[ad_1]

[ad_1]

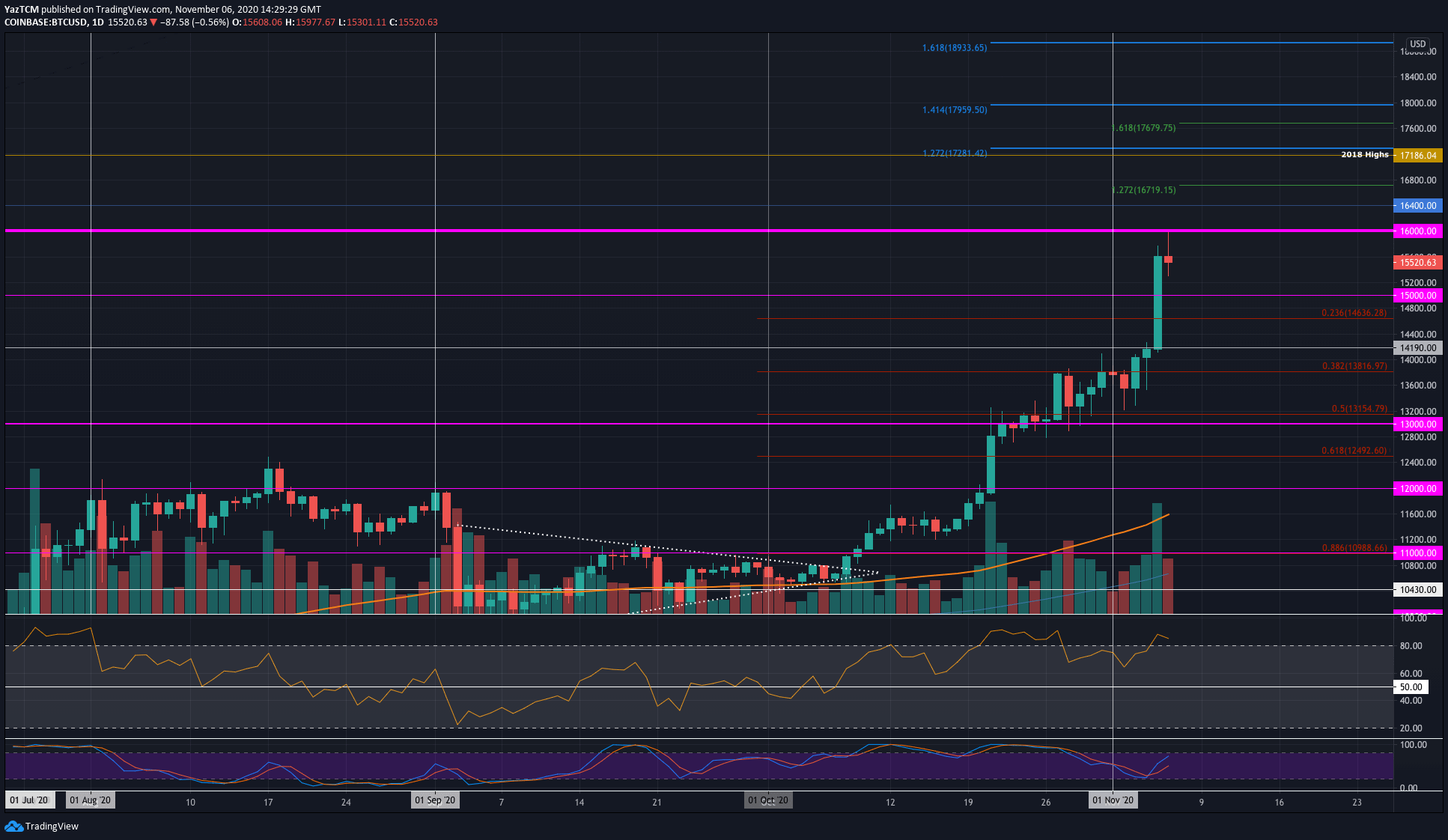

Bitcoin

Bitcoin saw an extraordinary 15.3% price surge this week which allowed the cryptocurrency to climb the $ 16,000 level today. It has since fallen slightly to $ 15,500 but is still very bullish.

BTC started the week at $ 13,200. From there it went higher into the $ 13,800 resistance but stopped over the weekend. At the start of the US election, BTC started to surge. Initially, it found resistance at $ 14,190, but yesterday it was penetrated as Bitcoin rose as high as $ 15,500.

Today, BTC has risen further to scratch $ 16,000, but has since fallen to $ 15,500.

Looking ahead, if sellers push BTC lower, the first support level is at $ 15,200. This is followed by support at $ 15,000, $ 14,635 (.236 Fib), $ 14,400 and $ 14,190. Below $ 14,000, added support is found at $ 14,815 (.382 Fib), $ 13,600 and $ 12,155 (.5 Fib).

On the other hand, if the bulls push up again, the first resistance level is at $ 16,000. Above this, resistance is found at $ 16,400, $ 16,720 (1,272 Fib Extension) and $ 17,000. Above $ 17,000, resistance is expected at $ 17,186 (2018 highs).

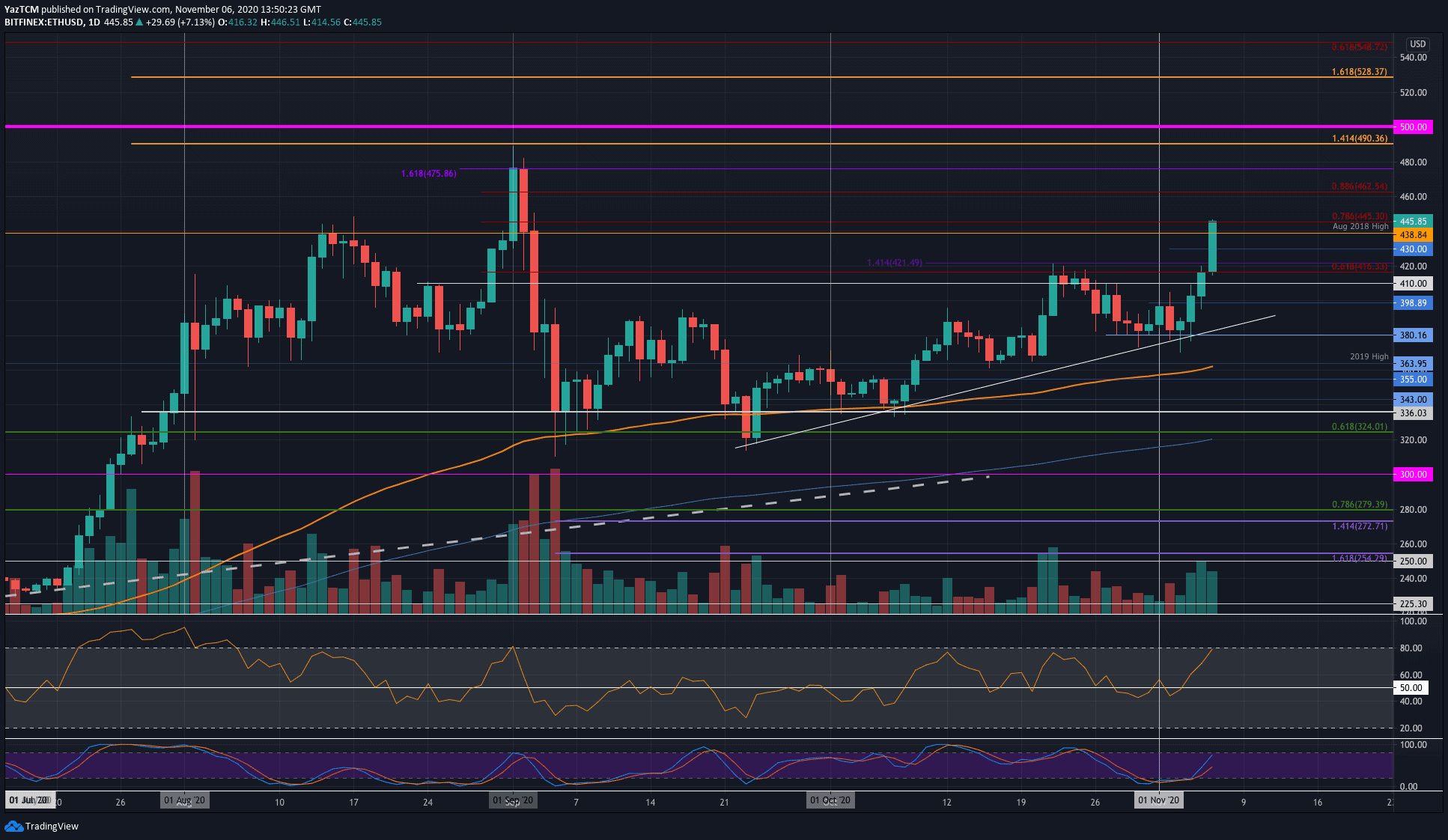

Ethereum

Ethereum saw a powerful 15.3% price increase when it hit the $ 441 level today. Last Friday it was trading at the $ 380 support while it rose as high as $ 400 over the weekend. Earlier this week, ETH fell back to $ 380 but managed to bounce off a rising trend line.

After the rebound, Ethereum rose higher to reach the resistance of $ 416 yesterday (bearish retracement .618 Fib). This resistance was penetrated today as ETH rallied higher in the $ 445 resistance provided by a bearish .786 Fib retracement.

Looking ahead, if buyers continue to break out of $ 445, the first high resistance level is at $ 462 (bearish retracement .886 Fib). Thereafter, resistance is found at $ 475 (September high closing price), $ 490 and $ 500.

On the other hand, the first support level is found at $ 438 (August 2018 highs). Below that, support is found at $ 420, $ 416, $ 410, and $ 400.

Against Bitcoin, Ethereum was trading at 0.0294 BTC (February 2020 highs) earlier in the week. During the week, Ethereum fell below 0.0207 BTC and yesterday reached support at 0.0267 BTC.

Today it managed to bounce off this support, pushing up again to reach the resistance of 0.0284 BTC.

If the bulls manage to climb back above the February 2020 highs of 0.0284 BTC, the first major resistance level is at 0.029 BTC. Above this, resistance is found at 0.0296 BTC (200-day EMA), 0.03 BTC and 0.0311 BTC (100-day EMA).

On the other hand, the first support level is found at 0.0278 BTC. This is followed by support at 0.027 BTC, 0.0267 BTC and 0.0262 BTC.

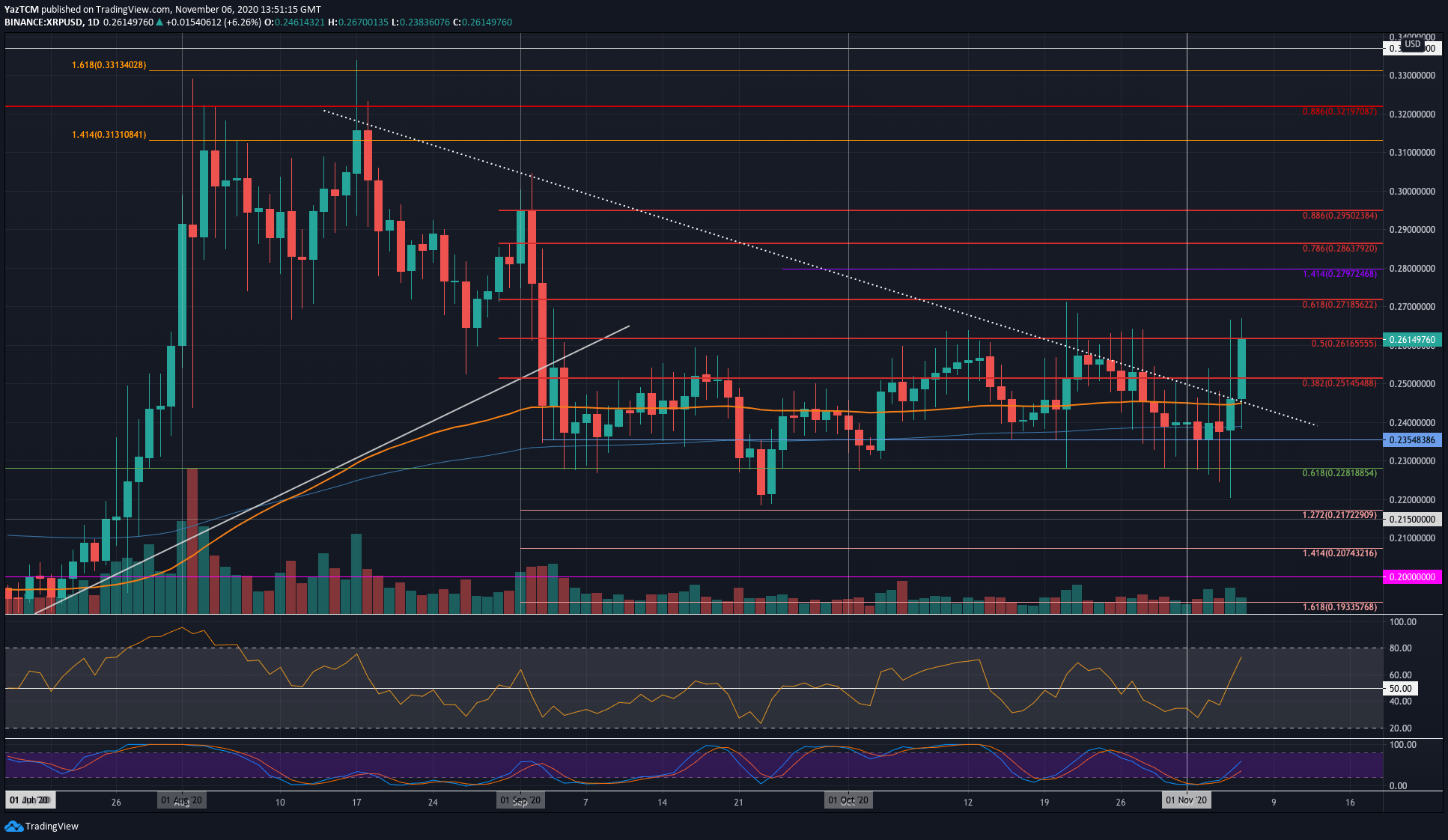

Ripple

Ripple has seen a 6.4% price hike in the past week, reaching the $ 0.261 resistance today. It traded at the 200-day EMA at around $ 0.24 on Friday. Over the weekend, XRP dipped to the downside but managed to defend the support at $ 0.235.

Yesterday, XRP climbed higher to reach resistance on a long-term downtrend line. This trend line was penetrated today as XRP rallied higher to break the resistance at $ 0.251 and reach the current resistance at $ 0.261 (bearish retracement 0.5 FIb).

Moving forward, if buyers manage to break out of the $ 0.261 resistance, the major resistance is found at $ 0.271 (.618 fib bearish retracement), $ 0.28 and $ 0.286 (.786 Fib bearish retracement).

Alternatively, the first support level is $ 0.251. Below that, support is found at $ 0.245 (100-day EMA), $ 0.24 (200-day EMA) and $ 0.235.

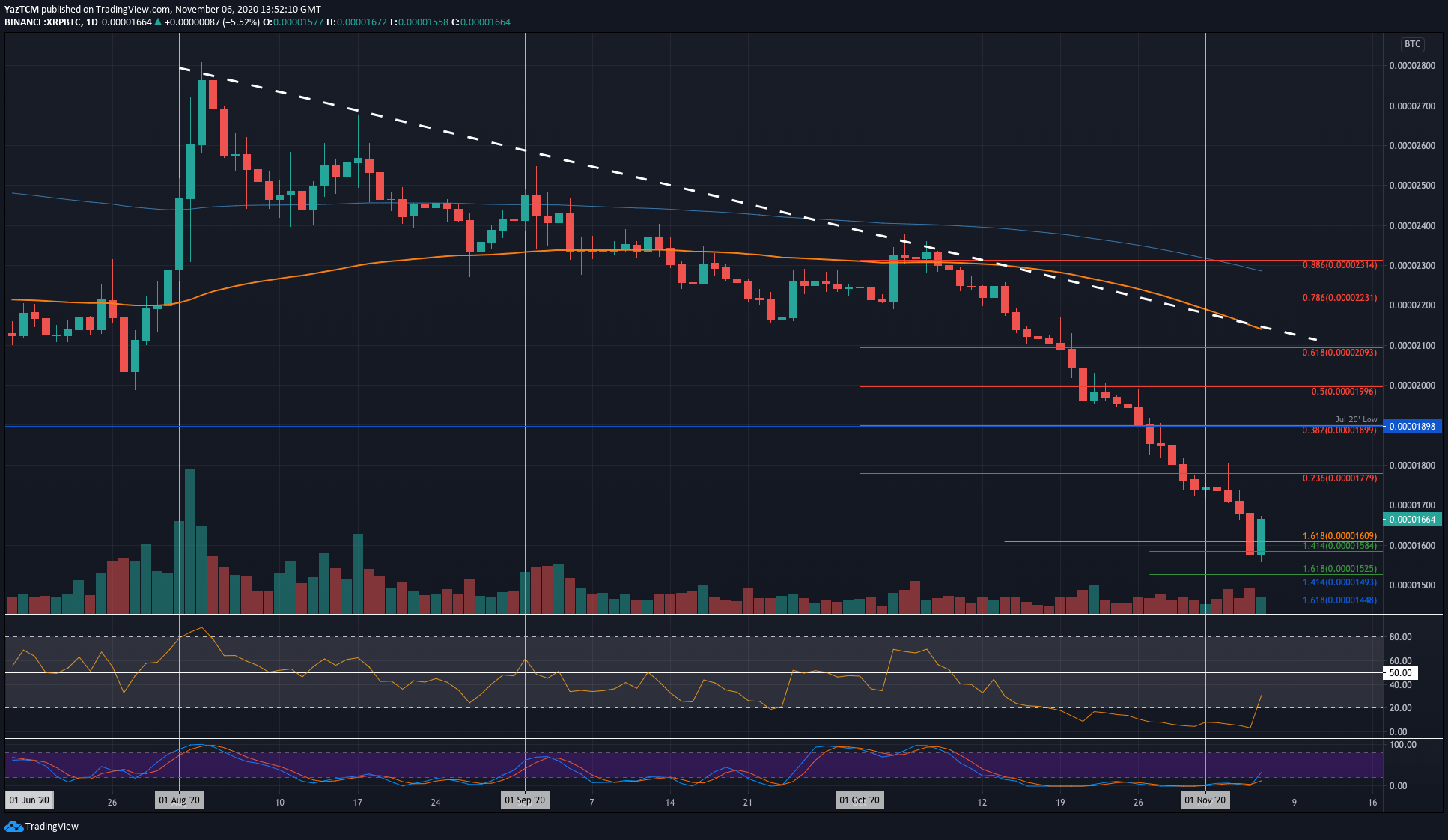

XRP was in free fall against BTC in October. In early November, XRP was trading around the 1780 SAT level as it started to decline. It continued to drop throughout the week until it hit 1555 SAT today, which allowed it to bounce back.

He has since pushed higher to trade around the 1665 SAT. Buyers will have to push over 1800 SAT before it can be considered a reversal of some form.

Looking ahead, if the bulls can continue to lead above 1700 SAT, resistance is found at 1780 SAT (0.236 Fib bearish retracement), 1800 SAT, 1900 SAT (20th July low) and 1996 SAT (0.5 Fib bearish retracement) .

On the other hand, the first support level is at 1600 SAT. Below that, support is found at 1585 SAT, 1555 SAT, 1525 SAT, and 1500 SAT.

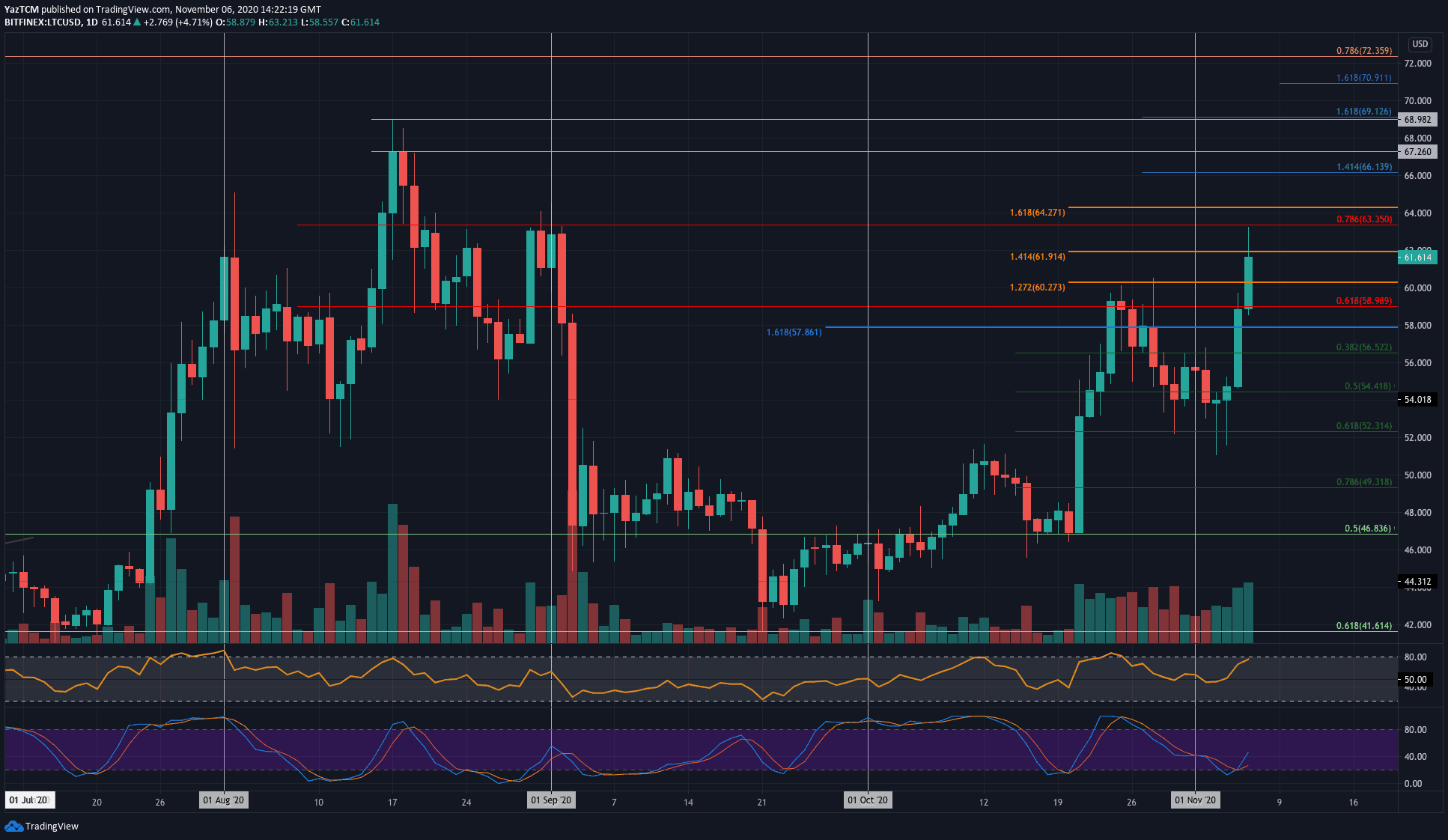

Litecoin

Litecoin saw a sharp 13.7% price increase this week as it rose to 2-month highs to hit $ 62. The coin was trading around $ 54 earlier in the week. It fell lower over the weekend, but managed to close every daily candle around $ 54.

Over the past four days, Litecoin has started to climb higher. It reached the resistance at $ 59 yesterday (bearish retracement .618 Fib). This resistance broke today as Litecoin rallied above the October high $ 60.30 and continued to rise to touch the resistance at $ 63.35 (bearish retracement of 0.786 Fib).

It has since fallen short to trade at $ 61.90.

Moving forward, if buyers manage to break out of the $ 61.90 (1.414 Fib Extension) resistance, the first resistance level is at $ 63.35 (bearish .786 Fib Retracement). Above this, resistance is found at $ 64.27, $ 66.15, $ 67.26 and $ 68.98 (August 2020 highs).

On the other hand, the first support level is found at $ 60. Subsequently, the support is found at $ 590m $ 57.86, $ 56.50 (.382 Fib Retracement), $ 54.40 (.5 Fib Retracement ) and $ 52.

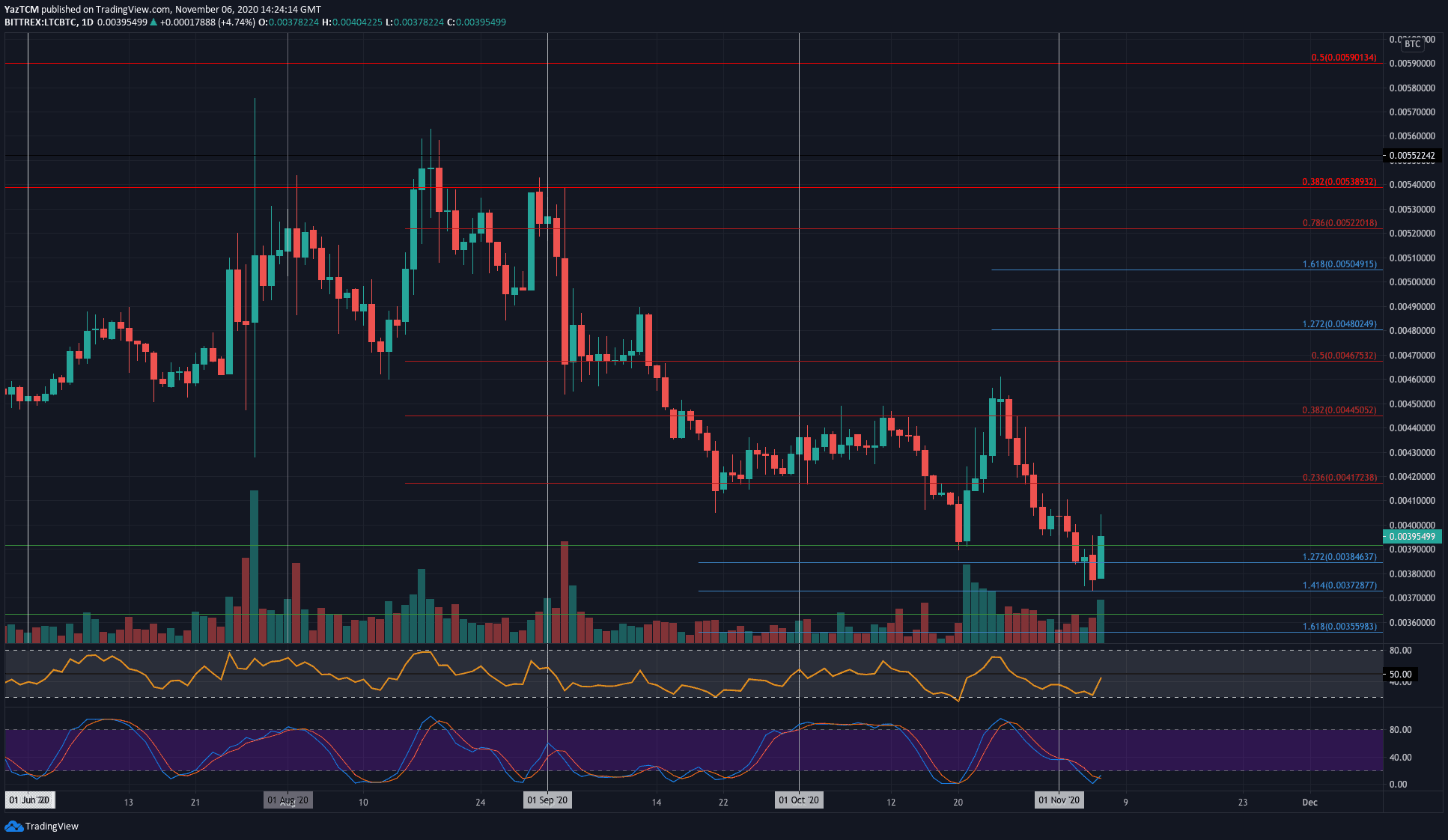

Against Bitcoin, Litecoin was trading at around 0.0041 BTC on Friday. From there, it fell during the week, dipping below 0.004 BTC to hit the low of 0.00372 BTC (downward extension of 1.414 Fib).

Buyers managed to recover from this support today as they push higher towards 0.00395 BTC.

Looking ahead, if the bulls can continue to climb above 0.004 BTC, the resistance is found at 0.0041 BTC first. This is followed by resistance at 0.00417 BTC (bearish .236 Fib), 0.0043 BTC and 0.0044 BTC (bearish .382 Fib).

Alternatively, the first support level is found at 0.0039 BTC. Below that, support is expected at 0.00384 BTC, 0.0038 BTC and 0.00372 BTC.

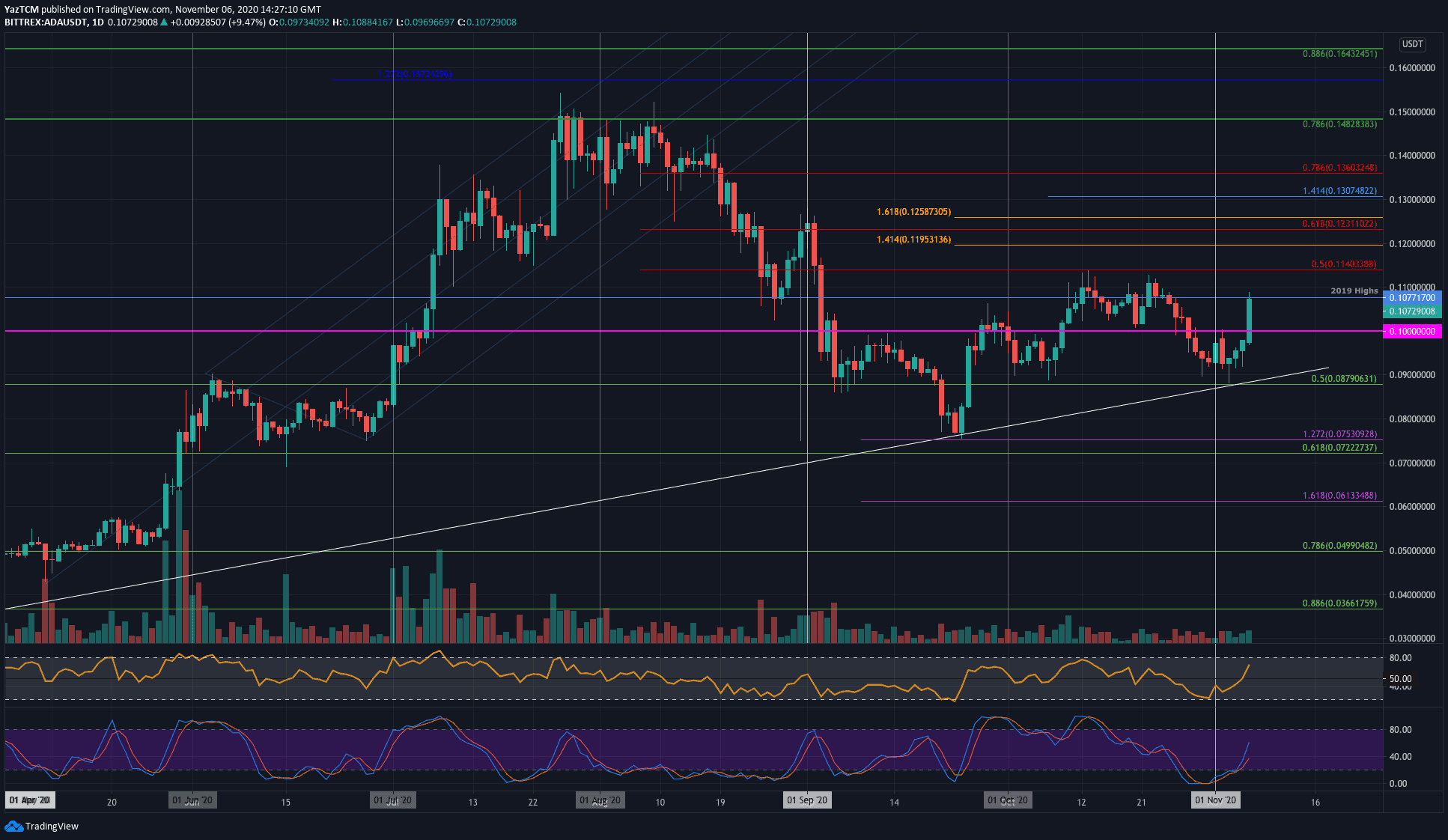

Cardano

ADA managed to climb a total of 10.6% this week to return to the 2019 highs of $ 0.107. The coin rose to the support of $ 0.087 (0.5 Fib) on Tuesday and managed to rebound from here. The support here has been further strengthened by a long-term rising trend line.

After the rebound, ADA continued to push above $ 0.1 and hit the $ 0.107 resistance today.

Looking ahead, if the bulls break out of $ 0.107, the first strong resistance level is expected at $ 0.114 (bearish 0.5 Fib and October highs). On top of that, resistance is found at $ 0.119, $ 0.123 (.618 Fib bearish retracement) and $ 0.13.

On the other hand, the first support level is expected at $ 0.1. Below this, support is found at $ 0.095, $ 0.09 and $ 0.087 (0.5 Fib and rising support trend line).

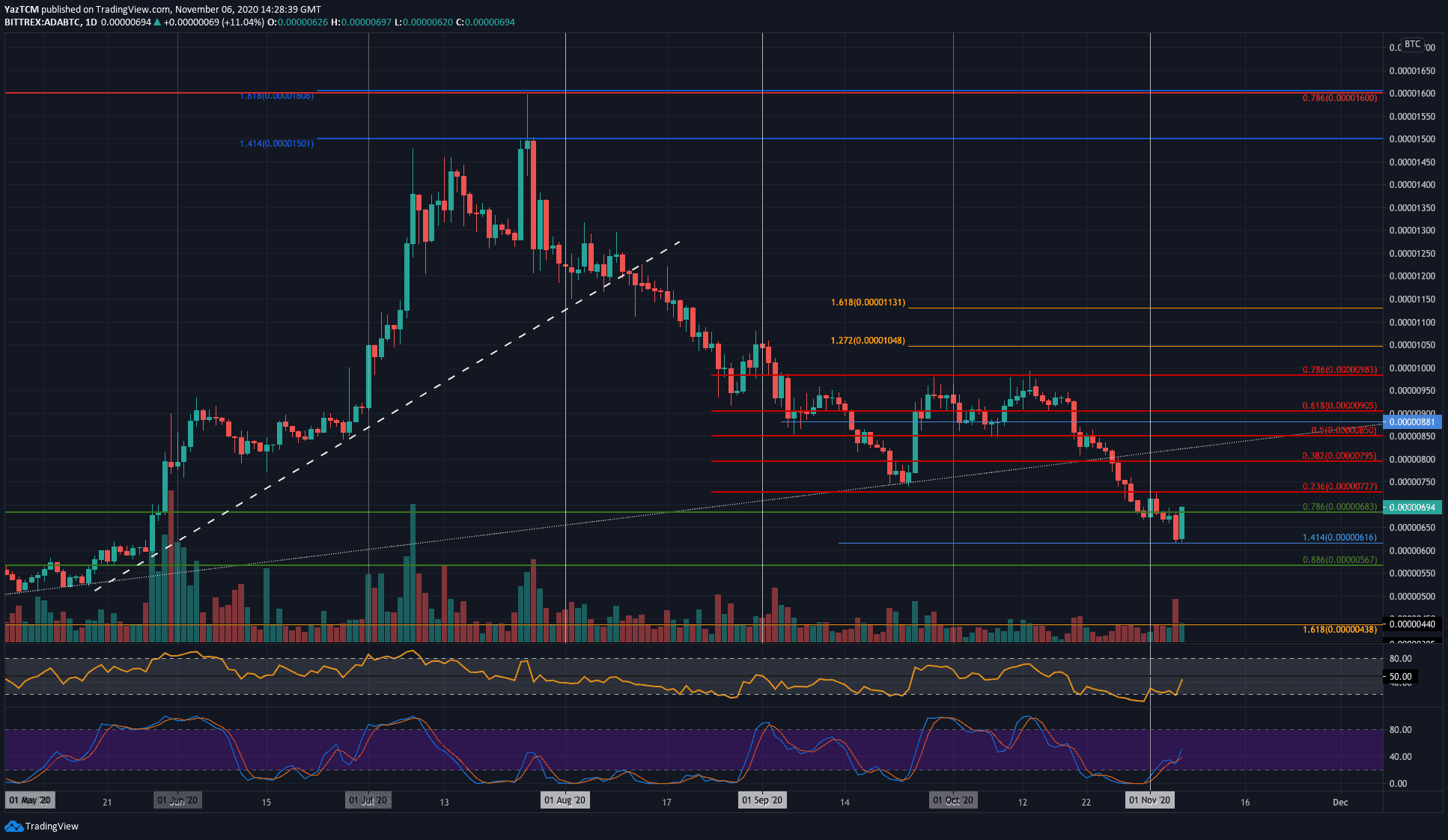

Against Bitcoin, ADA started the week around the 685 SAT level. It peaked over the weekend to hit the 727 SAT level, but continued to drop throughout the week until support was reached yesterday at 616 SAT (1.414 Fib extension down).

ADA rebounded from this support today to hit the 695 SAT level.

Going forward, if the bulls push higher, the first resistance level is at 727 SAT (bearish 0.236 Fib). Above this, resistance is found at 800 SAT, 850 SAT (bearish 0.5 Fib) and 905 SAT.

On the other hand, the first support level is at 650 SAT. Below that, support is at 616 SAT, 600 SAT, and 570 SAT.

Binance Futures 50 USDT FREE Voucher: Use this link to register and get 10% commission discount and 50 USDT when trading with 500 USDT (limited offer).

Disclaimer: The information found on CryptoPotato is that of the writers mentioned. It does not represent CryptoPotato’s views on whether to buy, sell or hold investments. It is recommended that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

TradingView Cryptocurrency Charts.