[ad_1]

[ad_1]

Since most cryptographic exchanges are having trouble keeping business, BitMEX is publishing record profits that have yet to be declared but will be highlighted below. Looking at the recent analysis of Coinbase, we find that the popular American exchange is having difficulty maintaining a customer base during a bear market. The exchange recorded a collapse of the volume of 83% compared to the highs of December and January.

According to recent reports, the volume of Coinbase in July was about $ 3.9 billion in trade compared to $ 21 billion recorded in January during the cryptocurrency run.

The only exchange that has partially survived the bear market from the above report is Binance. The July trade numbers were $ 11.3 billion in July and the OKEx figures reached $ 2.9 billion. We can blame the general decline in trading volume on regulatory uncertainty, the constant FUD, the blues of the ETF and a natural decline in the market after an impressive rally.

BitMEX

BitMEX was launched in 2014 but did not become popular in the crypt-up until June of this year, when traders realized that they could do a murder with Bitcoin (BTC). The exchange offers perpetual contracts and futures contracts. Ongoing contracts do not have an expiration date and have a financing rate that occurs every 8 hours. The futures contracts on the platform are regulated at the contract settlement price.

This, in turn, means that it is possible to shorten the digital resources of Bitcoin (BTC), Ethereum (ETH), XRP, Bitcoin Cash (BCH), Cardano (ADA), EOS, Litecoin (LTC) and Tron ( TRX) no to the platform. This opens the door to potential market manipulation by someone or an organization that knows what they are doing.

Limited or no access in some countries

The terms and conditions for the use of BitMEX indicate that trading is prohibited in some countries. One country stands out: the United States. Proof of this can be seen in the terms and conditions of use in which it states that:

"… that the access to the trading or maintenance of BitMEX positions is forbidden for any person residing or residing in the United States of America, Québec (Canada), Cuba, Crimea and Sevastopol, Iran, Syria, North Korea, Sudan, or any other jurisdiction in which the services offered by BitMEX are limited . "

Could they possibly avoid SEC control and the long arm of American law? Perhaps the financial instruments on BitMEX would not hold water with the SEC.

Profits, expensive offices and founders of billionaires

The exchange has recently leased the most expensive offices in Hong Kong in a move that raises more questions as to how much profits the exchange is making by offering the unique trading tools on their platform. The exchange will occupy the 45th floor of the Cheung Kong Center. Their average lease costs will amount to around $ 500k per month.

To add to the question about how much the exchange is making profits, Ben Delo, a co-founder of BitMEX, was recently named Britain's youngest bitcoin The billionaire ages at only 34 years

Demand from a what is now a billion dollars to earn BitMEX in profits?

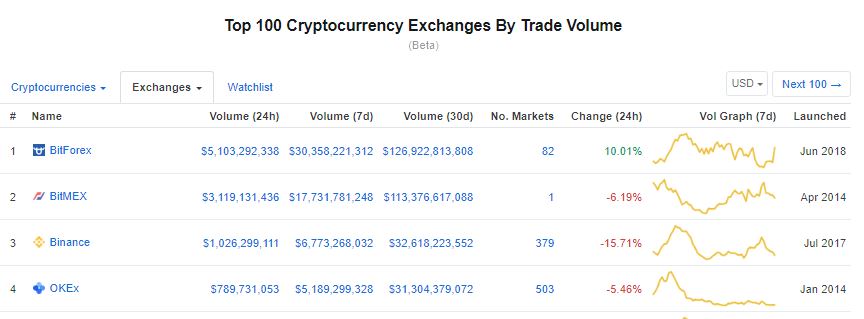

In the case of Binance, the exchange said it is looking at $ 1 billion in profits for the year 2018. Binance does not use the extra leverage on BitMEX, but has attracted a majority share of global operators . By checking coinmarketcap.com, we find out that the daily trading volume of BitMEX is three times higher than that of Binance.

BitMEX vs. Trading Volume Binance. Source, coinmarketcap.com

Connecting the Dots

Taking stock of the daily trading volume of both exchanges, BitMEX could allocate $ 3 billion in profits at the end of this year or even more.

Therefore, the question of whether they are getting the funds to rent the best office space in Hong Kong can now be solved. We can also understand how Ben Delo is a bitcoin billionaire.

However, there is still an unanswered question about why trade in the United States is prohibited and about the fact that the exchange has protective measures for its users against market manipulation [19659022] For the latest news on the cryptocurrency, subscribe to our Telegram!

Disclaimer: This article should not be taken as and is not intended to provide investment advice. Global Coin Report and / or its affiliates, employees, writers and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own in-depth research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Emily Morter through Unsplash

[ad_2]Source link