[ad_1]

[ad_1]

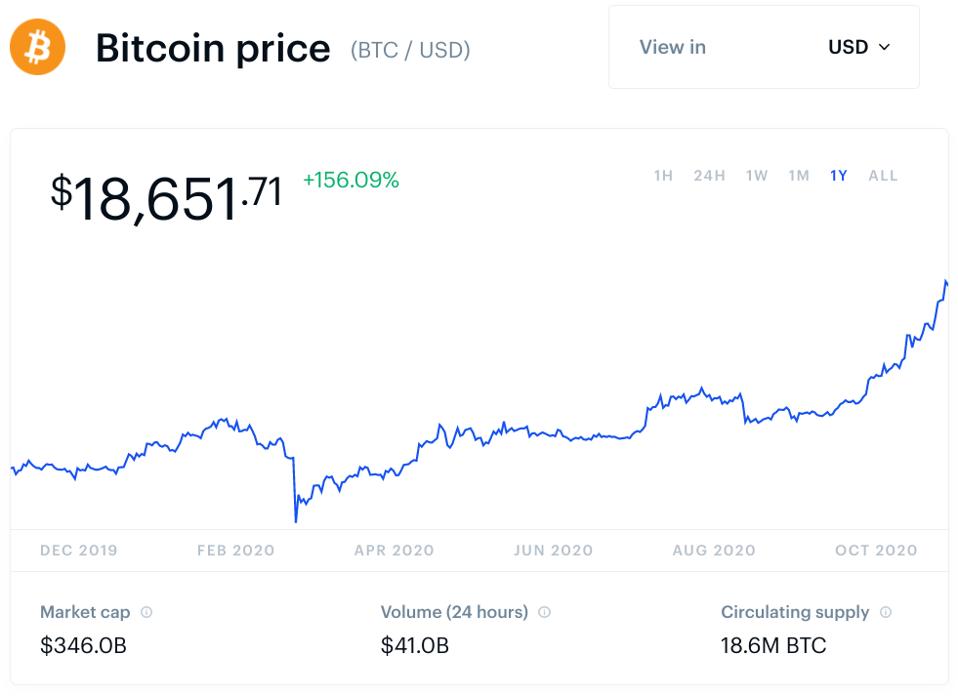

Bitcoin has rocketed the cryptocurrency market in recent weeks with the total value of the world’s combined cryptocurrencies adding $ 150 billion since the beginning of November.

Bitcoin’s price touched $ 18,900 per bitcoin this week, reaching an all-time high of 2017 and helping the other five major cryptocurrencies – ethereum, Ripple’s XRP, litecoin and chainlink – record huge gains. XRP has grown over 70% this week alone, with ethereum, litecoin and chainlink all up between 22% and 36%.

Now, as traders debate exactly how far this bull market must go, the bitcoin and cryptocurrency community is bracing for a pre-Thanksgiving surge and could receive a boost from the US Federal Reserve and the European Central Bank (ECB). .

Bitcoin’s price has more than doubled this year, helping Ethereum’s other major cryptocurrencies, … [+]

Getty Images

Bitcoin’s bull run in 2020 is believed to have been pushed more institutionally than the retail boom of 2017, when the global bitcoin craze pushed the price of bitcoin to an all-time high of around $ 20,000 only to then return to about $ 3,000 in 2018. But that retail demand may be around the corner.

Although the coronavirus pandemic prevents families from reuniting to the same extent as they did before Covid-19, historical data suggests that big holidays in the United States – and Thanksgiving in particular – usually drive the price of bitcoin up. noticeably higher.

“Nothing like a pre-Thanksgiving bitcoin run,” Catherine Coley, chief executive of Binance.US, a San Francisco-based bitcoin and cryptocurrency exchange launched by Binance headquartered in the Caymen Islands last year, said via email.

“This year has been extremely unpredictable, but bitcoin has held its value for most of the year and the recent bullish momentum shows many bitcoiners what we already knew: a global digital asset not tied to local fundamentals has potential. extreme growth and global adoption, especially at a time when nations are printing more currency to revive economic activity. “

Bitcoin has developed its reputation as digital gold this year, finding support from Wall Street and some big investors as central banks rev up their money printers in response to the coronavirus pandemic and the lockdowns put in place to contain it.

This week, investors in the US and Europe will get a clearer picture of just how seriously the US Fed and the ECB are considering providing additional stimulus in response to rising coronavirus cases around the world.

On Wednesday, the Fed will release minutes of this month’s monetary policy meeting in which President Jay Powell said changes to the asset purchase program were discussed to provide additional stimulus. Then, on Thursday, the ECB publishes the minutes of the October meeting where investors will seek more information on the ECB’s options after it said it wants to “recalibrate its instruments”.

Equity markets, as well as bitcoin and cryptocurrency prices, have been underpinned by global stimulus measures this year with investors encouraging the seemingly unlimited funds being distributed.

The price of bitcoin has risen more than 150% in the past 12 months with many bitcoins and cryptocurrencies … [+]

Coinbase

Elsewhere, the bitcoin and cryptocurrency market was set ablaze last month by news payment giant PayPal which allegedly launched bitcoin buying and spending services to its nearly 350 million users, giving many bitcoin developers and advocates validation. long sought.

“For 10 years, the discussions against bitcoin have been the same and yet bitcoin has continued to grow its user base, infrastructure and value, despite opponents,” Danny Scott, chief executive of the cryptocurrency and bitcoin exchange Isle of Man-based CoinCorner, said via email in response to recent news from legendary investor Ray Dalio Twitter thread on his “problems with bitcoin”.

“I feel we’re almost at the point where the proof requirement is on the skeptics as to why bitcoin won’t work rather than throwing empty, uneducated arguments,” Scott said, adding, “Bitcoin has been the best asset this year, not to mention the best performing resource of the last decade: the statistics speak louder than words here “.

.[ad_2]Source link