[ad_1]

[ad_1]

Quick grip:

- Ethereum successfully breached the $ 500 price cap by setting a 2-year high of $ 518 – Binance rate

- Ethereum’s move above $ 500 also coincided with an increase in deposits to the ETH 2.0 contract

- The process is now 28% complete, up from 20% yesterday

- Ethereum holders have until Monday November 23 to send enough ETH to activate Phase 0 by December 1

- If deposits continue to rise, ETH could continue to make money in the cryptocurrency markets

Ethereum (ETH) is once again above $ 500 in a venture that took two years of work. The last time Ethereum traded above $ 500 was in June 2018. Ethereum’s push above this crucial level is linked to the progress of the ETH2.0 update which is expected to launch Phase 0 on December 1st. .

Ethereum’s rise above $ 500 coincided with a spike in ETH 2.0 deposits

In order for the update to start on the scheduled date, 524, 288 ETH must be sent to the staking contract seven days prior to that date. This means that the process must be completed by Monday 23 November.

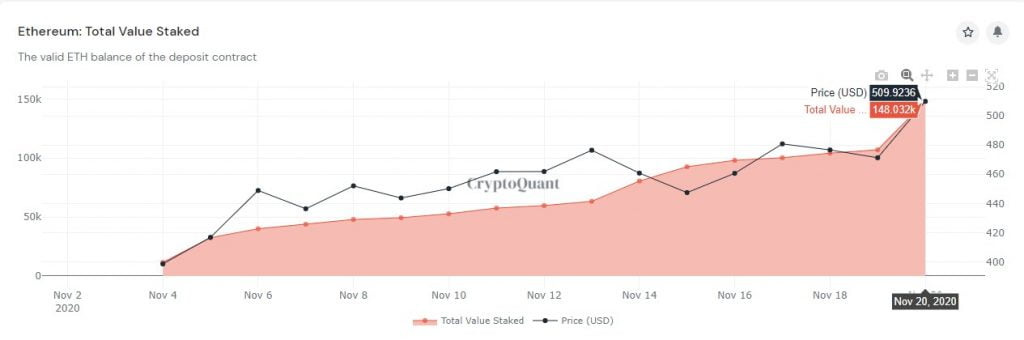

Yesterday, the process was completed at 20% with a total of 106,976 ETH of the 524,288 ETH requested sent to the deposit agreement. A quick glance at the progress via CryptoQuant.com reveals that the total sent to the deposit agreement is now 148,032 ETH, which is 28% of the requested amount.

Ethereum’s rise above $ 500 coincided with a significant 24-hour spike in ETH sent to the deposit contract, further confirming an earlier theory that whales wait until the last minute to do so.

The chart below, courtesy of CryptoQuant.com, provides a better visual representation of yesterday’s increase in deposits along with the rising ETH value in the cryptocurrency markets.

The value of ETH may continue to earn as more deposits are made

By connecting the dots, Ethereum traders are bullish on the price of ETH based on the number of deposits made for the ETH2.0 contract. The chart above from CryptoQuant also confirms this as the price of ETH in the cryptocurrency markets has increased linearly with the number of Ethereum deposits.

Therefore, and as ETH deposits continue, Ethereum’s value could continue to benefit until the full 524, 288 ETH is wagered. It is also worth noting that ETH2.0 has a number of other stages that will also provide considerable excitement to investors in the days and weeks to follow.

However, Ethereum traders and investors are warned that Bitcoin is due for a correction, any sudden volatility will definitely affect ETH. Therefore, the stop loss and the use of low leverage are highly recommended as the crypto-verse approaches tomorrow’s weekly close.