[ad_1]

[ad_1]

- This week's trading saw LTC / USD cancel gains and slip into a resistance range.

- The value of Litecoin could increase significantly as buyers are encouraged to increase their business.

The weekly timeframe chart shows how Litecoin underwent a lower correction from the bullish rally at the end of last year. Litecoin recorded historical highs above $ 300. However, the downward trend in 2018 saw Litecoin explore and update new lows to the extent that it formed support close to $ 21.9.

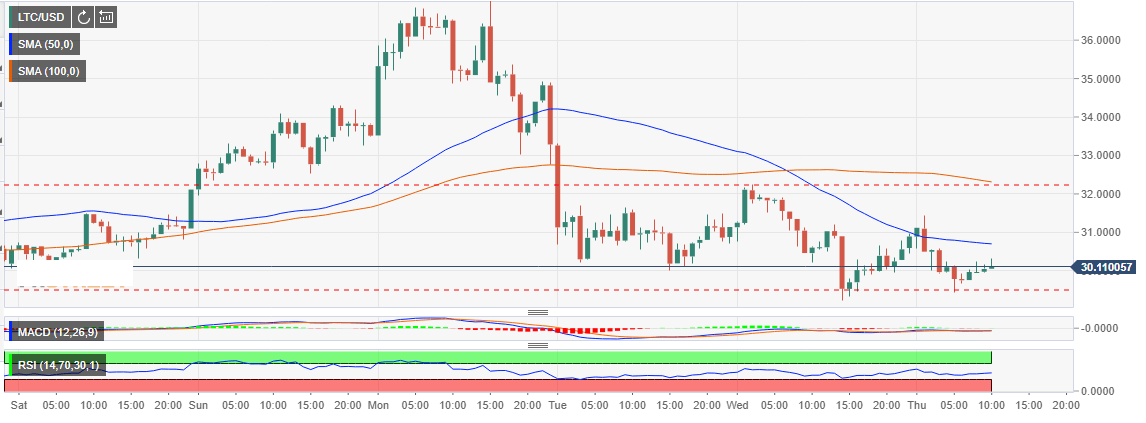

The decline in December marked the beginning of an inversion that could also be exchanged for a new year's rally. The reversal pushed the Litecoin price above $ 36.00 before the bullish momentum stopped at less than $ 37.00. This week's trading saw LTC / USD cancel gains and slip into a resistance range. A support was formed slightly above $ 29.00 while the interval limit was $ 32.26 (it coincides with 100 SMA in the hourly interval).

The aforementioned support paved the way for a continuous reversal of over $ 30.00. However, the bulls must pull the price over the 50 Simple Moving Average which will probably market the start of the new year's rally. A further correction from the range of bears will see growth that will fight the medium-term resistance zone at $ 37.00.

Another look at the chart, we see the MACD signal blocked slightly below the average level. If the signal line can cross the positive region, we will be able to see the value of Litecoin increase significantly as buyers are encouraged to increase their activity. In addition to that, the RSI on the hourly chart did not sink in the oversold despite the recent downward correction. In fact, it is slightly inclined towards the top. This shows that buyers have influence at the moment and the situation is set to continue towards the end of the year.

Chart at 1 LTC / USD