of $ 3200, which was last seen in October 2017 and in the third week of December 2018, is very likely.

We can also see that the 9-EMA (orange colored) line is located above the price action candles, thus acting as a dynamic resistance to price action. This provides a further confirmation that the price movement for the rest of the year will most likely be bearish.

Weekly chart BTC / USD: 30 December 2018

So we pay attention to the daily chart, where we see a number of things:

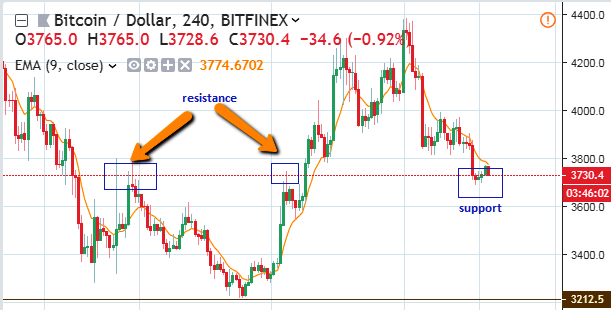

There are a number of things that should be noted by this chart.

- The short recovery period in the week before Christmas stopped in an area where the price had previously found resistance. This was at the mark of $ 4,560. This area also marks a previous resistance (boxed areas).

- A minor horizontal support exists at the price of $ 3,870. This level must be broken down because the price continues to move south.

BTC / USD daily table: 30 December 2018

BTC / USD daily table: 30 December 2018

- The main horizontal support line rests on $ 3,212, where the price found support two weeks ago.

- The 9-EMA indicator line was interrupted by falling prices, and is now on top of the day candles, offering a dynamic resistance to price action.

So, how does all this work?

Commercial scenario

The main support continues to remain at $ 3.122, while the greatest resistance continues to be the $ 4.560 level. In the long run, this appears to be the limit of the price movements of the BTC / USD, with price fluctuations between the $ 3,212 plan and the $ 4,560 cap. Within this price range, there are several key support / resistance levels that will serve areas where traders can create short-term items.

The scenarios for BTC / USD will depend on the behavior of lower price and higher support and resistance. A scenario favors the downward movement of BTC / USD, which will occur if the price action breaks the current lower support levels, better displayed on the chart at four hours in a row.

Four-hour BTC / USD chart

If the weekly price candle / bar closes below the support price level of less than $ 3,700, then the price action will make a run for the next support levels above $ 3,212. This move will have contests along the way, as different levels of minor support (such as $ 3,400) will have to be violated.

Market sentiment:

The long-term, medium-term and short-term prospects are as follows:

- Long-term – bearish

- Medium-term: neutral to bearish

- In the short term: from neutral to bearish

BTC / USD is expected to head south in the coming weeks to test the $ 3,212 long-term floor.

Note: it takes a whole week to form a candle in the weekly leaderboards, so these moves may take several weeks. Entries should be made on graphs with shorter time interval as the daily chart.

Well, the encrypted mania may have deflated. But it's not a bad thing! In fact, if you still believe in the transformative power of the blockchain, it means that many of these technologies have returned to the first adoption prices. At Coin Agora, our focus is on altcoins – small-cap crypts that have enormous potential to upset corporate ecosystems. Do not miss: let us help you overcome the noise and find the winners – join the Coin Agora community today!

Revelation: I am / we are long BTC-USD. I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link