[ad_1]

Janet Yellen

“The economy has the potential to make the world a better place. I became an economist because I wanted people to be happy. “(Conference at New York University in 2013)

Candidate for Treasury Secretary Janet Yellen

White House Economic Advisory Camouflage in Clinton

Fiscal expansion, emphasis on strong economic stimulus

New York Stock Markets Welcome to the news

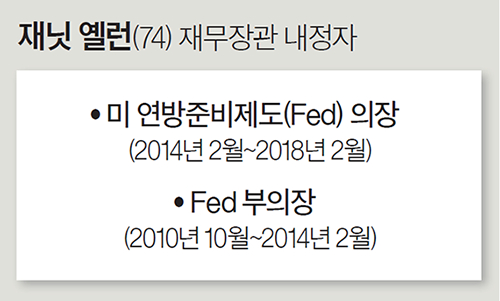

Janet Yellen (74), who said this, will soon become the first female finance minister in US history. On the 23rd (local time) the Wall Street Journal (WSJ) and Bloomberg News reported that President-elect Joe Biden has chosen Yelan as a candidate for the finance minister. Yellen, who served as chairman of the White House Economic Advisory Committee (CEA) (1997-99), the president’s key economic staff during President Bill Clinton’s days, set a new record of serving as head of fiscal and monetary policy. (2014-2018), two pillars of the economy. I built it.

Yellen’s appointment as finance minister is a sign that saving the economy is a top priority. This is the most important time for the government’s strong stimulus measures to revive the economy. In an interview with media such as Bloomberg last year, Yellen pointed out that “the economy needs to provide massive financial support,” saying, “The economy is in dire need of spending (through additional stimulus measures). “, as well as the stalemate in negotiations on additional stimulus measures by Congress. I took the baton myself. Yellow is the best person to persuade the Senate, where the Republican Party is expected to dominate, to put out the fires of negotiating further stimulus measures. The New York Times (NYT) said, “Yellen as finance minister will have to play a more political role. We note the role of exercising bargaining power and devising additional economic stimulus measures.”

Janet Yellen

The market is also welcoming. Following the news of Yellen’s bankruptcy, the New York Stock Exchange showed stability in overtime trading. There is a basis for market belief. As head of monetary policy, he has demonstrated his prowess by faithfully fulfilling the Fed’s two responsibilities to stabilize inflation and full employment. In office, the highest inflation was 1.9%, not exceeding the target (2%). The unemployment rate in the United States in February 2014, when Yellen took over the Fed, was 6.7%, but in October 2017, before retirement, it was 4.1%. It is at the level of full employment.

In order to raise the liquidity released through quantitative easing (QE) to escape the global financial crisis, the market did not shake significantly, although the benchmark interest rate was raised five times while in office. Yellen’s unique leadership in communications prevented the market from panicking.

The fact that Yelan is a wave of doves that focuses on job stability rather than suppressing inflation increases in monetary policy is another factor that raises market expectations. The thesis (“employment and production in the open economy, accumulation of funds”) also addressed employment policy. In his 2007 speech as governor of the San Francisco Federal Bank, he said: “I don’t want to hold back inflation, but the priority is to maintain the current political position (for job security).”

As a result, a consensus is expected to form with Fed Chairman Jerome Powell, who has morphed from “inflation fighter” to “occupation fighter”. When Yellen was the Fed chairman, Powell met hand and foot as a director.

Her husband is a professor at Georgetown University, George Acalof, who together with Tobin and Stiglitz won the Nobel Prize in Economics in 2001 by analyzing the impact of information asymmetry in the used car market on the market and on the economy. The two met at the Fed in 1977. His son Robert is also a professor of economics at Warwick University in England.

Reporter Jeon Sujin [email protected]

[ad_2]

Source link