[ad_1]

Dec 17, 2018 07: 48 & nbspUTC

| updated:

Dec 17, 2018 at 12: 08 & nbspUTC

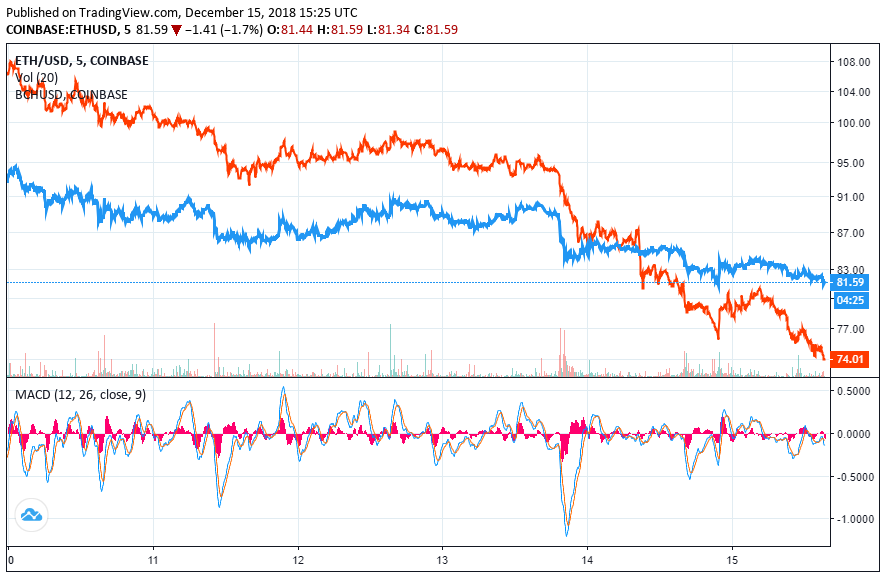

Bitcoin Cash has been on a free-fall in the market trends after the news of a lawsuit against Roger Ver for Hard-fork manipulation came to light. In the latest development, the turmoil seems to have dethroned BCH from its 4th spot for the market cap. BCH lost its position to Ethereum during the early morning hours of Monday 17 December. At the time of writing Ethereum was trading at $ 86 while BCH at an all-time low of $ 81.

The post-hard-fork war between the BCH ABC team lead by Roger and BCH SV team led by Craig Wright has been seen as a catalyst for the Crypto winter and bearish trend in the market.

BCH Hard-Fork Post Woes Cease to Die Down

The infamous November 15 Hard-Fork was a little different from the forks, as it had two contenders for the primary currency rather than the usual one. Both BCH SV and BCH were involved in bad mouthing on Hash War. BCH ABC was leading BCH SV on major parameters like the number of blocks mined or the total hash power generated. Even major crypto exchanges declared their support for BCH ABC, making a clear winner looking at the initial results.

However, BCH SV never lost hope and always gave a hurricane in the form of self-block recognition, or losing the early Hash War. Craig Wright still maintained his alpha status, and finally, his predictions came true when BCHS SV surpassed the ABC, both regarding market cap and trading value on December 7, amid the bearish trend of the market.

For the miners and going overboard to lawsuit for Roger Ver side. The end of Hash War Criminal exchanges declaring their support either in favor of ABC or SV and in some cases both the parties.

The current bearish trends and legal troubles for Roger BCH which started above $ 300 after the fork has gone down around $ 80 mark while BCH SV which started above $ 100 mark is currently trading around the $ 76 mark.

Final Thoughts

Looking at the condition of the BCH network, it's not hard to understand how fragile the crypto world is without to real-world entity backing it. The market is so volatile that the prices are dependent on the word "mouth", and a "fake rumor" with a full breakdown. The war of words highlight this issue more as both parties to a significant chunk of their market cap two to bad mouthing. The unnecessary hash war inflicted heavy losses for the miners.

The people in the crypto realm must look beyond the price and trade value of the cryptocurrencies and focus more on finding the wider acceptability. The value of the digital currency is higher

[ad_2]

Source link