[ad_1]

[ad_1]

Bitcoin (BTC) and its unprecedented price rally with a historical maximum value of around $ 20,000 in January 2018, have undoubtedly attracted the public's attention. Despite losing about 80 percent of its price later, 2018 was the year in which it saw the blockchain industry boom in many different vertical sectors.

2018 – A year of diversity

Despite the prolonged bearish market of 2018, which saw about 700 billion dollars of the total cryptocurrency market capitalization, the blockchain industry seems to be on the rise. CoinMarketCap currently it has over 2,000 different cryptocurrencies listed.

Needless to say, the market has had its ups and downs, but it seems as if it is safe to say that Bitcoin has managed to enter the mainstream field and become a real family name.

However, the infrastructure for a wider and more widespread adoption is still ongoing. While there are currently many trades that allow trading on the spot market where people can simply buy and sell coins, there are only a few exchanges like BitMEX for encrypted derivatives where traders can speculate on the prices of leveraged currencies.

Existing problems

Cryptocurrency exchanges play an important role in the overall adoption of the asset class because they allow users to interact with the market.

However, being quite nascent, cryptocurrency exchanges suffer from common problems: server overloads when making orders, relatively high commissions, lack of customer support, questionable policies and so on.

With market maturing, however, we see key players attempting to correct existing problems and provide clarity and transparency in a market that is in great need of it. Currently, the main exchanges in terms of volume traded are Binance, OKEx, Huobi, Coinbase and a few others.

The need for speed

The processing speed of purchase and sales orders is absolutely crucial for every operator. The importance is even greater for daily traders who engage with the market several times a day, making quick exchanges in order to exploit price fluctuations.

If there is one characteristic of the cryptocurrency market, it is volatility. Serious price fluctuations are not uncommon for most of the preferred cryptocurrencies, which is why the trading platform must be quick to allow the trader to make the most of every opportunity.

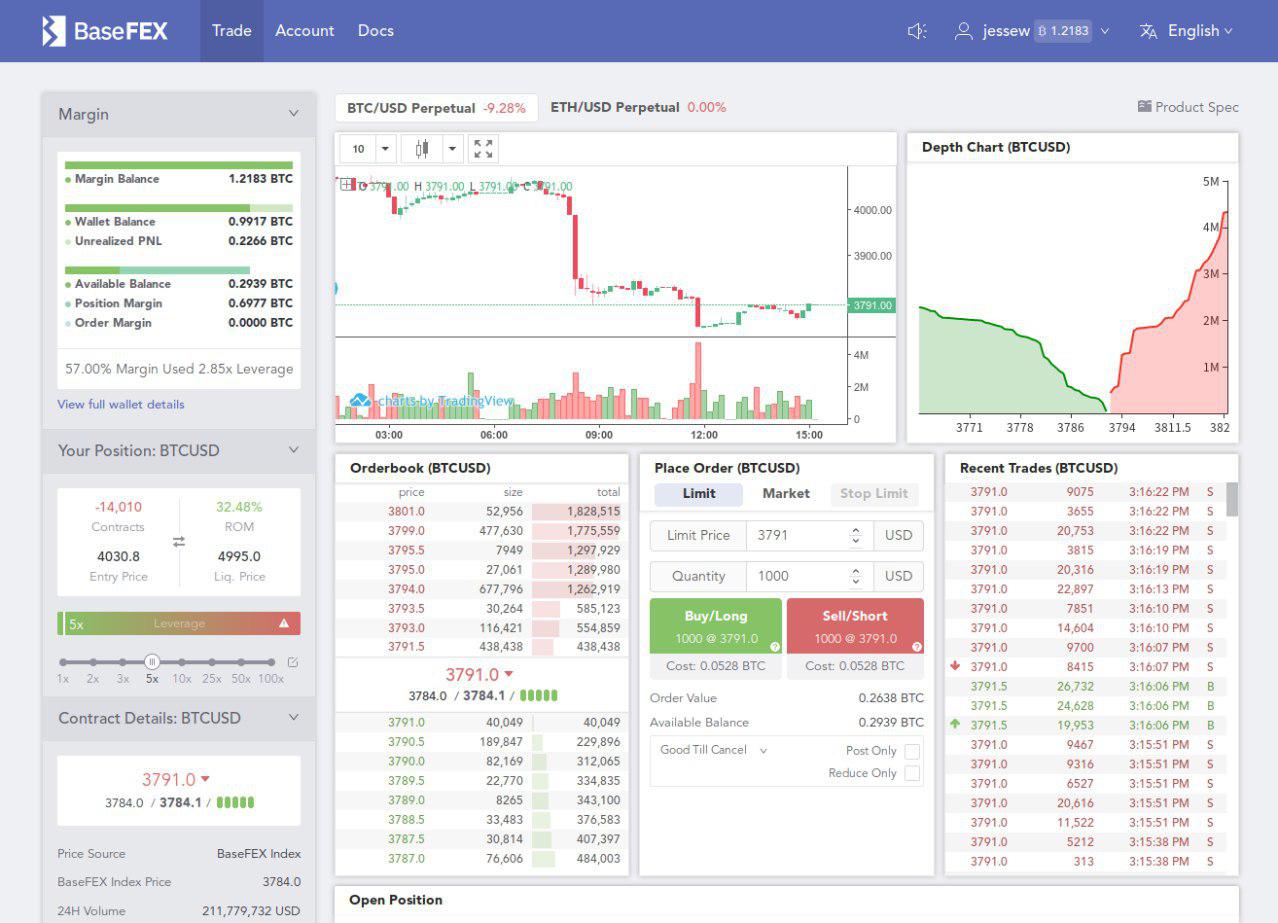

And while many of the exchanges out there fight with this, BaseFEX – a fairly new but fairly complete and easy to use derivative exchange of cryptocurrencies aims to make trading smooth, safe and accessible for traders around the world.

One of the main aspects of the platform is speed in particular.

Speaking on the issue was Jesse Wu, CEO of BaseFEX, who noted:

"On BaseFEX, traders simply do not see the server overload message when they place orders.The trading engine always accepts traders' order placements even under extreme market conditions.The architecture of the BaseFEX trading engine is It has been designed with a high level of processing capability in mind from the very beginning, and we have leveraged a range of cutting edge technologies in the evolving Internet industry to ensure fast processing and throughput In addition, each component of the system is carefully designed to maintain the idempotence, an engineering feature very difficult to achieve, but once achieved a high processing power and a high degree of reliability is so guaranteed, because it allows you to run exactly the same components on multiple servers simultaneously without causing problems. "

BaseFEX starts with a leveraged swap product of BTCUSD Perpetual – a product that looks a lot like futures but without any agreement. Allows traders to exchange the BTC / USD price with a lever up to 100x. The team also promises to add other derivatives in the future.