[ad_1]

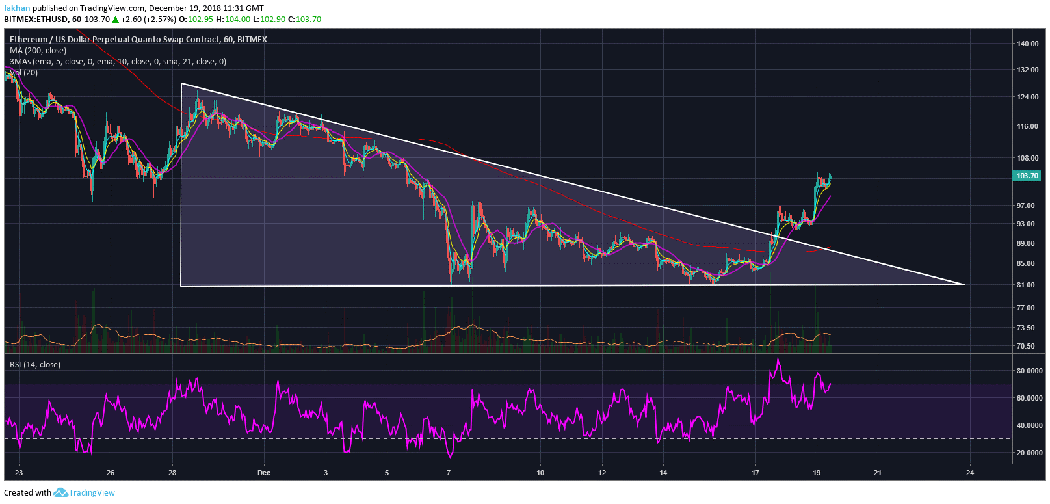

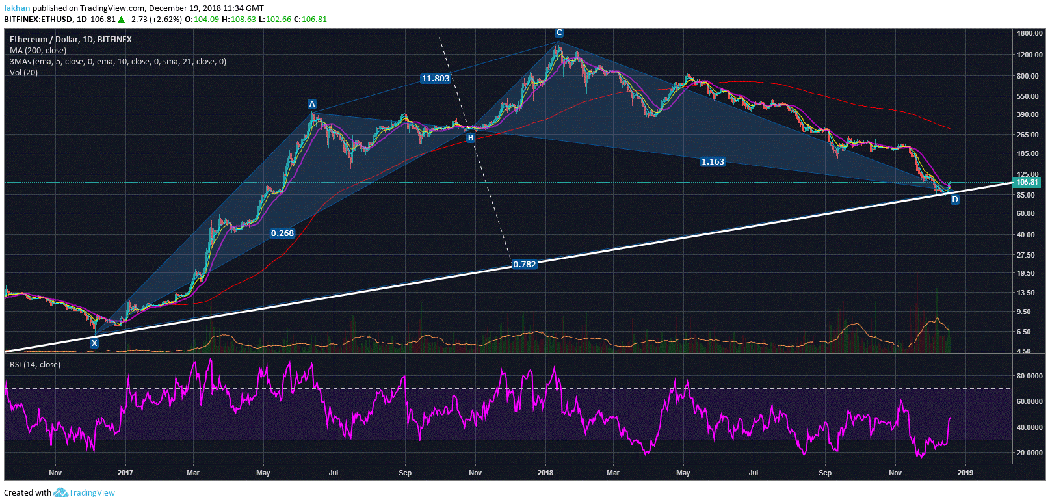

Ethereum (ETH) broke above the descending triangle from which it was traded from the beginning of December. This is seen as the beginning of a new trend and investors are already flocking to Ethereum (ETH) to get on board before the next bullfight. The last two years concerned the launch of new ICOs on the market. Most of these international organizations have raised funds by accepting payments in Ethereum (ETH). This new funding helped ETH / USD reach a new all-time high in December 2017. Ethereum's (EHT) prospects were very bright and had no competition in its space. Beyond that, he had no internal problems or legal problems in relation to ICOs.

There is a strong conviction in the crypto community that a new wave of ICO is going to flood the market, which is again leading to an increase in the demand for Ethereum (ETH). This is based on the premise that most of these international organizations will continue to use Ethereum (ETH) to raise funds. There is another hypothesis that most of the upcoming startups will raise money through ICO. However, in recent months, we have seen the new startups avoiding to associate themselves with the term "ICO". This is because most of the ICOs were scams or projects built on shallow foundations that were bad during the recent correction. Attention now seems to be on the STO.

The STO or security token offers differ from ICOs as they are direct investments in exchange for capital. On the other hand, ICOs generally do not offer a shareholding in the company. Offers token investors or token prizes in exchange for an investment in the project. Now, if we see a change from ICO to STO, most new projects are unlikely to opt for Ethereum (ETH) to raise funds. In fact, if it is a security offer, then they can raise funds through a variety of other ways that are not limited to just one cryptocurrency. So, if the ICOs are offstage, will Ethereum (ETH) have the same question as before?

Well, given that Ethereum (ETH) has been around for a long time and is now close to being actually used to solve real-world problems, it will continue to see an increase in demand. However, the monopoly it once enjoyed has long since disappeared. Platforms such as Ethereum Classic (ETH), Cardano (ADA), Quantum (QTUM) and Lisk (LSK) are now actually serious contenders in space that defy that monopoly. Having said that, Ethereum (ETH) has just completed the correction and has already started a new cycle as ETH / USD has returned over the 21-day EMA. It is very likely that Ethereum (ETH) will see a new record of its previous historical maximum over the next twelve months. It could even reach a new historical high by 2020. However, the gains of 50 times or more we have seen in the past may not be repeated again.

Source link