[ad_1]

[ad_1]

The forecasts from the respected corners of the mainstream financial world – GP Bullhound and Saxo Bank – could be good news for the crypto industry and its status as a valid and profitable asset class.

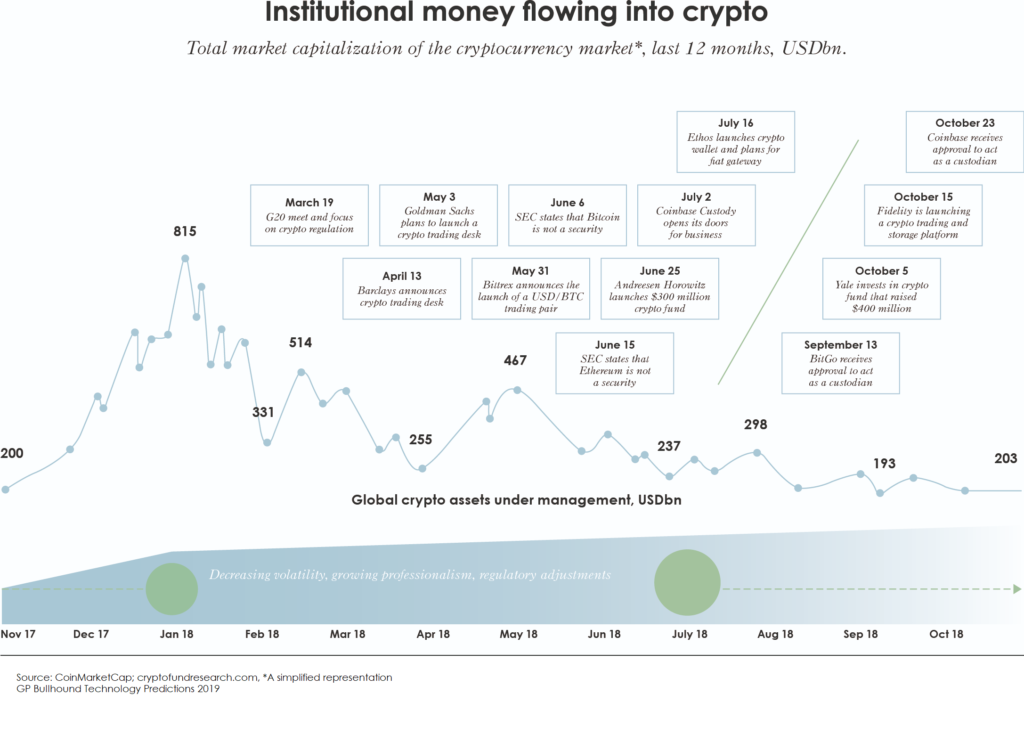

The US investment and consulting firm, GP Bullhound (GPB), under the heading "Cryptocurrency will Grow Up", agrees with the balance of opinion among analysts who cover cryptography, which institutional money will lead to recovery.

The GPB forecast report is bullish:

"We still have to see the best of cryptocurrencies.The blockchain activity is also gaining ground with traditional financial institutions, ensuring that they do not lag behind.The 2019 should be the year in which the institutional capital flows into cryptocurrency , with previous obstructions and rigid revoked regulations, "

Last year, the technology-focused investment firm rightly predicted the implosion of cryptography, which he could later say was not too difficult to predict. However, he put a number on his premonition, claiming that a 90% correction would take place, although he was surprised by the rate of collapse.

Nine out of 10 of its 2018 forecasts have proved to be correct, so its prediction of recovery of the cryptocurrency 2019 should not be dismissed as only warmer air by investment firms seeking to protect their investments.

And for institutions, it's not just the attraction of financial gains to buy coins on the fund (wherever and whenever that might be), but investing in the technology of distributed registries in general:

"We expect that 2019 will be the year of the flow of institutional capital into blockchain, which will not be exclusively motivated from a financial standpoint, but supported by the growing demand we see on the corporate and family office side and on their desire to build positions Initially this will be done through funds, equity investments in blockchain technology projects as well as financial instruments and derivative products related to the main cryptocurrencies ".

The Bakkt platform of Intercontinental Exchange is probably one of the critical ramps for "the influx of institutional capital", as could be the small number of currently existing regulated instruments.

These include the Bitcoin Investment Trust from Grayscale Investments of Barry Silbert (although it is trading at a premium at its net asset value which would be daunting); exchange-traded securities (these are debt instruments, not ETFs) provided by Bitcoin's XBT Provider products and CoinShares Ethereum tracker and new offers such as the Amun Crypto Market Basket's ETP index, which recently launched the first fund crypto index in Europe on the Swiss main market.

Amun's product currently has the second highest turnover of all the products traded on the Swiss market.

Added to this is the growing interest in security token (STO) offerings reported by EWN in November, and entry routes are in sight and GPB agrees:

"There is a massive wave of fully compliant" token "security tokens (" STOs ") and also developments around resource tokenisation (" TOA ") are wide – both should continue to raise the level of market very quickly … "

However, as GPB points out, institutional input still has to address issues related to regulatory clarity, liquidity and custody.

However, Olga Feldmeier, CEO of Smart Valor, who is building a platform for security token, commenting on the bullish position of GP Bullhound, noted: "Cryptocurrencies will continue to innovate beyond the well-known bitcoin and Ethereum, and we will see many more emerging coins and payment products: this will pave the way for mass adoption, which we will see in the second half of 2019. "

GP Bullhound to watch

The companies / partnerships of GPB to watch are:

Alibaba, AWS / Qtum, Binance, Bitfury, Blockstack, Bloomberg / Galaxy, Coinbase, Gemini, Soros Fund Management, Goldman Sachs, IBM / Stellar, Ledger, Revolut, NYSE Bakkt, Rockefeller / Venrock, T3, Yale, Stanford University, Harvard University, MIT, loyalty

The GPB coins to watch:

Bitcoin, Ethereum, Monero and Stellar.

The year blockchain leaves the labs

For those who were starting to lose confidence in the blockchain technology that emerges from the fintech laboratories of the numerous financial institutions that manage the pilots, the GPB confirms that many are still on track to emerge in nature, as stated by the company FOMO.

"Below the surface, the activity in Distributed Ledger Technology (" DLT ") is in full speed, even within the financial institutions."

A story of financial adoption (not all about Ripple, which does not receive a mention from GPB) that did not have much coverage was the announcement by Calastone that he will transfer his global fund transaction business to blockchain. This will have the effect of reducing costs for mutual fund investors, assuming that savings are transferred from fund giants such as Vanguard, BlackRock and Fidelity.

Calastone is not a small surplus – it has trading volumes estimated at $ 80 billion a month, with 1,300 institutions part of its network in 34 markets around the world.

Julien Hammerson, CEO of Calastone, underlined in the press release of the company: "In taking this first step using blockchain, we are providing our customers with the necessary tools they need to be ready for the future. "

Saxo Bank provides the breakdown of credit: this is a cryptic opportunity

The other prediction with cryptographic implications – from Saxo Bank – has been passed down from the cryptic and mainstream financial media.

Earlier this month, Saxo Bank published its annual "Outrageous 10-odds" and it must be said that this year does not seem too scandalous given the times we live in.

Among the 10 predictions of 2019 there is a recession in Germany and the dismissal of US Federal Reserve President Jerome Powell by President Trump – none of which is probably too far from the brand.

However, it is his fifth prediction that should interest the cryptowatchers.

The number five provides a corporate credit crunch that sees Netflix and General Electric (GE) caught in a downward spiral debt crisis.

This would represent a dramatic reversal of leadership in equity markets, as traditional (but not GE) securities with healthy cash flows and reliable and growing dividend payments replace growing companies such as the FAANG stocks in the technology sector.

GE, once the US economy and its most precious company, are in trouble, is struggling. Saxo plans to rollover its $ 100 billion in liabilities that are driving the credit market crazy "pushing the credit default price above 600 basis points".

Panic ensnares Netflix, predicts Saxo.

"The carnage spreads even to Netflix, where investors suddenly struggle with the company's formidable influence, with a net EBIDTA debt after the CAPEX ratio of 3.4 and over $ 10 billion of debt on the balance sheet. Netflix funding doubled, slamming the brakes on content growth and depleting the share price ".

Why should there be something for a crypt?

The credit is the oil that makes the machine work. Credit is fundamental to the way that not only the financial system works, but the entire economic system, allowing companies like Netflix and Tesla to build their businesses despite the absence of profits, with lenders who they bet on their return on capital when the products arrive on the market and the money starts to flow.

Bitcoin for $ 8,761,904

But if the collapse of the credit market is a big problem for the credibility of the financial system.

And brought in an even cruder outlook from the IMF's latest global public and private debt figures, which are estimated at $ 184 billion in 2017. This equates to $ 86,000 for every person on the planet.

Or, if you prefer to use the exchange equation approach to bitcoin valuation, assuming that debt acts as a form of money creation, you could divide the debt by 21,000,000 to get a price of $ 8.761.904 for the bitcoin.

So, the next time someone (perhaps the economist of Nouriel Roubini or Kenneth Rogoff says that buying encryption is a lottery) tells you that the crypt is in a bubble (true, but perhaps close to full deflation) and is intrinsically worthless (false, because it carries value and stores it, no matter how inefficient), reminds them of the mountain of debt that keeps the current system afloat and artificially inflates asset values.

Fictitious capital in the budget

It is true that these huge liabilities must be balanced by the activities – in a budget. But in the real world, those "assets" may not be worth the paper they are written on.

The divergence of the debt from its docking activity does not exactly encourage confidence in the monetary forms that give it expression.

The chief economist of Saxo, Steen Jakobsen, states:

"The edition of this year [of its outrageous predictions] has a unifying theme of 'enough is enough'. A world that is emptying will have to wake up and start creating reforms, not because it wants but because it must do it. The signs are everywhere. "

He continues:

"We think that 2019 will mark a deep pivot from this mentality while we are reaching the end of the road by accumulating new debts and next year we will all begin to pay the piper for our wrong ways".

Sgt Barnes in classic modern film Platoon he says it more succinctly: "When the car breaks, it breaks".

Just as the Great Recession led to the invention of bitcoin, the break in the credit cycle could be the background of the next act in the long game of encrypted adoption.

Even the skeptical fiat lovers may be forced to consider what was once unthinkable.