[ad_1]

[ad_1]

- Synthetix puts up with the fight against control, down 17% from the week.

- Does the compound see a dead cat bounce? The 4-hour chart is bearish.

- Litecoin buyers return with conviction, more likely gains?

Decentralized Finance (DeFi) tokens are trying to catch up with the positive turnaround seen on the crypto board in the second half of this week. However, Synthetix, Compound and Litecoin failed to benefit from the renewed wave of purchases, emerging as the leading laggards among the top 50 widely traded digital assets.

Synthetix (SNX) experienced 17% erosion on a weekly basis. Compound (COMP) and Litecoin (LTC) have lost more than 13% and 12% of their value respectively.

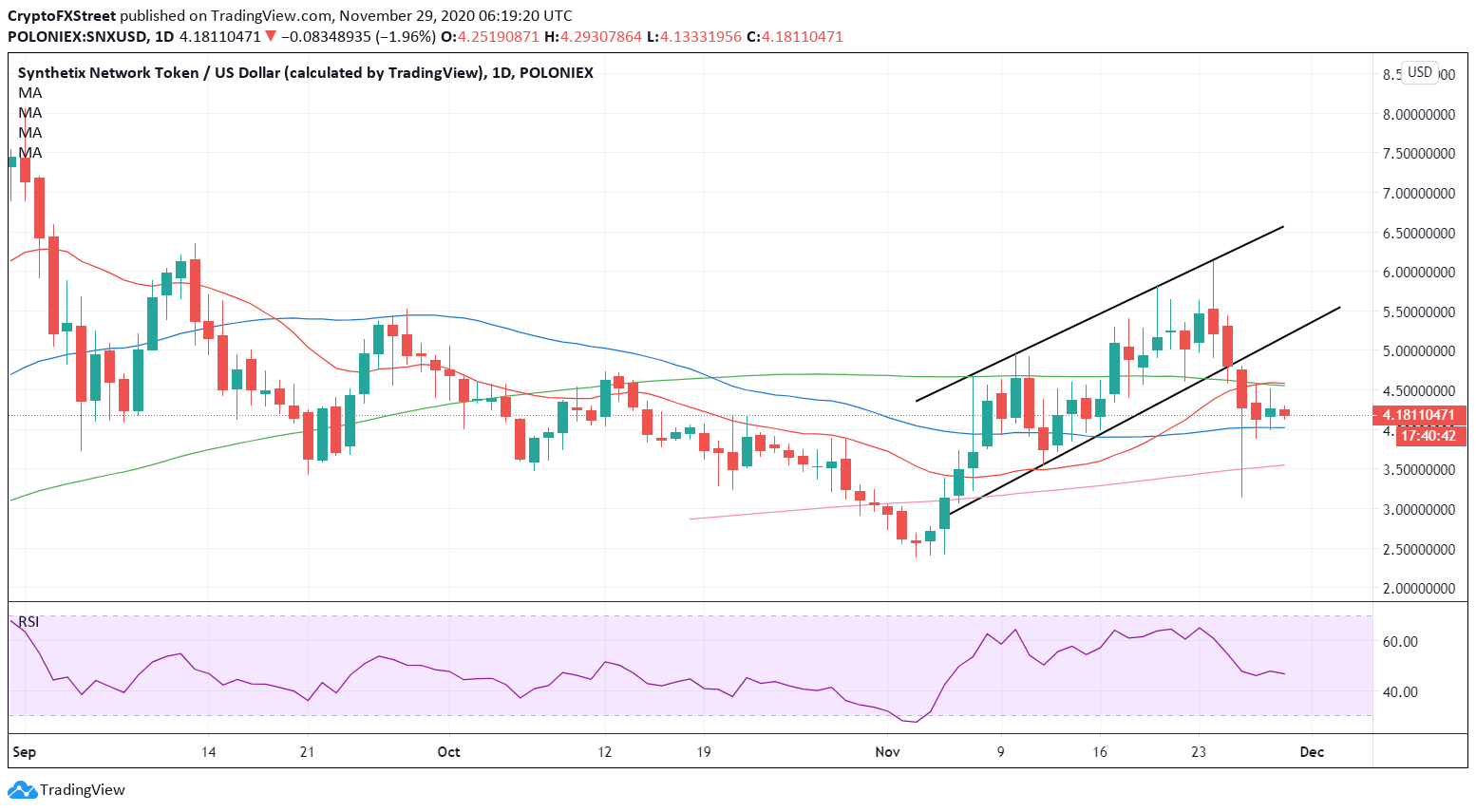

Synthetix: Saturday’s top awaits confirmation

Synthetix (SNX / USD) is the worst of the 50 most traded cryptocurrencies this week, having lost 17% of its value. Coin No. 43 returned to the red zone following a temporary reversal seen on Saturday. The price is currently trading in a tight range around $ 4.20, waiting for a new trading impulse.

SNX / USD: daily chart

The spot extends its bearish consolidation into this Sunday’s third consecutive session. The coin witnessed a strong sell-off to a three-week low of $ 3.1850 reached last Thursday following a break of the rising channel on the daily chart.

The bulls have managed to retake the 50-day horizontal moving average (DMA) at $ 4.023 and are now holding it, keeping the downside in check. A breach of the latter could bring 200-DMA support back into play at $ 3,452. The 14-day relative strength index (RSI) points south below the midline, keeping sellers bullish.

All eyes remain on Sunday’s close after Saturday’s top as the bulls await confirmation for a bullish reversal. Immediate resistance is seen at $ 4.60, the confluence of the 21 and 100 DMAs.

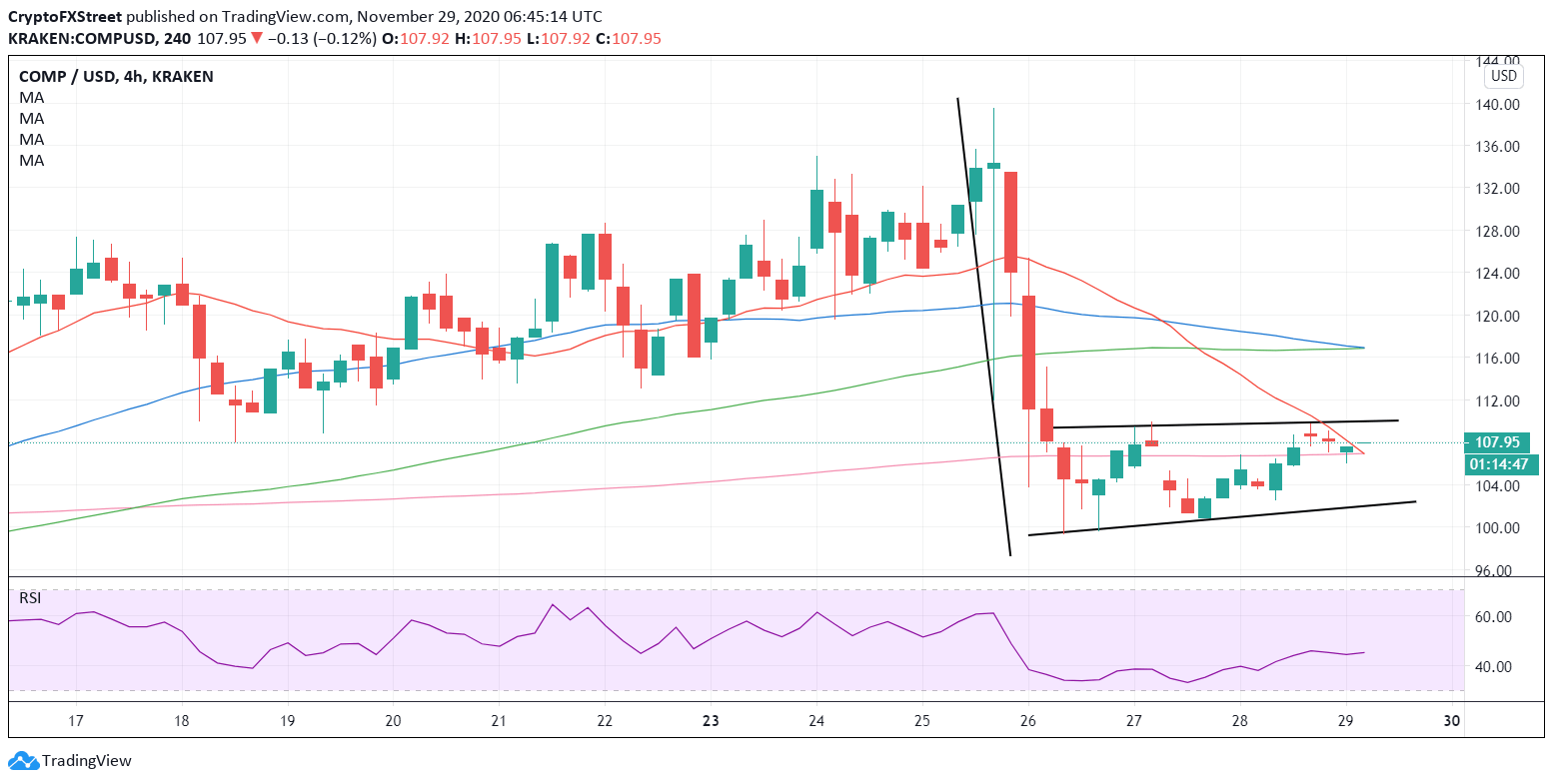

Compound: ready for an additional drawback

Compound (COMP / USD) is looking to take advantage of Saturday’s recovery from nearly two-week lows of $ 112.01. Despite the rebound, the path of least resistance appears to be bearish amid a bearish technical setup on the 4-hour chart. Coin No. 44 remains on track to suffer a 13% weekly loss, last seen trading at $ 107.60.

COMP / USD: 4-hour chart

The recent slide followed by the consolidation has carved out a bullish flag formation on the 4-hour chart. The pattern would be validated on a break below the support of the rising trend line at $ 102.12 on a four-hour close.

A bearish breakdown could trigger a sharp drop to the November lows of $ 81.01. At the moment, the price is fighting the 200 simple moving average (SMA). The bearish crossover and the RSI suggest that there are further downside possibilities. The RSI is trading flat around 44.87 as 21-SMA is on the verge of piercing the 200-SMA from above. Alternatively, a sustained break above the trendline resistance at $ 109.88 could expose the next significant barrier at $ 116.94, which is the convergence of the 50 and 100 SMAs.

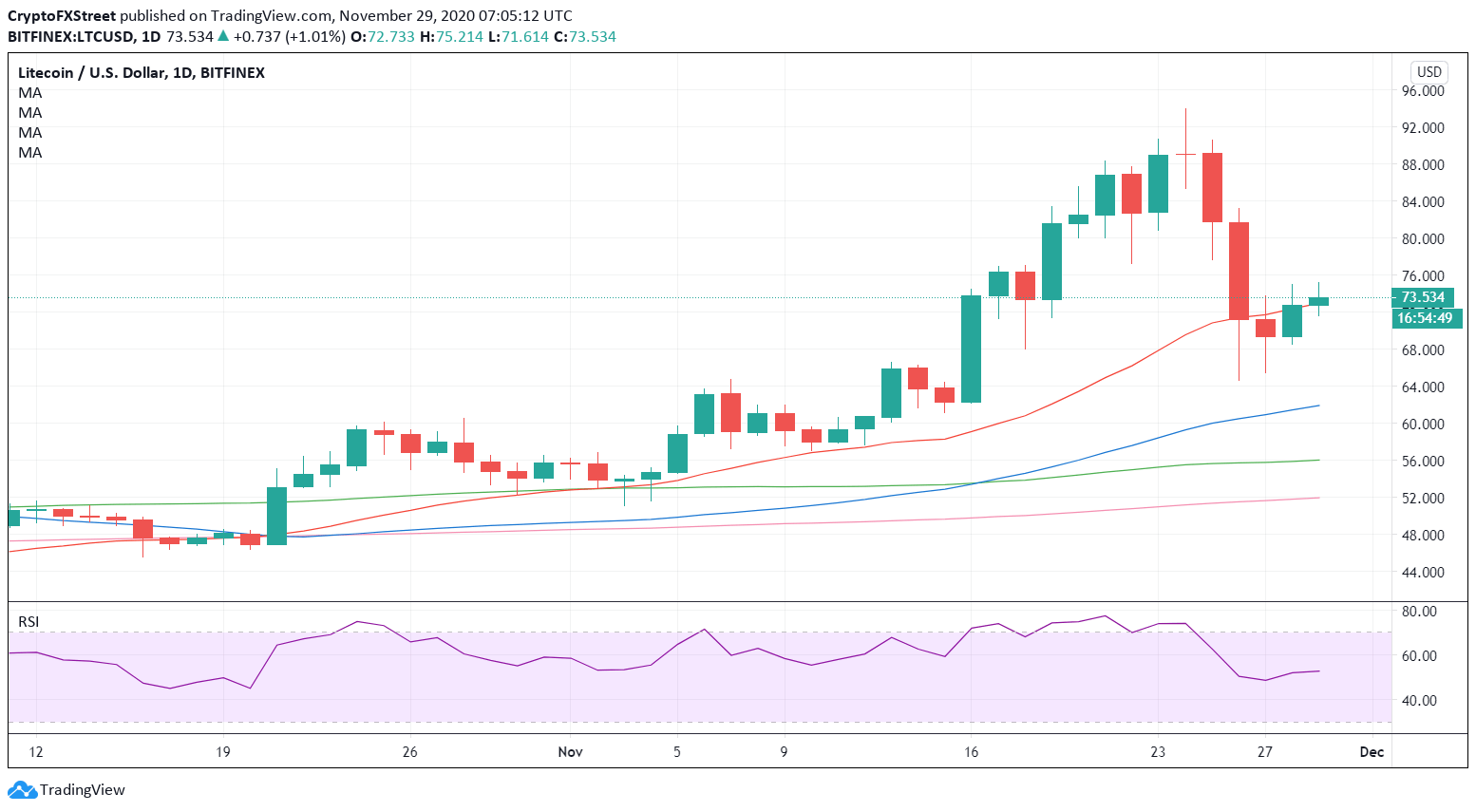

Litecoin: bulls insist but upside seems limited

Litecoin (LTC / USD) appears to have found love over the weekend, extending its recovery mode into the second consecutive day. The bulls are taking their cue from the upbeat sentiment seen in the crypto space, still losing 12% on a weekly basis.

LTC / USD: daily chart

The eight most preferred currencies battle the 21-day moving average (DMA) at $ 73.26, observing a close above it on a daily basis, in order to confirm a bullish reversal. The coin hit an eleven-day low of $ 64.60 earlier this week. The 14-day RSI points higher within the bullish territory, indicating further upside. Meanwhile, the price mainly trades the major averages.

The bulls try to break out of the $ 80 barrier on the road to recovery. On the flip side, the spot could challenge multi-day lows. Further south, the bullish 50-DMA at $ 62.10 could be the level to beat for the bears.

.[ad_2]Source link