[ad_1]

Original title: Weekend blockbuster! Overwhelming Apple and Amazon, a Chinese company finally did it

Summary

[Fine settimana pesante! Apple e Amazon travolgenti hanno finalmente una compagnia cinese per farlo]China’s “new car manufacturing forces” Concept Stocks had a crazy night! Shares of electric vehicles Zhongge New Energy collectively rose during early overnight trading. Shares of Weilai Auto, Xiaopeng Auto and Ideal Auto all hit record highs.

The “new automotive forces” in China Concept Stocks had a crazy night! Shares of Zhongge New Energy electric vehicles collectively rose during early overnight trading.Wei Laimachine,Xiaopeng MotorswithIdeal machineStock prices have all hit record highs.

between them,Wei LaiIntraday increased by more than 11%,Market valueThe highest value reached 73.1 billion dollars (482.7 billion), surpassingBYDAt 479.9 billion yuan, it once became China’s number one auto company.

Ideal machineAt one time it increased by almost 30%,Xiaopeng MotorsAt one time it increased by more than 12%. On the last trading day, threethe companyThe company’s share price increased by 12%, 27% and 33% respectively!

01

DealPressure on the foreheadAmazon、Apple

The transaction amount is even more exaggerated.Wei LaiDaily intraday automobile revenue was US $ 27.3 billion, setting a historic one-day revenue record of Chinese conceptual stocks and also overwhelming over the same periodAmazon$ 11.7 billion andApple$ 9.7 billion in revenue.

November 13One-day US Equity Turnover TOP20

Some netizens commented: “While we don’t have the largest stock in the world by market capitalization, we have the largest stock in the world by trading volume!”

02

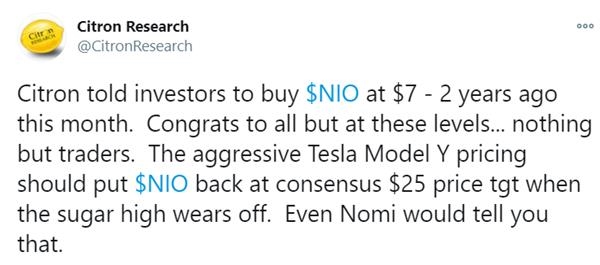

Citron short selling institute: Weilai is expected to be halved

But the good times didn’t last long and the Citron short selling agency suddenly issuedrelationship, He said Weilai’s share price fell outside the reasonable range, the share price should be “halved”, and the target price should be $ 25.

Affected by this, the share prices of three Chinese concept stocks of new energy vehicle companies plummeted after reaching a record high in the intraday market. Weilai Automobile’s share price closed 7.74% lower at 44. , $ 56;Xiaopeng MotorsClosed down 6.13% at $ 41.99;Ideal machineThe stock price closed 1.83% lower at $ 31.20.

In fact, short-selling agency Citron had unusually recommended buying NIO stock in November 2018, when the share price was $ 7.

Why the cedarattitudeA big reversal in two years? In this report, Citron stressed that it was the company and its charismatic leader who recommended buying Weilai stock.Li BinIt piqued their interest, but after tough trades, Weilai Auto’s share price was unable to use its electric vehicles in ChinamarketThe recent state or performance of the company can reasonably be explained.

03

Three reasons to be bearish

There are three main reasons why Citron is short of Weilai stock price:

First, the impact of competitors’ price cuts

Citron said,TeslaAnd Model Y in ChinaPrices, Or it will impact NIO sales.

Cedar quoteGerman bankAccording to the analysis,TeslaIt could significantly reduce ShanghaifactoryModel Yprice, Probably from 488,000 yuanRMB(US $ 73,000) to 360,000-390,000 yuan (US $ 56,000-58,000). Model Y could become a direct competitor to Weilai EC6 and ES6, which could hurt market sentiment in the short term and hit Weilai’s order growth momentum.

German bankI said it now in ChinaAnalystprediction,TeslaThe Model Y price will be much lower than the key price that poses a threat to Weilai.Tianfeng SecuritiesRecently inResearch reportChina pointed out that the starting price of the Chinese-made Model Y could be 275,000 yuan, which is a very attractive price.

Secondly, the rating is too high

Citron believes NIO’s current valuation is 17 to 18 times sales over the next 12 months, while Tesla’s is 9 times.varianceThe distance has reached a record, although BuffettinvestmentofBYDIt has also skyrocketed by 400% this year, but the rating is only three times higher than sales.

At the same time, due to strong competition, Weilai isGuoxin EnergyThe share of the car market is only 3%. In October, Tesla’s sales in China were more than double those of Weilai Automobile. Previously, Tesla’s share of the US market was close to 50%.

Data show that Weilai Automobile delivered in October this yearProduct5,055 vehicles, breaking through 5,000 for the first time; From January to October, Weilai Automobile’s January to October sales volume was 31,400.YoYIncrease of 111.4%, positioning itself firmly among the new Chinese carsenterpriseBest sellers.

According to Tesla’s data, Tesla sold 12,100 vehicles in October and about 92,400 vehicles from January to October, which is about three times that of NIO.

Third, the investor structure

Previous research from Bank of America Merrill Lynch showed that when Citron was studying NIO’s high-profile songs two years ago, the title “activelyCirculationThe “quantity” short selling ratio (ie the number of shares not held by passive investors) can exceed 100%.

Citron believed that “Nio would face” very little resistance on the way to the $ 12 share price, based on this potential short squeeze momentum.

(Weilai’s number of short-selling shares hit a low in nearly two years, source: Citron)

But now Citron believes speculators betting on NIO are more inclined to treat the stock market like a casino than optimistic about its prospects. At the same time, Weilai’s number of short selling shares hit a nearly two-year low.

Citron said that for NIO investors, now is the time to take profits and find the next disruptive technology.

Indeed, in 2019, Wei Lai experienced the “darkest moment”: the delivered ES8 had spontaneous combustion incidents, the financing was stopped, the company’s CFO left and the accountsCashThere was once only 1 billion yuan left.

On October 2, 2019, Weilai hit an all-time low of US $ 1.19 / share, which was only 19% of the listed issue price of US $ 6.26 / share, nearly “delisting” from the US stock market. At this time Hillhouse Capital has also chosen to liquidate its shares.

More than a year later, Weilai Automobile’s share price jumped more than 40 times, resulting in a surprising reversal. Faced with the aggressiveness of short selling institutions,PerformanceIt is the key.

NIO will release its third quarter 2020 financial report after the close of business on November 17, 2020, Eastern time (November 18, Beijing time). At that time, it will be bull or bear and NIO will use the financial report data to speak.

(Article source:Eastern wealthResearch Center)

(Responsible publisher: DF134)

Solemnly declares: The purpose of this information released by Oriental Fortune.com is to disseminate more information and has nothing to do with this booth.

.

[ad_2]

Source link