[ad_1]

[ad_1]

Software developers in India are betting big on learning all the crazy guys about the rapidly expanding blockchain technology. The country hosts the second largest number of blockchain developers in the world with nearly 19,627 developers, according to a market analysis conducted by Dappros, a London-based blockchain consulting firm.

In fact, India is second only to the United States, which has 44,979 blockchain developers since October 24, 2018.

The data of India may be higher as the data collected by Dappros are mainly based on information from open sources such as LinkedIn. It does not take into account developers whose social network profiles are not accessible.

The same is true for developers in the United States.

Read – India is one of the most important in the world leader blockchain by 2023: Poll

A large number of blockchain developers in the country would mean that India could gain an advantage over other countries when it comes to developing Blockchain-based applications or improving applications through technology.

But why choose blockchain technology? Something whose popularity can be attributed to the increase in cryptocurrencies – which in itself remains ruined by controversy.

The same technology, in addition to being used by cryptocurrency companies, is used in many fields such as the credible management of databases, government programs and in different phases of supply chain management.

Before examining the uses of the blockchain, let's try to understand how this technology works.

How does blockchain technology work?

In a network based on blockchain technology, if someone requests a transaction or attempts to access certain information, this request is transmitted over a peer-to-peer (P2P) network of computers known as nodes.

The network of these nodes validates the transaction, which may involve cryptocurrency, contracts, registrations or other information and the status of the user using a known algorithm.

Once verified, the transaction is combined with other transactions to create a block of data for the ledger. The new block is then added to the existing blockchain permanently and unalterably.

The immutable property of the blockchain and its public availability among its users, both in a public and private ledger, provides transparency and shows transaction data in real time.

In the real world, for example, one can imagine buying a car. If the whole process, from production to sale, to resale and even to re-use or to the termination of the car, will be recorded on an immutable public-sector ledger, this will largely eliminate the possibility of tampering, fraud and prevent them from being used in illegal activities.

Read – Blockchain: Utopia or reality?

Alternatively, in simple terms, blockchains are similar to a spreadsheet that is duplicated thousands of times across a computer network. The network is designed to update this spreadsheet regularly, making data easily accessible to everyone on the Internet. Because the blockchain database is not stored in a single location, it makes it difficult for a hacker to corrupt the information.

Technology has gained importance in recent years as it promises greater security, transparency and incorruptible refuge for storing information.

Where can we use blockchain technology?

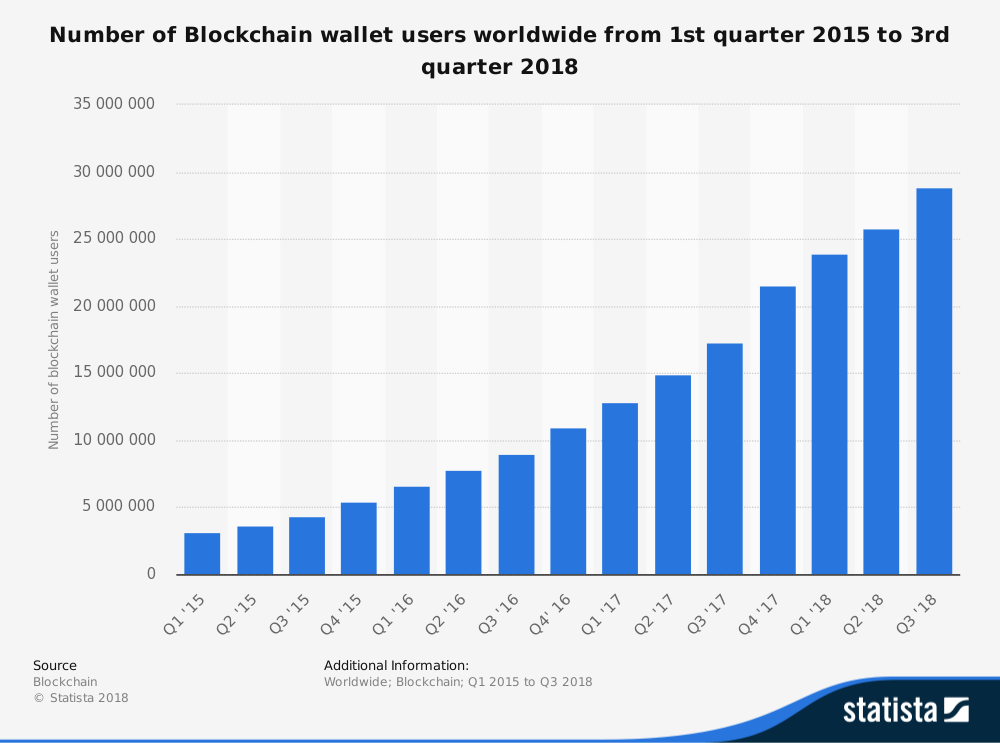

Currently, finance offers the strongest use cases for technology. The number of blockchain wallet users worldwide has risen by 809% in Q3FY18 since Q1FY15, according to blockchain.info.

The number of blockchain portfolios has grown from the creation of Bitcoin, reaching over 28 million users as of September 31, 2018.

The World Bank estimates that over $ 430 billion of money transfers were sent in 2015 via blockchain wallet and at the moment there is a strong demand for blockchain developers.

While finance seems to be the strongest case of use for blockchain, it offers multiple benefits to companies that use this solution in areas that require a high degree of trust for business transactions.

Read – Blockchain: the right medicine for the asset management industry

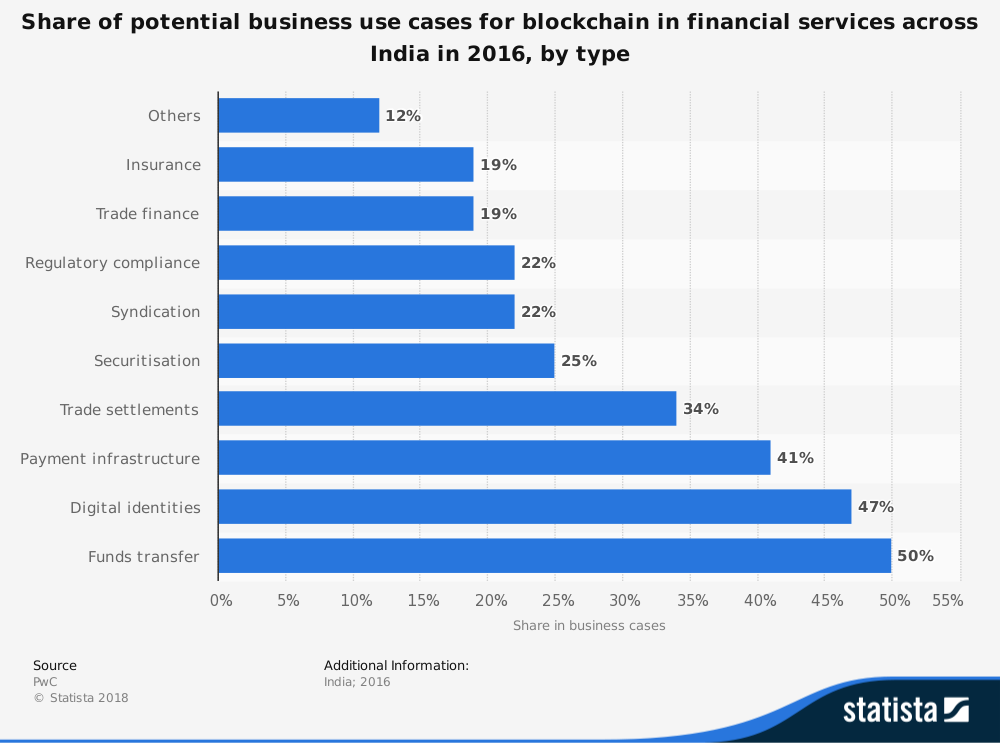

Other possible cases in which blockchain can be used include digital identities, payment infrastructures, commercial agreements, securitization, commercial finance and insurance.

For example, smart blockchain contracts can be used in real estate to support complex legal agreements. In an intelligent contract, the parties can agree on a sequence of conditional execution paths based on the events. The smart contracts, invented in the years & # 39; 90 by Nick Szabo, in blockchain are small programs that are executed if certain criteria are met. They were integrated into the blockchain technology and Ethereum cryptocurrencies. Therefore, smart contracts can be applied to any system that involves a contract between a seller and a buyer.

Many companies, including Microsoft and IBM, are focusing on this technology because the model provides users with greater accessibility, privacy and control over their personal data. Blockchain technology offers companies a better solution to protect their users' data.

The technology also offers the possibility of reducing costs and an opportunity for companies to build and maintain an infrastructure that offers capacity at lower costs than traditional centralized models.

Read – How and why blockchain technology is a tough one to crack for hackers

Blockchain can process transactions faster because it does not use a centralized infrastructure. And even if there is no totally secure system against cyberattacks, the distributed nature of the blockchain provides an unprecedented level of trust. These characteristics of the blockchain have attracted the attention of various start-ups, businesses and governments to implement this technology.

"In the last year we have witnessed several cases of financing Bitcoin bags based on blockchain based in India, however, in the field of traditional financial services, potential cases of use of the underlying architecture of blockchain, or Distributed Ledger Technology (& # 39; DLT & # 39;) look promising, Blockchain-based systems offer enormously improved trust and transparency and, thanks to its native regulatory advantages, the adoption of DLT in the Indian banking sector is also finding support from regulators, "according to a Trends report by FinTech from PwC.

Use of blockchain to increase further

Due to a number of these benefits, worldwide spending on blockchain solutions has increased. Global spending on blockchain solutions is expected to reach $ 2.1 billion in 2018, more than double the $ 945 million spent in 2017, according to the Worldwide Worldwide Blockchain Spending Guide of International Data Corporation (IDC).

IDC expects blockchain spending to grow at a sustained pace in the 2016-2021 forecast period with a five-year compound annual growth rate (CAGR) of 81.2% and total spending of $ 9.7 billion in 2021.

"Many technology providers and service providers collaborate and collaborate with consortia such as Enterprise Ethereum Alliance and Hyperledger Projects to develop innovative solutions that improve processes such as post-trade processing, traceability and traceability of shipments in the supply chain and transaction records for auditing and compliance In addition, multiple regulators and central banks have commented positively on blockchain and DLT and this will help accelerate demand in regulated sectors such as financial services and health care, "said Bill Fearnley, junior research director Worldwide Blockchain Strategies.

These developments indicate that blockchain technology will be used in the coming years. This also means that Indian blockchain developers could bid on the right technology.

"It is clear that with the many advantages associated with Distributed Ledger Technology (DLT) and the support of regulatory authorities, the blockchain is poised for rapid growth in the Indian banking sector for years to come," said the FinTech report.

Incoming challenges

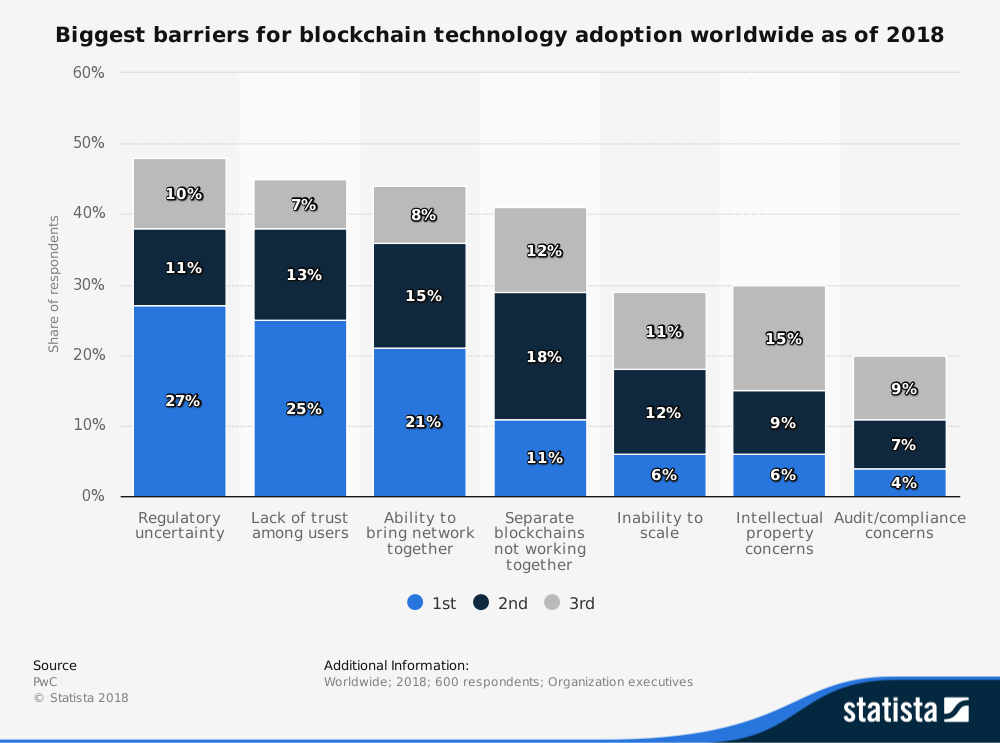

While the available data indicate a massive expansion in the use of blockchain technology, it still has many barriers to its path. According to a PwC report, many organizations that have at least some involvement with blockchain technology feel that regulatory uncertainty (48 percent) is the main barrier to its adoption worldwide.

The lack of trust among users (45 percent) and the ability to reunite the network (44 percent) are the next two barriers that these companies believe could influence them in the next three to five years.

Because the technology is still new, users are skeptical about reliability, speed, security and scalability. There are also concerns about the lack of standardization and the potential lack of interoperability with other blockchains.

The lack of understanding among users also contributes to the confidence gap. Even now, many executives are not clear on what is really blockchain and how it is changing all aspects of businesses. People might need more time to adopt this new technology, build trust and use this platform for different applications.

"It is perhaps ironic that a technology designed to ensure that consensus strikes an obstacle to the initial need to design rules and standards," says the report.

[ad_2]Source link