[ad_1]

The Silicon Valley Community Foundation, one of the first American charities to accept cryptocurrency donations, may have accumulated billions of dollars of them at the end of last year, when their values were close to their peak.

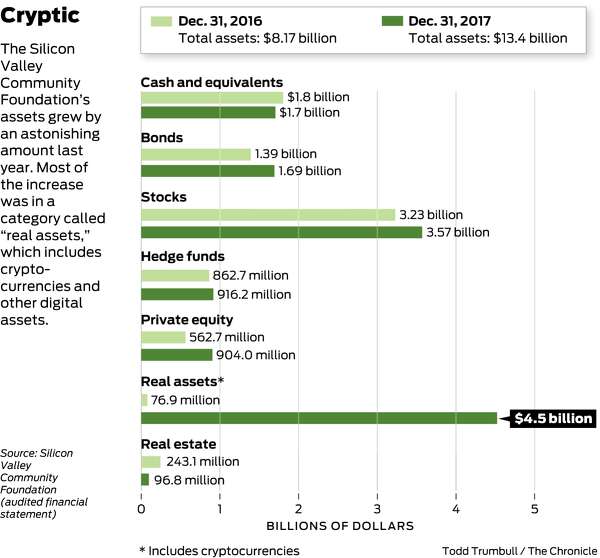

The foundation held $ 4.5 billion – almost a third of its investment portfolio – in a category of assets that appear to be "digital assets", according to accounting experts who reviewed the recently certified certified financial statement for the 2017.

This would help explain the mysterious and meteoric explosion of the foundation's activities last year. In February, before being shaken by a scandal of misconduct at work that led to the departure of its CEO and best fundraising executive, the foundation revealed in a press release that its activities last year they were inflated to around $ 13.5 billion. This rose 5.3 billion dollars from the end of 2016, with a gain of around 65 percent.

He provided no explanation for the increase, which far surpassed any return that could have come from a diversified portfolio of stocks and bonds. The foundation has absorbed around $ 1.4 billion in contributions and distributed about $ 1.3 billion in grants last year, so growth should have come almost entirely from investment.

In a column at that time, I hypothesized that the cryptocurrencies – which had risen in December before returning to Earth – may have played a role in that huge growth. And now it seems that it was right, based on the financial statement of the foundation dated June 14th.

Under "risk concentrations", the statement stated that one-third of the foundation's $ 13.4 billion investment portfolio was in "a class of real assets" "On December 31. The report showed $ 4, 46 billion in a category called Tier 2 real assets. Based on its footnotes, this could just be what the report calls "digital assets", assessed using the prices obtained from authorized online exchanges, said Brian Mittendorf , chairman of the Ohio State University accounting department.

The report does not define digital assets, but "I interpret it as cryptocurrency," said Mittendorf.In the end of 2016, the foundation had only $ 77 million in real assets, none in the Level 2. Real estate is a separate category in alternative assets.

Daniel Figueredo, the partner who directs the nonprofit practice for the BPM auditing firm, said that the term digital activity "generally refers to cryptocurrencies".

Moss Adams, the auditing firm that checked the report, declined to comment.

"I am surprised by such a large organization that it could maintain such a volatile position the end of the year," said Mittendorf.

Most charities that have started accepting cryptocurrencies sell them as soon as possible.

The foundation declined to comment, except by e-mail. He said that "it does not reveal the specific mix of activities" in any asset class.

He said that the foundation "has been equipped with cryptocurrency assets dating back several years, and are held in some recommended individual donor funds, we have never purchased any and we do not have any of these assets in our investment pools. , consistent with our general investment philosophy of maintaining a diversified mix of assets in our long-term investment pools.Within the way we have prudently managed large assets endowed in the past, we have a liquidation plan in place to sell gradually cryptographic activities over time and reinvesting the proceeds in a diversified investment portfolio. "

Wade Loo, chairman of the foundation review committee, stated in an e-mail that the board" considers this practice prudent for the creation of charitable funds from the wide variety of "donor" resources.

The foundation is not unrelated to concentrated positions. At the end of 2015, it held 29% of assets in a publicly traded stock, presumably Facebook. Its CEO, Mark Zuckerberg, has placed 18 million shares of Facebook in its fund recommended by the Foundation in 2012 and another 18 million in 2013. In 2014, the co-founders of WhatsApp Jan Koum and Brian Acton donated large amounts of Facebook shares after it

The foundation's single shareholding had been reduced to 17% of assets at the end of 2016 and only 7% at the end of last year.

The foundation has grown to become the nation's largest community foundation and ninth public charitable institution in general, partly allowing Silicon Valley philanthropists to give alternative assets, such as private companies and cryptocurrencies, to usually to consultancy funds made by donors who founded the foundation. These funds make up the vast majority of the assets of the foundation.

The funds recommended by donors are individual accounts held in a public charity, usually a community or non-profit foundation established by an intermediary company. Fidelity, Charles Schwab, Goldman Sachs and Vanguard sponsor donor funds and are now among the 10 largest public charities in the nation.

Donors get a tax deduction when they place an irrevocable gift of money or valued goods into the account. Donors can recommend how the money should be invested and which charitable organizations should get grants from their fund. These recommendations are usually followed if they meet the guidelines of the sponsored organization.

These funds are controversial because donors receive an immediate tax deduction for their donation, but they are not required to distribute the money to charity based on any program. In the meantime, the assets are placed in the funds, obtaining advice and other fees for the finance companies.

Chris Larsen, who founded the San Francisco payment company Ripple, donated cash and XRP – a virtual currency on which Ripple holds a major stake – to the foundation since 2013. "They were one of the first organizations to accept donations in digital goods, "he said in an email. "These donations have worked well for both the Foundation and the beneficiaries," he said, adding that he will continue to make donations through them.

Like most cryptocurrencies, XRP had a wild ride last year, rising from six-tenths of a cent on January 1 to $ 2.32 on December 31st. Now it is trading around 44 cents.

In a 2014 article in the chronicle of philanthropy about Larsen's cryptocurrency donation, Mari Ellen Reynolds Loijens, former head of the official development of the foundation, said: "You must be fearless to work with someone like that and say, & # 39; OK, we've never done it before. I do not even know if it's legal. "

Loijens resigned from the foundation in April following allegations that, in the pursuit of growth to all the costs, she made fun of the staff. The managing director Emmett Carson was put on leave shortly thereafter and resigned in June after an investigation that harshly criticized his leadership.

Other charities have started to take cryptocurrencies, but they typically sell the asset immediately and reinvest the proceeds into something less risky. Schwab Charitable said in an email that he had received about $ 2 million worth of bitcoins since he started accepting it last year and "typically aims to complete the conversion on the day the contribution was received."

accepting bitcoin this year. "Our policy is to liquidate them as quickly as possible," whether they enter the foundation itself or in a fund recommended by donors, said its Chief Financial Officer Sonja Velez.

Ray Madoff, a Boston Law Law School professor, said it was "Inappropriate" for the foundation to allow funds recommended by donors to hold cryptocurrencies when they would not buy them on their own. "The reason that donors get tax benefits for a donor-funded donation is because the sponsored organization has full ownership and legal control over these donated assets, so their fiduciary duties should extend to those funds." [19659004] But Professor of the University of Oregon University, Susan Gary, said: "It does not seem to me to be imprudent, it could be that they need more time to liquidate" the good.

Kathleen Pender is a chronicler of the San Francisco Chronicle. Email: [email protected] Twitter: @kathpender

[ad_2]

Source link