[ad_1]

The Ethereum bulls will be smiling today as the price threatens to scale the 50-day exponential moving average (50EMA) for the first time since the November 6 rejection.

The last ETH was traded above the 50EMA in the 1-day May chart.

The bears that still hold the shorts are forced to liquidate the positions, thus increasing the momentum, while the classic bullish inversion model develops.

Over a week, ETH is 43% higher on Coinbase.

Ethereum co-founder Joseph Lubin called the crypto fund in a tweet on December 21st, which was the strongest red candle on the one-day chart of the past week.

Lubin cites the epic FUD in its reasoning, which the bulls might interpret as a sign that the capitulation between a significant layer of market participants has already taken place.

I am calling the criptobottom of 2018. This fund is marked by an epic amount of fear, uncertainty and doubt on the part of our friends in the seals of the 4th and the crypto-fifth.

– Joseph Lubin (@ethereumJoseph) 21 December 2018

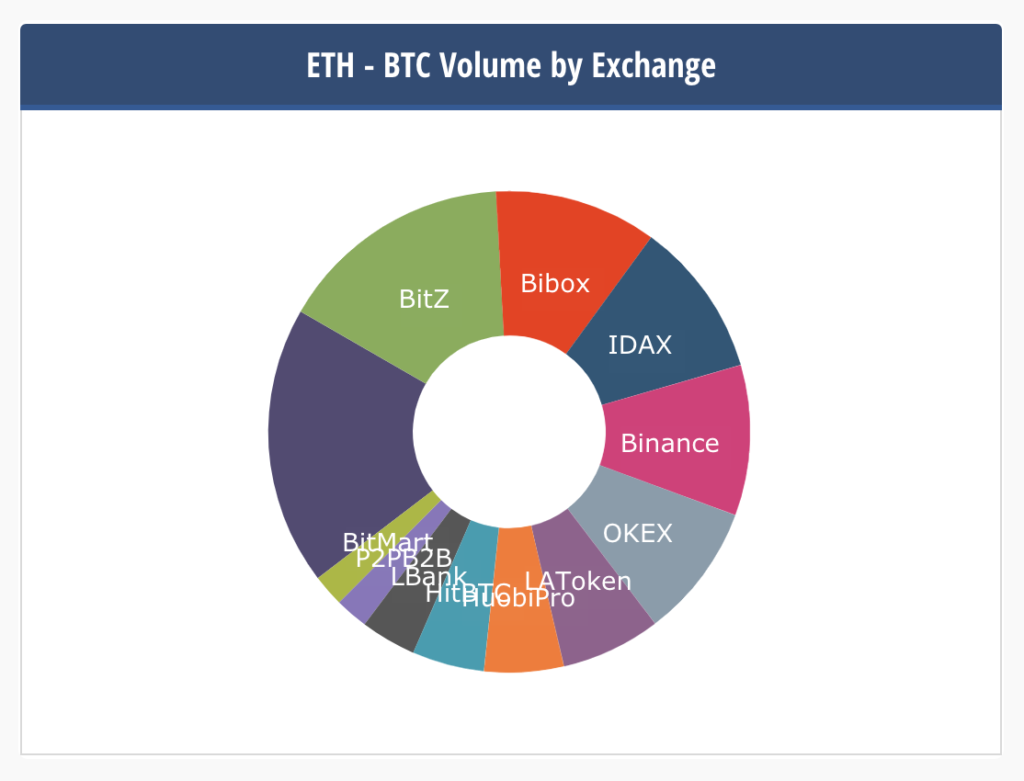

ETH has increased by 15% in the last 24 hours traded at $ 127 on Kraken (see table below) at the time of writing. Against BTC, ETH is 10.5% higher on BitZ than BTC0.032. BitZ of China is currently the busiest trading venue for ETH globally (see volume table below).

Strong continuous bullish inversion

The bullish reversal is quite surprising, with six days out of eight, with five strong green candles that underline the strength of the advance.

The red wick of September 12 and the downdraft of November 14 in the wake of the BCH fork, provide the first objective level for ETH, with an expected resistance.

If the bulls carry this, then $ 204 calls, given to us as the price level immediately before the November 14 sell-off, seen at the top of the red candle.

The bulls will be encouraged by the fact that the downtrend in place since November 14 has been decidedly broken.

1 day chart of ETHUSD Kraken, courtesy of TradingView

Do not fear CSR

ETH was oversold on the relative strength index (RSI) on August 14th and has since rallied strongly.

Vice versa, the RSI that currently shows a reading of 61 is approaching the territory of overbought, but in this structure it could be a good sign, given the strong bullish inversion that is under way.

Resistance to $ 135

Resistance looks strong at $ 135, found on the opposite side of the triangle at the trough at $ 80 on December 14/15.

However, given the current momentum and the closeness of that level of resistance, the bulls can reasonably be sure to overcome the obstacle, to reach targets of $ 166 and then $ 204, assuming that the broader market does not affect.

The session maximum has already touched $ 133 on Kraken.

Asian buyers

The ETH / BTC volume is strong in Asia, with BitZ (Hong Kong), BiBox (China) and IDAX (Mongolia) accounting for over a quarter of the ETHBTC market, according to cryptocompare. Binance is the next largest with 10% of the volume.

[ad_2]

Source link