[ad_1]

[ad_1]

- The launch of Ethereum 2.0 is scheduled for December 1st.

- There are many things investors should keep in mind as they navigate the transition period.

The launch of the second version of the Ethereum protocol, also known as Serenity, could become the biggest event of the year for the industry. It will define the future of the second largest cryptocurrency ecosystem based on the market value and protocol chosen for the vast majority of decentralized applications.

Ethereum 2.0 is designed to become a self-sufficient financial ecosystem with a unique value. The long-awaited update will bring many changes to the world of computers, making the network more scalable and secure. The blockchain will also move from Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism and create options for passive income for ETH holders.

The new version will be launched on December 1, 2020. However, switching to the new version is a complicated process that won’t happen overnight. Additionally, there are several essential things to take into consideration in order to successfully navigate this time.

1. The launch date can be changed

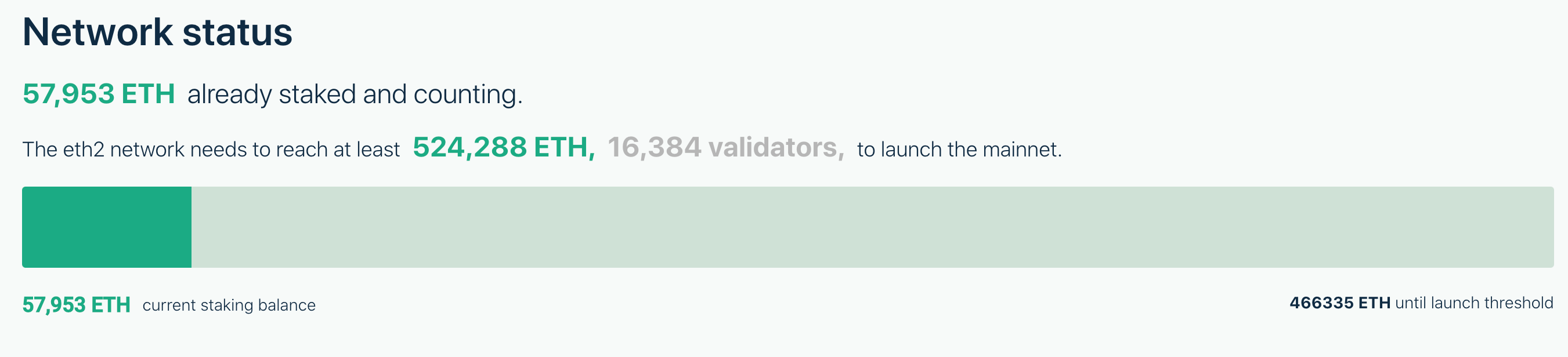

Ethereum 2.0 developers announced that they would begin rolling out Beacon Chain, the critical component of the new protocol version, on December 1. However, this date is not set in stone. In reality, it depends on the project ensuring the support of at least 16,384 validators with the total amount of 524 288 ETH staked into the network, over $ 200 million at the current exchange rate.

These conditions should be met at least one week before December 1st; otherwise, the launch of the Beacon Chain genesis block will be postponed again.

A dedicated deposit smart contract set in motion on November 4th acts as a bridge between ETH 1.0 and ETH 2.0 as it allows users to send their coins from the current blockchain version to the new one and participate in staking.

Over 57,000 ETH have already been wagered, about 10% of the requested amount.

ETH 2.0 Launchpad

2. Two networks will coexist

Ethereum 2.0 will be launched as a separate network that will run in parallel with the first version of the protocol. This means that the life of a normal ETH user will not change overnight. Users will continue to interact with their ETH-based applications and services as usual.

Since the migration to the new protocol is too complicated, the developers decided to do it step by step to ensure that all services are running continuously and that the entire ecosystem does not collapse if something goes wrong.

3. 32 ETH will be frozen for an indefinite period of time

Ethereum 2.0 will allow users to earn passive income of around 7% per year, which is a very interesting feature and a fundamental difference from the existing framework.

However, to become a validator, the network participant must transfer at least 32 ETH – approximately $ 14,700 at the current exchange rate – to the smart deposit contract. These coins will effectively be locked for an indefinite period, meaning the user will not be able to retrieve them until the transition progresses to Phase 2, which is expected to happen in two years at the earliest.

Experts fear that this condition may discourage people from joining the network in the early stages because they will have to say goodbye to their money for an extended period. The value of their deposits may decrease over time if the price of ETH falls.

Furthermore, as the total value of ETH locked in the network will increase, deposits will become less profitable.

4. Scammers are everywhere

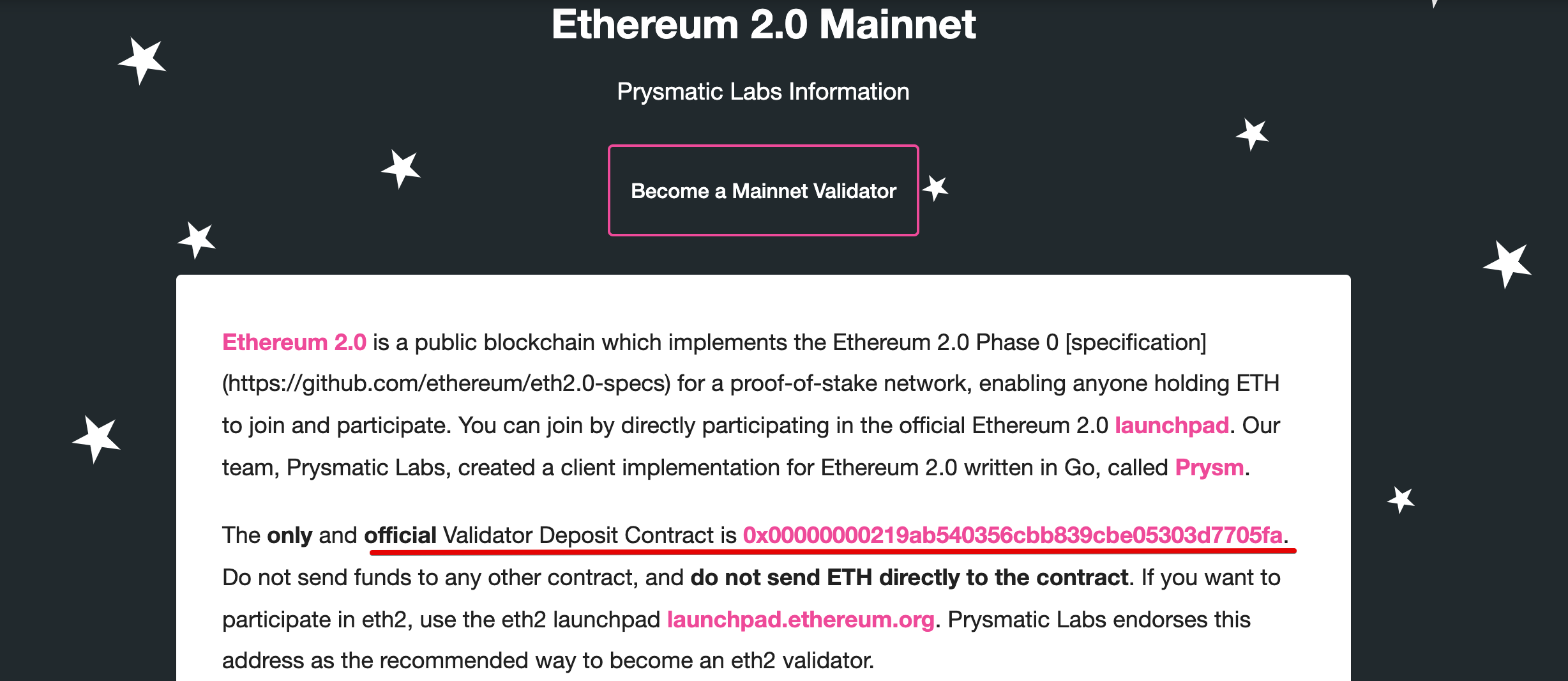

ETH users interested in staking their coins on the smart deposit agreement and participating in the Phase 0 distribution should be aware that many scammers try to have coins deposited via their links, websites or applications.

The whole process is very complicated and investors should do their due diligence before sending their money to a smart contract. The official validator deposit agreement address is provided on the Ethereum 2.0 mainnet website. Anyone using a different address is a scammer.

Prysm Eth2 Testnet

According to information provided on the ETH 2.0 mainnet website, the developers urge ETH owners to only use the Eth2 launchpad utility at launchpad.ethereum.org

Do not send funds to any other contract and do not send ETH directly to the contract. If you want to join eth2, use the eth2 launchpad launchpad.ethereum.org. Prysmatic Labs advocates this address as the recommended way to become an eth2 validator.

5. There are multiple clients for ETH 2.0

Since Ethereum is a decentralized network, anyone can create their own software to work with ETH 2.0. Currently, four validation clients are listed on the official ETH launchpad website. They are Lighthouse, Nimbys, Prysm and Teku. All of them have their advantages and disadvantages and users can choose the one that suits them best.

Basically, the variety of software vendors building apps for ETH 2.0 makes the network more user-friendly, inspires healthy competition, and ensures that a single developer doesn’t control the entire network.

Key points

The launch of the Beacon Chain is the beginning of a great journey that will ultimately transform the Ethereum protocol into a new, more secure and scalable ecosystem with advanced features. The launch is scheduled for December 1st. However, it depends on the project guaranteeing the required amount of coins and the support of over 16,000 validators.

To become a validator, users would have to deposit at least 32, which will be frozen on the new protocol which will run in parallel with the old chain. The stakers will be able to get their money back once the migration is complete.

There are currently four officially supported ETH 2.0 validators, but independent developers can create their own software to interact with the new chain as well. Competition ensures that a single software vendor does not monopolize the network.

ETH holders must do their due diligence and avoid using unverified software or services as they could be scammers.

Implications on ETH pricing

At the time of writing, ETH / USD is trading hands at $ 458. The second largest coin bottomed at $ 83 on March 13 and has steadily gained ground since then. If the Ethereum 2.0 launch proceeds according to the plan, the price could easily reach $ 800 as there is no resistance between the current price and $ 800, according to In / Out of the Money Around Price (IOMAP) data.

Analytics and Charts-637407770634765134.png)

Ethereum’s In / Out of the Money Around Price

The update will improve ETH’s security and scalability, which will have positive pricing implications.

Switching to Proof-of-Stake (PoS) will incentivize investors to hold their coins for staking rewards. This trend will reduce the supply of tokens due to increasing demand, leading to higher prices.

.[ad_2]Source link