[ad_1]

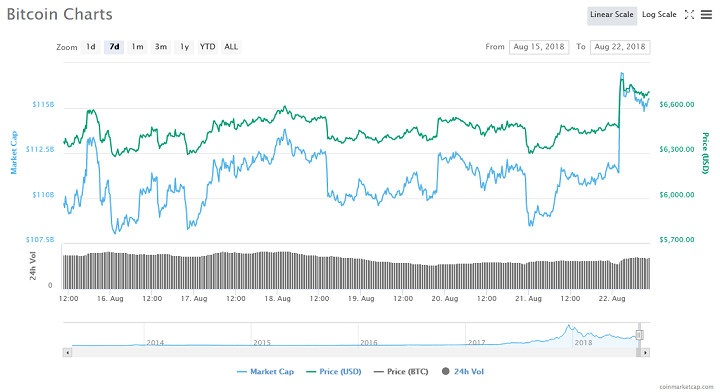

Bitcoin gained momentum in the early hours of Wednesday (UTC), following the scheduled closure for maintenance of BitMex, a BTC trading platform. The first-class cryptocurrency nearly broke $ 7,000 before a pullback that brought the price to $ 6,600.

Bitcoin climbs when BitMex turns off for maintenance

Shortly after the BTC derivatives trading service, BitMex went offline for scheduled maintenance, the price of Bitcoin skyrocketed. Over a period of 20 minutes, BTC rose by over $ 400, to reach almost the price of $ 7,000. After the increase, BTC has reached a new high since 24 July.

However, the price gain was short-lived as the withdrawal brought Bitcoin to $ 6,600 at the time of printing. Despite the withdrawal, Bitcoin is still growing by over 3% in the last 24 hours. Total market capitalization now stands at $ 217 million, with even the altcoins registering significant price increases over the previous 24 hours.

All the top ten coins are currently in the green. Stellar and Litecoin lead the way in 24 hour earnings with 4.51% and 3.31% respectively.

Price manipulation or short compression

The fact that the price increase occurred during a shutdown of one of the most important BTC trading platform raises questions about price manipulation . In a tweet published Tuesday afternoon, Alistair Milne expected a short compression to coincide with the arrest of BitMex.

According to Business Insider some anonymous sources claim that scheduled maintenance a frenetic commercial activity.

Commenting on the development, Bitwise's CEO, Hunter Horsely said:

It's a silly short-term trade. Buy when maintenance starts. Sell when it ends.

Reports indicate that the arrest of BitMex has created arbitrage opportunities in the market that have led directly to the sharp price spike. According to CoinRoutes' CEO, Dave Weisberger:

Bitfinex took him up to 6800+, but when GDAX reached, his customers paid more than $ 100 when the other trades fell to 6700. C & C # 39; It was a real arbitrage for a while all this happened.

The relevant question now is whether this price run is also a short squeeze, especially with the upcoming SEC decision on the presentation of Proshares Bitcoin ETF. The SEC still has to approve any application of the BTC ETF regarding liquidity, manipulation and lack of sound custody solutions. Proshares' decision is the first of a series of similar decisions before the SEC in the coming weeks.

Do you think that the price movement means manipulation? What impact would the Proshares ETF have on Thursday at the current mini-rally? Continue the conversation in the comments section below.

Image courtesy of Coinmarketcap.

[ad_2]

Source link