[ad_1]

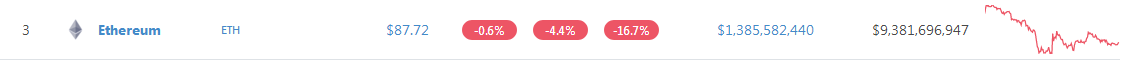

Last price of Ethereum

At spot prices, bears are not just stress tests on the dApp ecosystem, but they test the determination of investors and all market stakeholders. Obviously, it's a fall from grace to the grass, that the dive from $ 1,400 to less than $ 100 has been detrimental to investors, developers and businesses. ConsenSys – with more than 1,000 employees and currently in 30 countries are believed to be burning $ 100 million of support staff and projects mostly from Joseph Lubin – we hear the sting. Days after asking for resilience, the company announced that it will license 13% of staff.

To read: Crypto Startups Going bankrupt in the middle of Market Crash

Apart from that, the news is that even with these low prices, hackers are now targeting the unsecured portfolios of Ethereum and the mining platforms. As reported by our team, hackers scanned the network for a week and their main goal is to select port 8545, a JSON-RPC interface used by portfolios and data mining hardware. The interface depends on the user to set passwords and, if left open, hackers can exploit that opening and subtract funds.

Read also: Changpeng Zhao Likens Binance Chain for Ethereum, BNB To ETH

On the development front, developers' decision to agree and set a date for Constantinople is something very positive and would do much to instill trust in the ecosystem by preventing the project from migrating to competing networks.

Analysis of ETH / USD prices

On a weekly basis, ETH / USD fell 17 percent in the last week and fairly stable in the last day and hour. And even if bears are digging, ETH is down 85 percent compared to the 2018 peaks and as the Fibonacci retracement rules require, a natural correction is imminent. This is why traders and investors globally expect prices to rebound and close above $ 100 by the end of the week. Once done, then it is likely that ETH / USD would expand to $ 130 or higher. Otherwise, it falls to $ 50 or less will be inevitable.

Trend: bearish and slight accumulation

From left to right, the trend is clear. The ETH / USD is bearish and fluctuates in a narrow range of $ 17 with limits to $ 100 and $ 83. Unless there are earnings above $ 100, bears have control and considering the recent rate price erosion, we can not discard the possibility that prices fall below $ 83.

Volumes: growing, bullish

As a price range, three bars are a standout: December 7, 1900HRs bull bar-321k versus 179k average, dic 8-2300HRs bull bar-163k versus 134k average and dic 9-1500HRs bull bar-130k versus 85k average. All these bars limit price action. In the true sense of the word, the action of ETH / USD prices is still swinging by December 7th in ups and downs. Therefore, for buyers to be in charge, we have to see strong gains above the 7 December highs at $ 100, while falls below the lows would cause a sell-off to $ 50.

Candlestick training: Bear Breakout

Of course, bears are responsible, but at spot prices, prices are in range mode and accumulate. As already mentioned, bears have control, but if bulls gain momentum and push prices above $ 100, then ETH buyers have a chance.

Conclusion

From the above, this is our ETH / USD business plan:

Buy: $ 100-Dec 9 Highs

It stops: $ 85-Dec 8 Lows

Objectives: $ 130, $ 160

Interruptions below $ 83 invalidate this business plan.

All graphics courtesy of Trading View.

This is not an investment advice. Do your research.

Source link