[ad_1]

[ad_1]

When it comes to a payment system for cross-border payments, Ripple goes to the top of the list. With the launch of various products and constant collaboration, Ripple attracted the main market players in 2018.

According to the latest announcement, the transfer of Coinone, which is a subsidiary of the Korean cryptocurrency exchange called Coinone, is introducing the new mobile payment app based on Ripple's blockchain technology. As a result, the country's first blockchain mobile app specifically uses RippleNet, a Ripple product. The officials revealed that the goal behind Ripple and Coinone's collaboration is to offer an immediate payment service to two million South Korean immigrants.

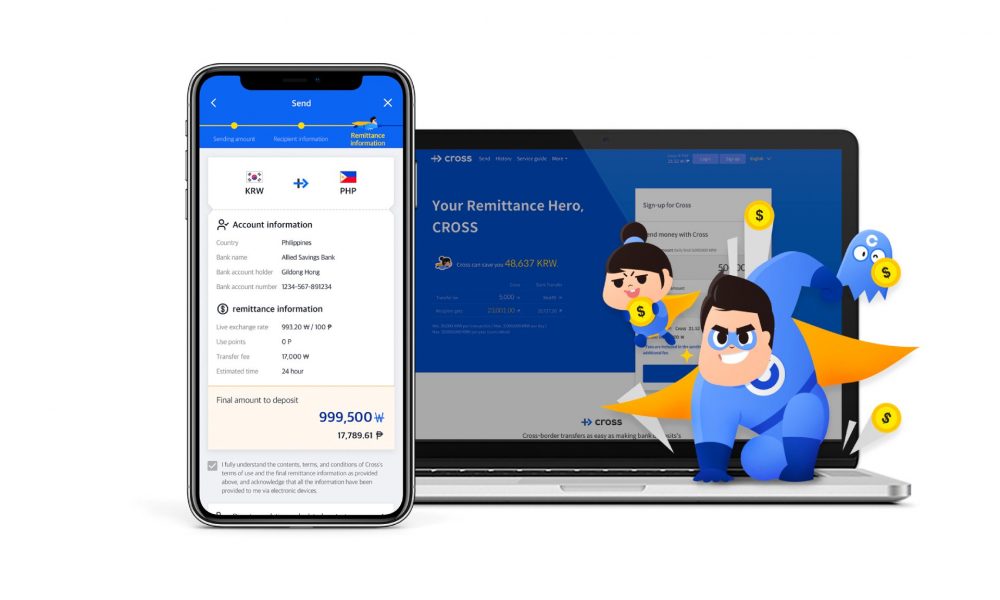

Cross payment service Made by RippleNet

The new Coinone Transfer app It is called "Cross" designed to offer international payment solutions throughout Thailand and the Philippines in order to reduce the costs involved in cross-border transactions. Furthermore, collaboration is planned to expand its operation in various regions in the near future. In addition, it will tighten a strong link with Siam Commercial Bank (SCB) in Thailand and Cebuana Lhuillier in the Philippines. The announcement reads as;

"With plans to aggressively expand across the region in the coming months, Coinone Transfer has rapidly expanded the service through new financial institutions using RippleNet – connections formed with Siam Commercial Bank (SCB) in Thailand and Cebuana Lhuillier in the Philippines.

In addition, thanks to the partnership with Siam Commercial Bank, customers of banks can access payments promptly. However, it encourages the reliability of payment transparency using Ripple's advanced blockchain technology.

The Coinone Transfer partnership with SCB will soon offer Cross customers a direct link to PromptPay, which allows any recipient with a bank account in Thailand to receive a payment directly and instantly. "

Unlike traditional payment methods and other remittance options within the region, Cross aims to provide secure solutions for users with or without a bank account.