[ad_1]

[ad_1]

Welcome to the US elections, day one.

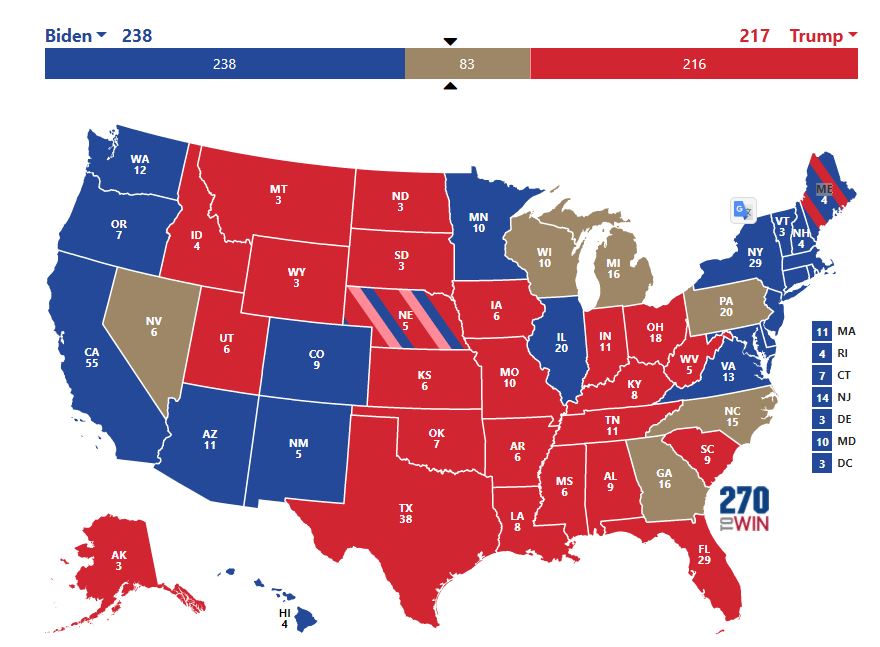

The situation is rather fluid, but as of this writing, Democrat Joe Biden is leading both in the popular vote and in the confirmed electoral votes.

However, a total of six states with a combined total of 83 electoral votes have yet to make a final decision. This could really go either way.

The map above was created by me using the tool at 270towin.com. I know different networks like to report numbers differently so I kept the score by myself and posted frequently Twitter updates.

As for the backing of the six undecided states, we’ve made some inferences on social media, but it’s important to note that each of these states may still drop either way.

The only thing that is clear from the current state of affairs is that there is no red wave or blue wave. This is an incredibly tight election.

As for the time frame, we are getting smarter by the hour and I have a good feeling we can end up in the US tomorrow morning, if not by the afternoon.

At that point, hopefully they have a win and a concession. Otherwise, well … all bets are void.

Market reactions

Despite all the hype surrounding this election, the markets have remained remarkably calm.

Apparently, the real situation on the ground may not change much, at least as far as the partisan division is concerned.

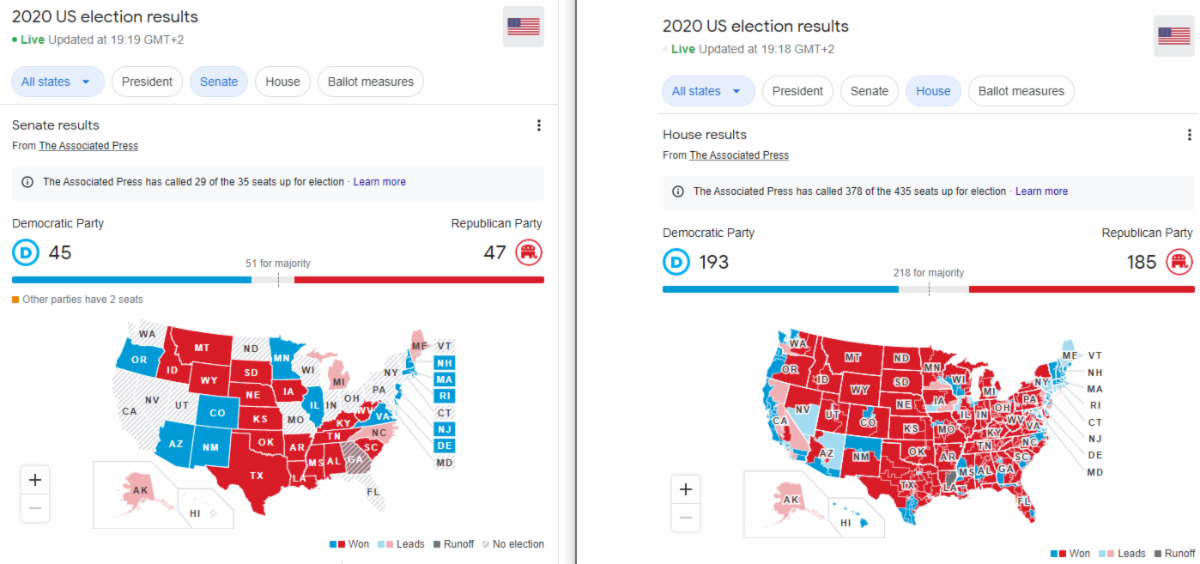

No matter who takes the White House, they probably won’t be able to hold congress too.

As it seems right now, the Democrats are ready to take back the House, and the Republicans are likely to take back the Senate. So the preliminary results show that no substantial change is expected.

Understandably, the markets have not been entirely impressed so far. The VIX is down 17% today which shows how much people are watching and waiting instead of trading.

At first there was a rather dramatic move in US 30-year treasury bills. It seems that some investors were expecting a big blue wave and had to quickly relax once it became clear that it wasn’t going to happen.

Bitcoin’s reaction

Well, why would bitcoin react to the US presidential election?

Bitcoin was created, and is currently used by many, as a hedge against central banks, not the White House.

Since members of Congress are the ones responsible for public spending, the puppet who serves as the figurehead of the nation tends to play a secondary role in both fiscal and monetary policy.

Therefore, it is impossible to definitively discern whether the current share we are seeing in bitcoin is the result of the election, the broad rally or any other reason.

The movement may not be large in percentage terms, but as far as the charts are concerned, we have just eliminated a major technical hurdle. While the breakout may still reverse and turn into a fake one, today’s close should prove more decisive than the elections so far.

[ad_2]Source link