[ad_1]

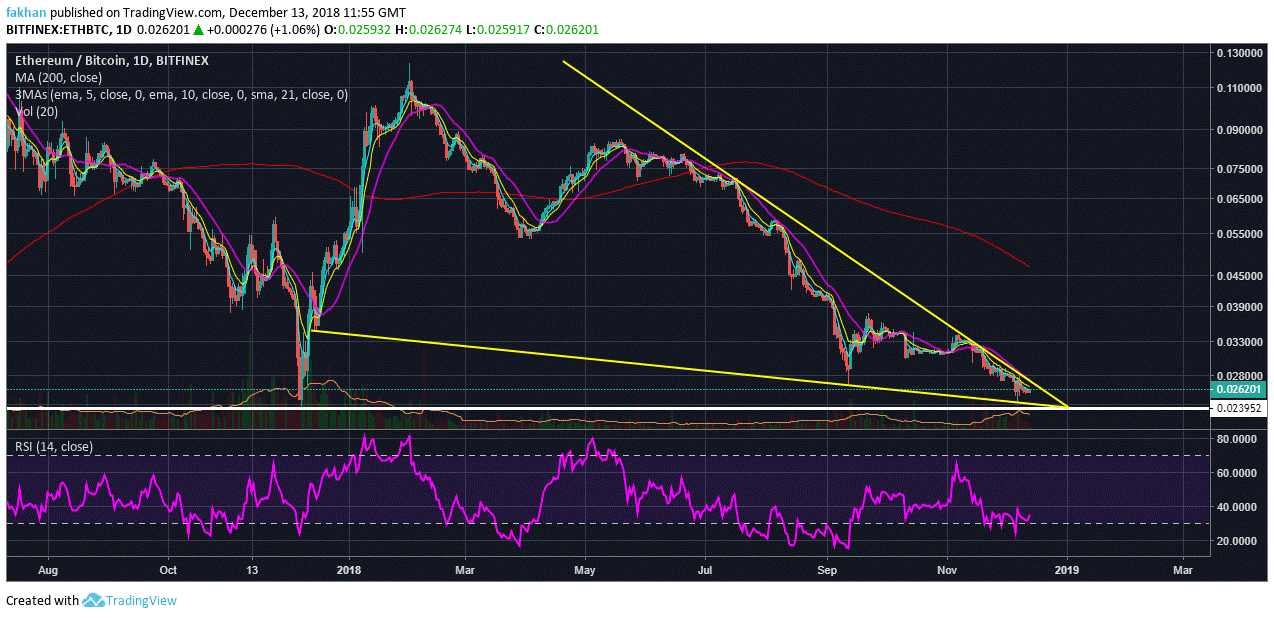

Ethereum (ETH) failed to overcome the 5-day EMA resistance against Bitcoin (BTC) and US Dollar (USD). This means that a new record of the previous annual minimum is now inevitable and Ethereum (ETH) will have to fall in the coming days to completely complete the correction. It is possible that the fund that will be established in the coming days is not the definitive fund and Ethereum (ETH) could fall in early 2019, but ETH / BTC has long been waiting for a recovery and is about to arrive but not before to put it at the bottom. RSI for ETH / BTC has room for a further decline at least for a new test of the minimums at the end of 2017.

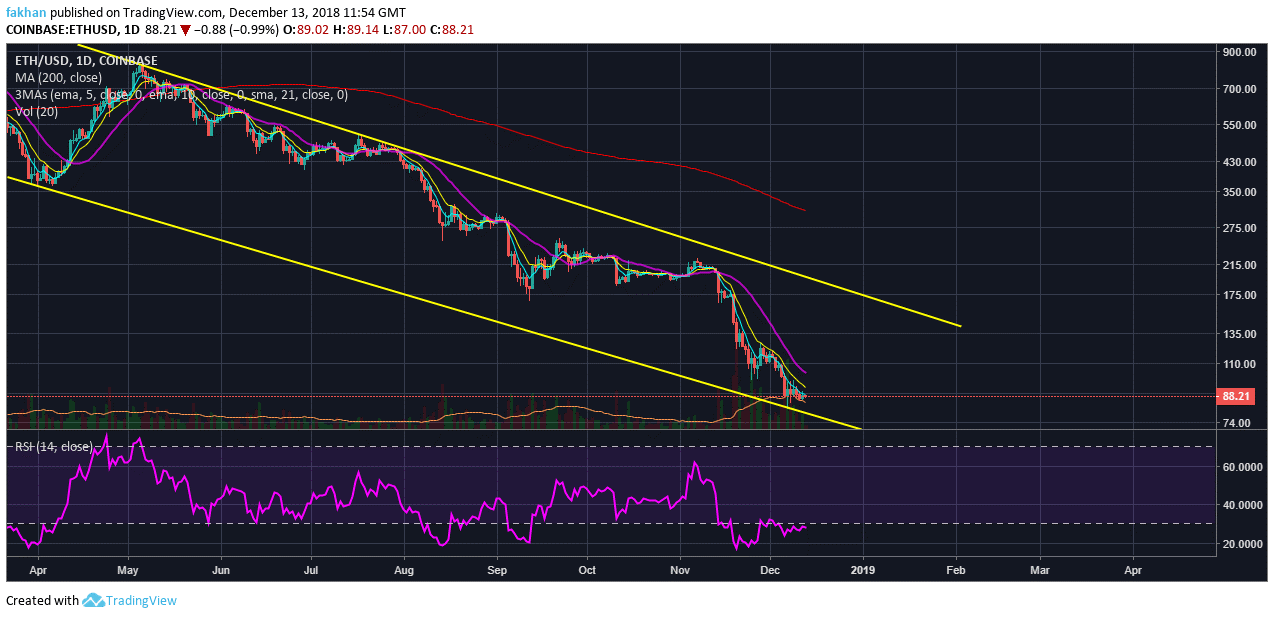

Ethereum (ETH) has defended against major stops at current levels, because the price has already fallen significantly from its all-time high and now has little room for further disadvantages. That said, the price will have to go down to test the previous annual lows in the coming days. The probability of a recovery before a new test of the previous lows is now very low considering that the bulls are not ready to intervene before the bears make their way with the price. Any attempt to hinder a fall at this stage will only mean taking a knife that falls. The bulls and the bears are both agreed at this stage that it is inevitable to repeat the test of the annual lows. The number of short films for Ethereum (ETH) against both Bitcoin (BTC) and the US dollar (USD) has now risen again.

Ethereum bears (ETH) will let themselves go and we will probably see a strong squeeze after the price has dropped to $ 70. However, at the moment, the bearish resolution is stronger than ever and they are not willing to let go. The number of courts began to decline last week when the chances of a recovery began to appear, but soon after Ethereum (ETH) had to reject the 10-day EMA, the number of shorts started to rise again. . This time, the number of courts will not fall unless the bearish resolution is seriously hurt. The only way that will happen is if the price drops to around $ 70 and goes straight from there to stage a successful recovery.

The daily chart for ETH / USD indicates that there is still room for a decline to $ 70. The price has struggled to exceed the 5-day EMA over the past ten days, but has failed every time. Now even the RSI seems to have met resistance and is ready to go down in the next few days. Probably this would be the last time we will see Ethereum (ETH) at such low prices this year. Once the ETH / USD starts to recover towards $ 200, the bullish resolution will strengthen again and many investors will return to FOMO. This would probably prepare the basis for a definitive capitulation at the beginning of 2019, which will make this cycle similar to the one after 2014.

Source link