[ad_1]

[ad_1]

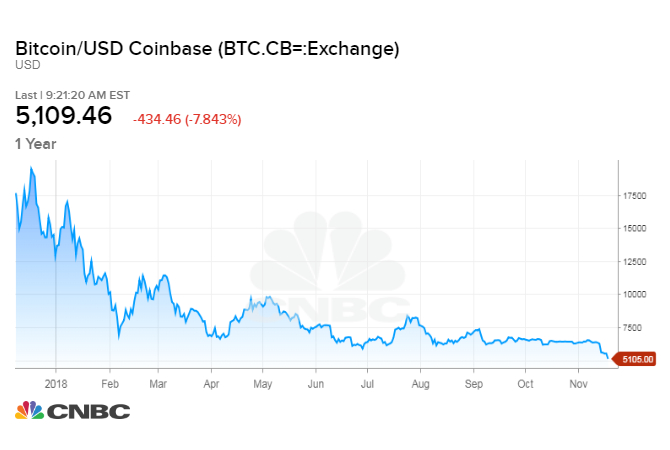

The rapid acceleration also coincided with the introduction of a bitcoin futures market in December. Peak prices were in line with the day the Chicago Mercantile Exchange, or CME, introduced bitcoin futures trading on December 17th. The Chicago Board Options Exchange, or CBOE, opened a futures market a week ago. Until futures existed it was extremely difficult, if not impossible, to bet on the decline in bitcoin prices.

On Monday, both bitcoin futures have reached the lowest level since they were introduced. Bitcoin CME futures fell to $ 5.015, while bitcoin contracts on the CBOE dropped to $ 4.990.

Other important cryptocurrencies have been mostly lower this week and this year went even worse than bitcoin. The XRP, the second largest by market capitalization, fell 5% on Monday, while the ether fell more than 13%, according to data from CoinMarketCap.com. In the last week about 40 billion dollars were swept away by the entire cryptocurrency market capitalization, which was around $ 172 billion on Monday.

Analysts attributed the continuation of bitcoin sell-offs to technical levels and blocked orders in the market after bitcoin fell below $ 6,000.

"The next logical level of support is $ 5,000, but if it does not, the next logical level of support will not be up to $ 3,500," said eToro Mati Greenspan analyst in a customer note on Monday. "With all the prices falling lately, this certainly fits the market definition of buyers."

Others have indicated a division of the bitcoin cryptocurrency money. The digital currency was split into two versions last week – "Bitcoin ABC" and "Bitcoin SV" – which analysts added to uncertainty in the broader cryptic markets.

Last week US regulators kept their promises to regulate non-compliant cryptocurrency projects. The Securities and Exchange Commission announced its first civil sanctions against crypto founders on Friday as part of a broader legal and regulatory crackdown on abuses and genuine fraud in the growing digital currencies sector.

SEC president Jay Clayton said at the start of this year that all cryptocurrencies aside from bitcoin and ether are securities and "if it's a security, we'll settle it".

"The SEC regulation last week scared a lot of people," said Kyle Asman, partner and co-founder of the encrypted consulting firm BX3 Capital. "Those who are not sophisticated investors listen to" SEC "and hit the" sale "button.

The cryptocurrency collapses even after the new warnings from the member of the Executive Board of the European Central Bank Benoit Coeure at the Bank for International Settlements in Basel, according to a Bloomberg News report.

"Bitcoin was an extremely smart idea, but not all smart ideas are a good idea," Coeure said Thursday. "In more than one way, bitcoin is the evil spawn of the financial crisis."

Coeure also said he was in agreement with the head of the BIS, Agustin Carstens, who in June declared: "The cryptocurrencies are, in short, a bubble, a Ponzi scheme and an environmental disaster".

Correction: This story has been modified to clarify that Benoit Coeure quoted Agustin Carstens when he said on Thursday that bitcoin is "a bubble, a Ponzi scheme and an environmental disaster".