[ad_1]

- The cryptocurrencies enjoy a fifth day of hikes with Bitcoin breaking the $ 4K barrier.

- Ethereum also has room to get up, but Ripple may lag behind.

- Here are the levels to be observed according to Confluence Detector, our proprietary tool

The continuous recovery in the world of digital coins. In the last five days, the criptos are climbing two steps forward and consolidating for a while. These are very healthy gains are the mirror image of unhealthy falls without real recoveries, only "the dead cat rebounds".

The move began before the first anniversary of the Bitcoin peak near $ 20K and continues later. There are no clear catalysts, but the theory of whale accumulation is gaining ground. According to the theory, whales operating outside the cryptocurrencies have downloaded coins from November 14 onwards only to induce others to sell and push prices down. After the accident, they will begin to accumulate again. And in Q1 2019, when Bakkt and NASDAQ join the cryptic world, prices will continue to rise and the whales will widen their wealth.

In any case, it is essential to be aware of the technical levels ~

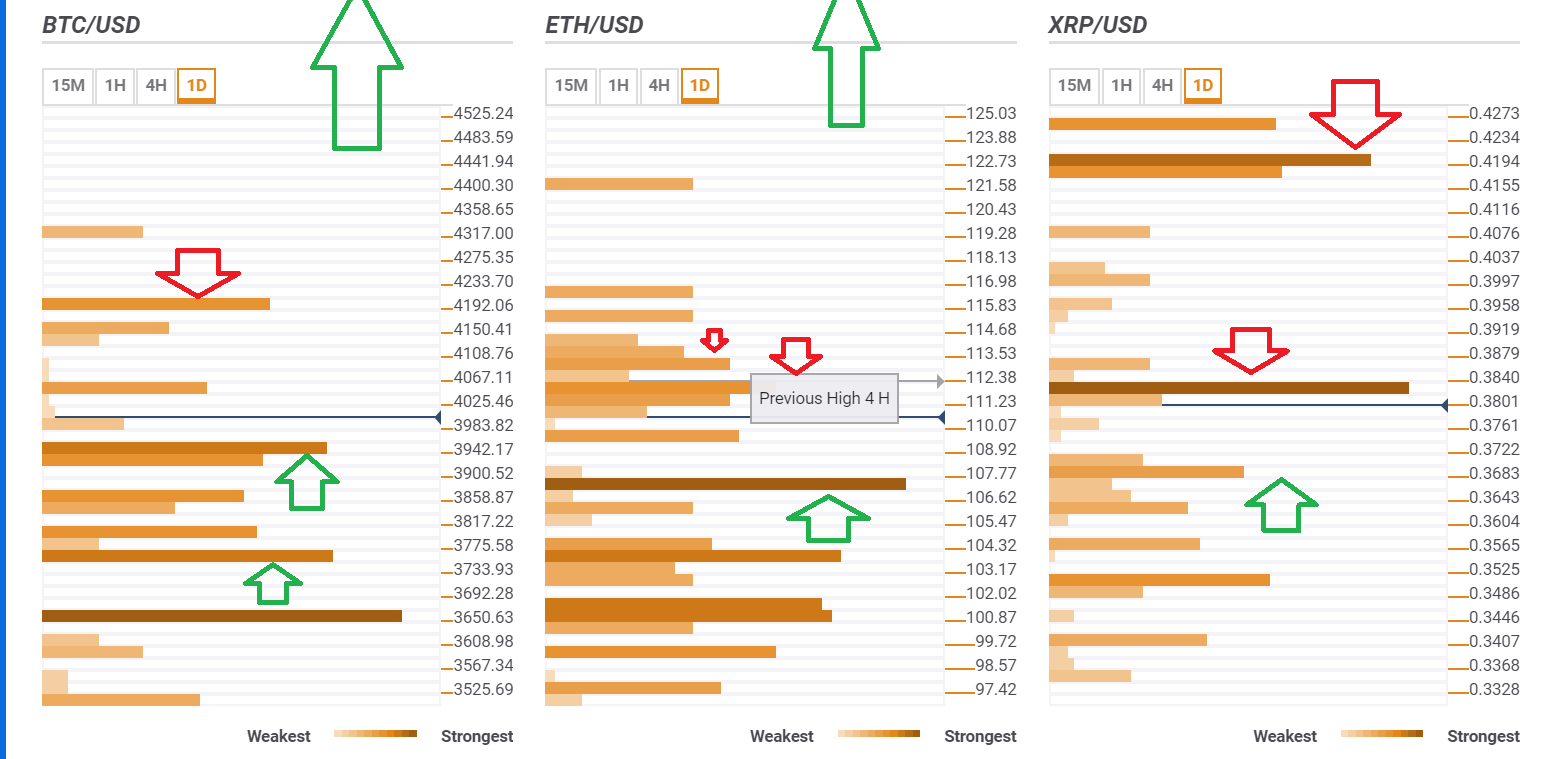

BTC / USD looks over $ 4,500

Bitcoin, the grandfather of cryptocurrencies, has a certain resistance to $4,045 that is the convergence of different technical levels including the Simple Moving Average 5-15m, the Pivot Point one-day Resistance 2, the Bollinger Band 15 minutes Middle, the previous 1h-high and the SMA 5-1h.

Higher, $4,192 it is the Fibonacci of 23.6% a month. However, these are not significant levels and our chart ends at $ 4,545, indicating that there is room for further gains over this line.

On the other hand, support is substantial. A $3,492 we see the previous 1d-high, the PP 1w-R3 and the SMA 10-1h. Another noteworthy line is $ 3,858, which is where the PP 1d-R1 and the Fibonacci 23.6% of a day converge.

All in all, the path of least resistance for BTC / USD is on the upside.

ETH / USD at over $ 125?

Similar to Bitcoin, Ethereum also enjoys a healthy pillow and a few levels of upside. The purpose of our ETH / USD reaches $125 up to where there are no huge obstacles. About $112 we see the confluence of the Fibonacci 161.8% at one week, the BB 4h-Upper and the SMA 200-4h.

A $113 we see the PP 1d-R2, the BB 1h-Upper and the PP 1w-R3.

Vitalik Buterin's project has considerable support for around $107, where we see the PP 1d-R1, the SMA 10-1h and the PP 1w-R2.

XRP / USD will fight with $ 0.3820

Ripple has a different story. Take on an obstacle to $.3820 which is a dense mass that includes the very important Fibonacci 23.6% of a month, the BB 1d-Upper, the BB 15m-Middle and some other lines.

If the number 1 Altcoin manages to overcome this obstacle, $.4194 is the clear goal It is the meeting point of the one day Pivot Point R2 and the 38.2% Fibonacci of a month.

Support waits for XRP / USD to $.3670 which includes 38.2% Fibonacci for one day, BB 1h-Middle and SMA 5-4h.

Source link