[ad_1]

[ad_1]

On July 20, Ethereum was preparing for a crucial rally, the one least expected by the rest of the community. Between July 21 and September 1, Ethereum would experience a huge surge, which would see it climb to $ 489 from $ 235, also hitting its 2-year high. While the bullish rally was memorable, the bearish pullback was also quite surprising, with Ethereum falling to $ 309 on September 5th.

While Ethereum was once again above the $ 400 level at press time, the key difference between July 2020 and the current rally remains the crypto phenomenon of the year: DeFi.

How important was DeFi in July 2020?

DeFi’s interest was widespread and its impact was significant on the Ethereum network. From high transaction fees to miners becoming more profitable, DeFi has brought a serious level of attention to Ethereum, and perhaps played a huge role during Ether’s price pump at $ 489.

However, the excitement was short lived. Shoddy DeFi tokens stifled the euphoric nature of these apps and with Ethereum’s price plummeting in the charts, the hype was starting to wear off.

The YFI token, which was worth almost $ 43,000 at one point, had dropped dramatically and was trading at around $ 13,900. Now, with another rally hinting at the price of Ethereum, the market indicators look rather split in half.

According to the latest news from Santiment analysis, Ethereum miners remained resilient to turbulent market movements, holding their position. In addition, an increase in new active ETH addresses was also noted.

Source: Twitter

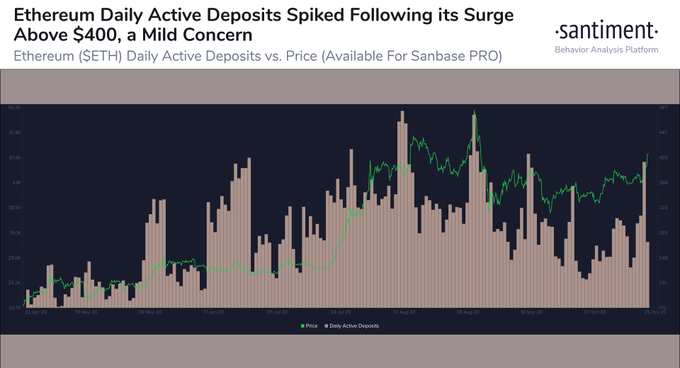

However, daily active deposits (number of unique deposits on Ethereum) have increased a lot, a development that could lead to a selling scandal, eventually causing the Ethereum rally to collapse.

Source: Skew

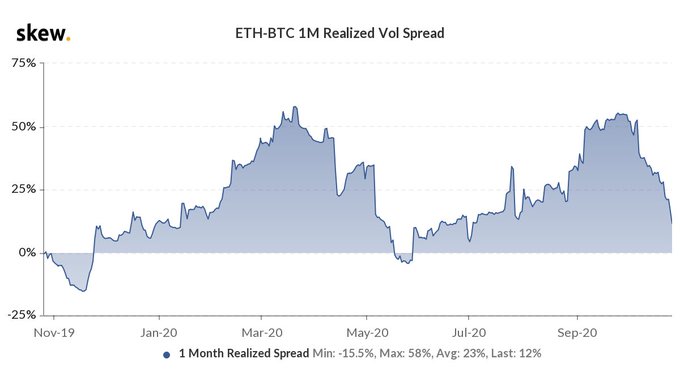

In addition, as illustrated by the attached chart, ETH-BTC’s realized 1-month volatility spread fell sharply, indicating that Bitcoin’s price was more open to swings, when trading than Ethereum.

Can the absence of DeFi for Ethereum be addressed?

The long-term answer is yes.

While DeFi had its appeal for traders to incorporate transactions on Ethereum, it was probably just a summer bubble. Hence, the short-term rally in July 2020 raged towards the highs it did.

While DeFi was one of the main reasons behind Ethereum’s rally, it was equally responsible for the decline. DeFi tokens were already losing their grip on the community after several “carpet shots” questioned the credibility of the space. Indeed, it can be argued that it is a blessing in disguise for Ethereum that the current rally has not coincided with an active DeFi market. However, even ignoring DeFi entirely is not ideal, as it indicates reasonable forms of decentralized financial products for the future.

Indeed, according to Lanre Jonathan Ige, researcher at Amun AG,

“The softening of the immediate hype for DeFi will be disappointing for the trader in the short term, but overall it’s probably good for the industry. The bubble of the summer wasn’t sustainable, but it showed that various aspects of DeFi (lending, trading, DAO) are actually useful for particular use cases. “

So, will Ethereum rise above $ 480 in the next 2-3 weeks? Maybe not.

However, if it does, it will be far more sustainable than the DeFi-backed rally of July 2020.

[ad_2]Source link